FOMC Preview for July 31: Opening the Door for Data-Dependent Easing

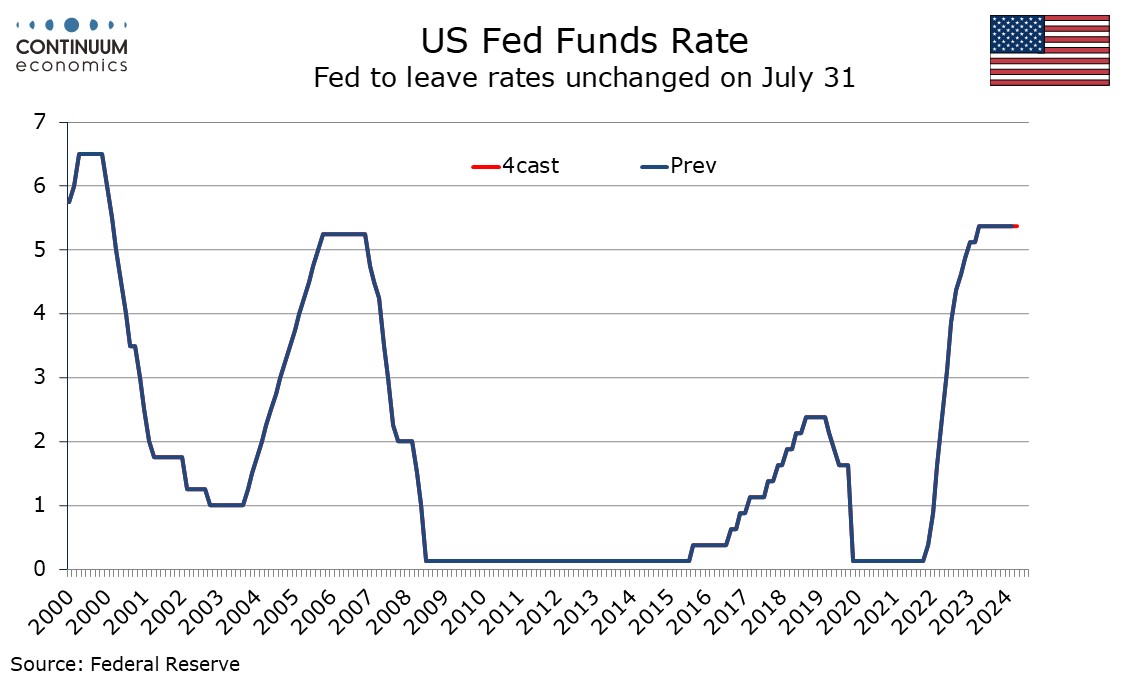

Bottom Line: The FOMC meets on July 31 and while a change in rates remains unlikely, the FOMC is likely to signal that easing is possible if data before the next meeting on September 18 provides further evidence of falling inflationary pressure. This will see changes to the wording of the statement, but Chairman Jerome Powell will stress that any easing will be data-dependent.

The Decision

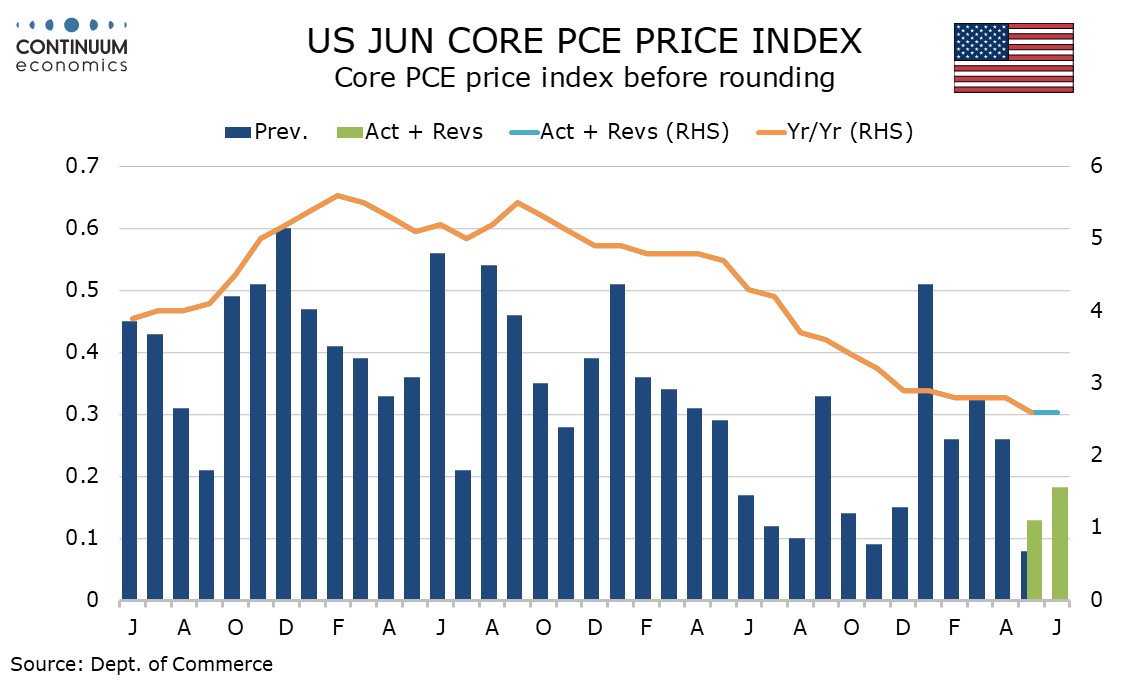

Former New York Fed President William Dudley caught some attention in calling for a rate cut at this meeting, based on the fact unemployment is now increasing, signaling growth falling below potential. However, a move at this meeting remains unlikely, particularly after the healthy 2.8% annualized increase in Q2 GDP. May and June monthly inflation data has come in consistent with the Fed’s 2.0% annual target, but after a firm first four months of the year the Fed is likely to need more subdued data before easing, even if the strong start to 2024 needs to be seen alongside an acceptably subdued second half of 2023.

The vote to hold rates will probably be unanimous, but it should be noted that the retirement of hawkish Cleveland Fed President Loretta Mester will see dovish Chicago Fed President Austin Goolsbee gain an alternate vote, and he is the most likely potential source of a vote to ease. Mester’s replacement, Beth Hammack, will take office on August 21, so will vote at September’s meeting.

The Statement

This meeting will not see the FOMC’s dots updated, leaving focus on the statement and the press conference. After the Q2 GDP data the FOMC is likely to continue to see the economy as having expanded at a solid pace with job gains strong and unemployment low, though they could note that the rate is now rising. More important will be the wording on inflation, which they can state has continued to ease while they may decide to no longer describe it as elevated. They will not however want to give the impression of declaring victory. Describing it as above target rather than elevated could be an appropriate adjustment. In the last statement they noted modest further progress towards the 2% target. The word modest could be dropped this time.

The last statement stated that risks to the employment and inflation goals had moved toward better balance. This statement may suggest that risks have moved into, rather than toward, a better balance. They key phrase in the last statement was that the Committee does not expect that it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably towards 2%. This is likely to see some fine tuning but will still state that greater confidence is still needed before easing. However stating easing will become appropriate if greater confidence is achieved rather than easing will not be appropriate until greater confidence is achieved would signal that easing as soon as September will be considered if data is acceptably soft.

The prospect of several significant, if subtle, changes to the wording of the statement is likely to sustain hopes that September could see easing begin. Chairman Jerome Powell will however make it clear that easing will be data-dependent, in particular on CPI and non-farm payroll reports for July and August which will come between the July and September meetings. Still, not putting the sole focus on inflationary data will make it clear that the Fed is eyeing downside economic risks as well as being wary of the potential for stubbornly strong inflationary data. The impression given will be of a Fed that is hoping to lower rates to reduce downside economic risks provided that inflationary data does not provide any obstacles. Our central view is that the Fed will ease at each of the three remaining meetings this year, in September, November and December, though that does assume a softer tone to economic data.