US Q2 GDP exceeds expectations, business investment the main upside suprise

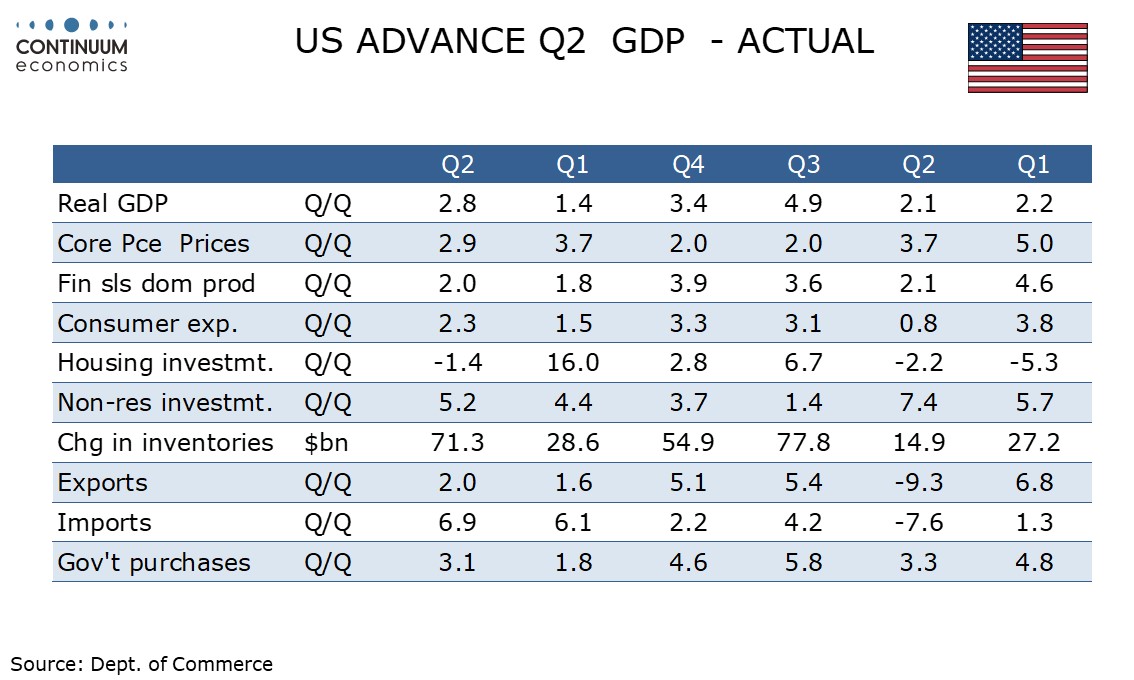

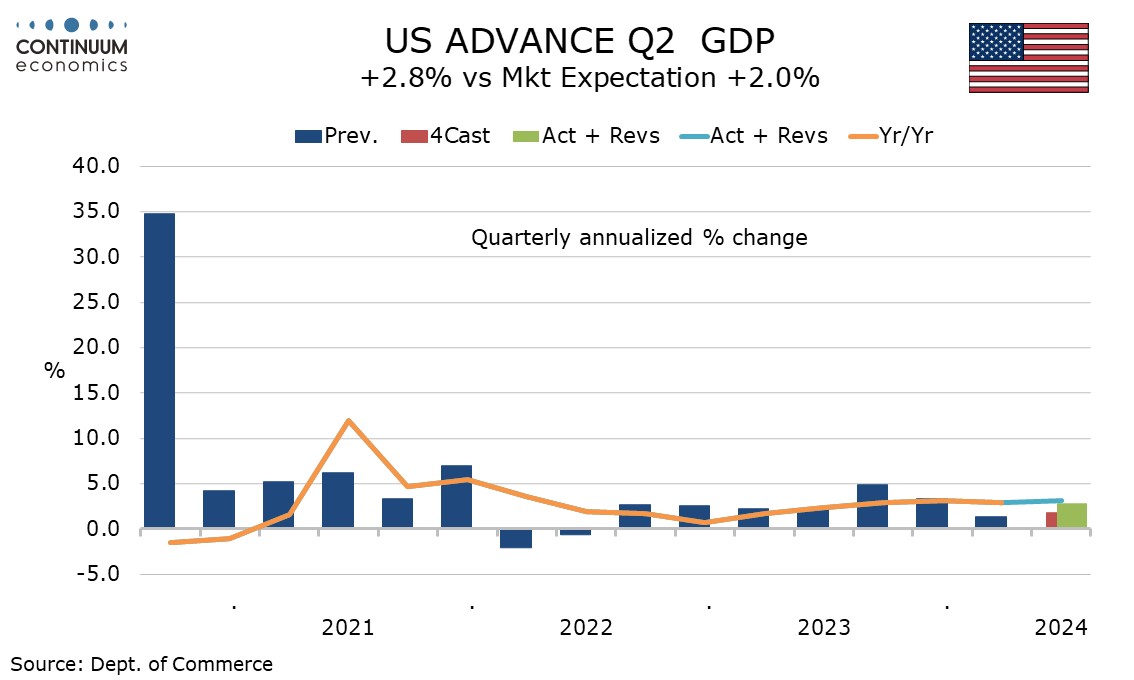

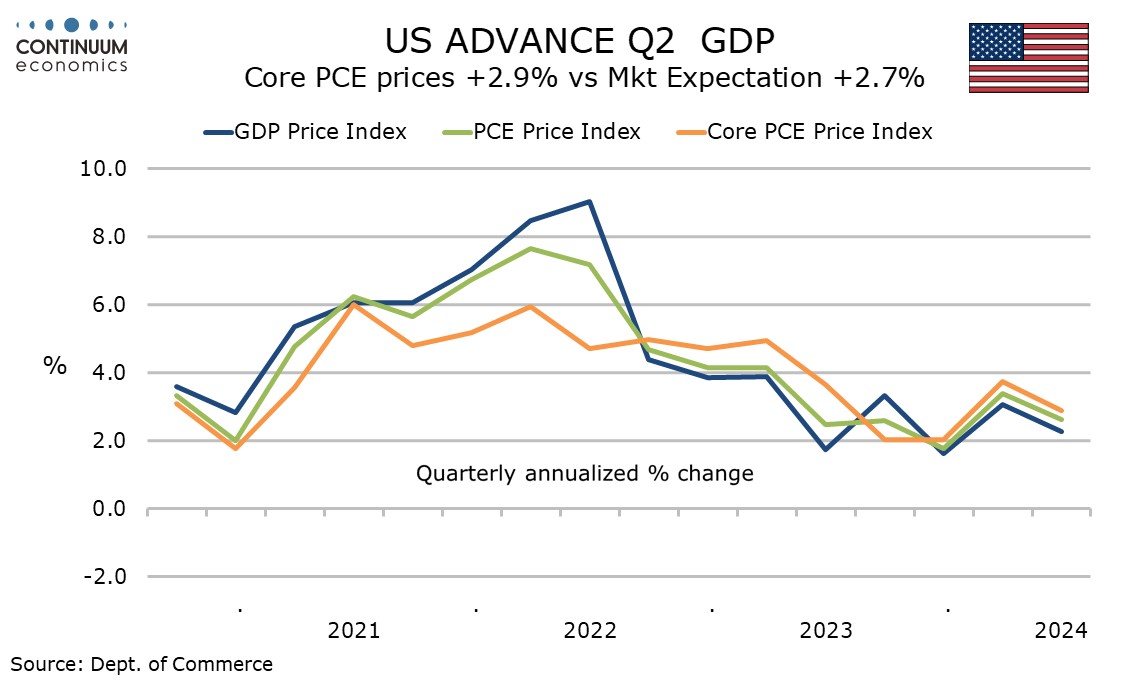

Q2 GDP has come in significantly stronger than expected with a 2.8% increase while core PCE prices are also above consensus at 2.9%, which suggests despite yesterday’s call from former New York Fed President Dudley, a July Fed easing remains very unlikely.

Initial claims at 235k from a hurricane Beryl-inflated 245k last week also suggest the labor market remains firm. June durable goods orders unexpectedly plunged by 6.6% on aircraft, but the ex transport rise of 0.5% is on the firm side of trend. This is on balance a firm set of data.

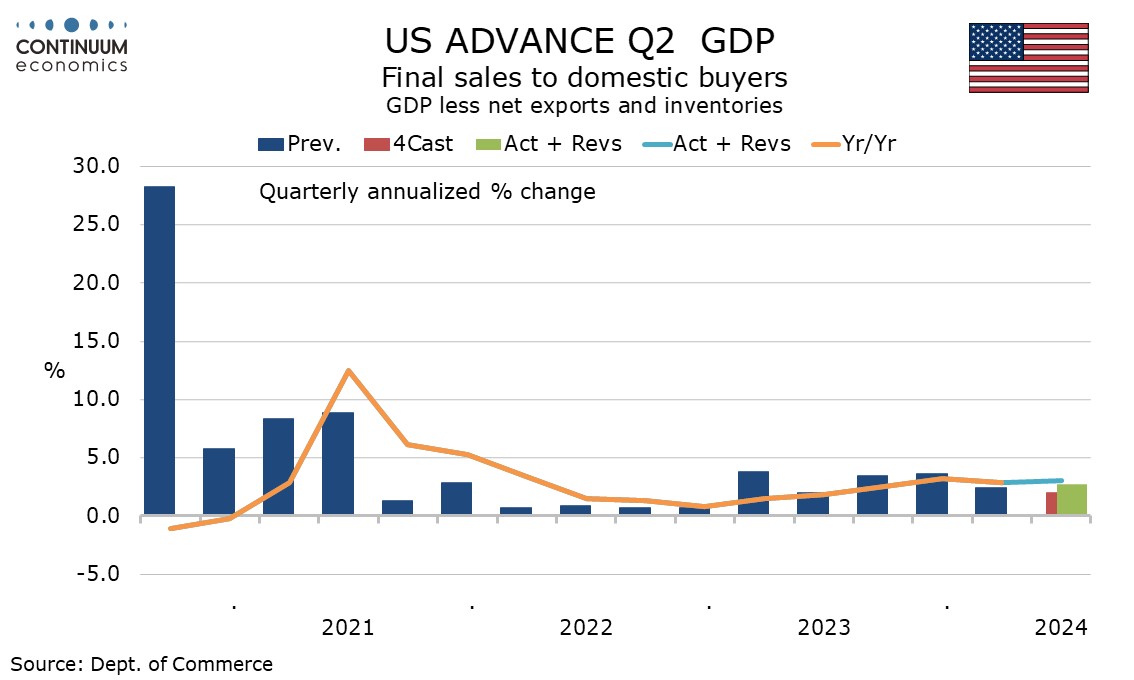

The GDP increase is a significant improvement on Q1’s 1.4% though final sales to domestic buyers (GDP less inventories and net exports) saw only a moderate pick up, to 2.7% from 2.4%, though this shows a solid pace in domestic demand persists.

Final sales (GDP less inventories) rose by 2.0% so the 0.8% boost from inventories carries some downside risk for Q3. A negative of 0.7% from net exports offset most of the inventory boost, though yesterday’s narrower advance June goods trade deficit restrained the negative somewhat. Exports increased by 2.0% and imports by 6.9%, both similar to their Q1 outcomes.

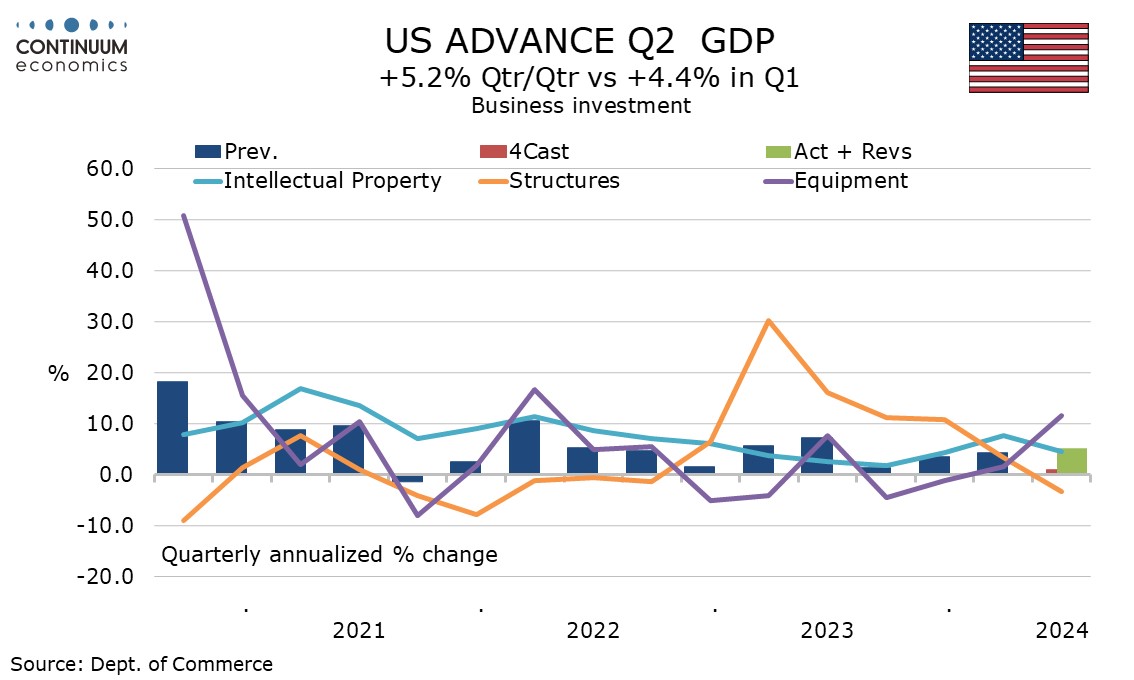

The main upside surprise was a rise of 5.4% in business investment, with equipment at 11.6% much stronger than expected and a nine quarter high. Also in the business investment detail were a 4.5% rise in intellectual property, in line with trend, and a 3.4% decline in structures, the first decline in seven quarters.

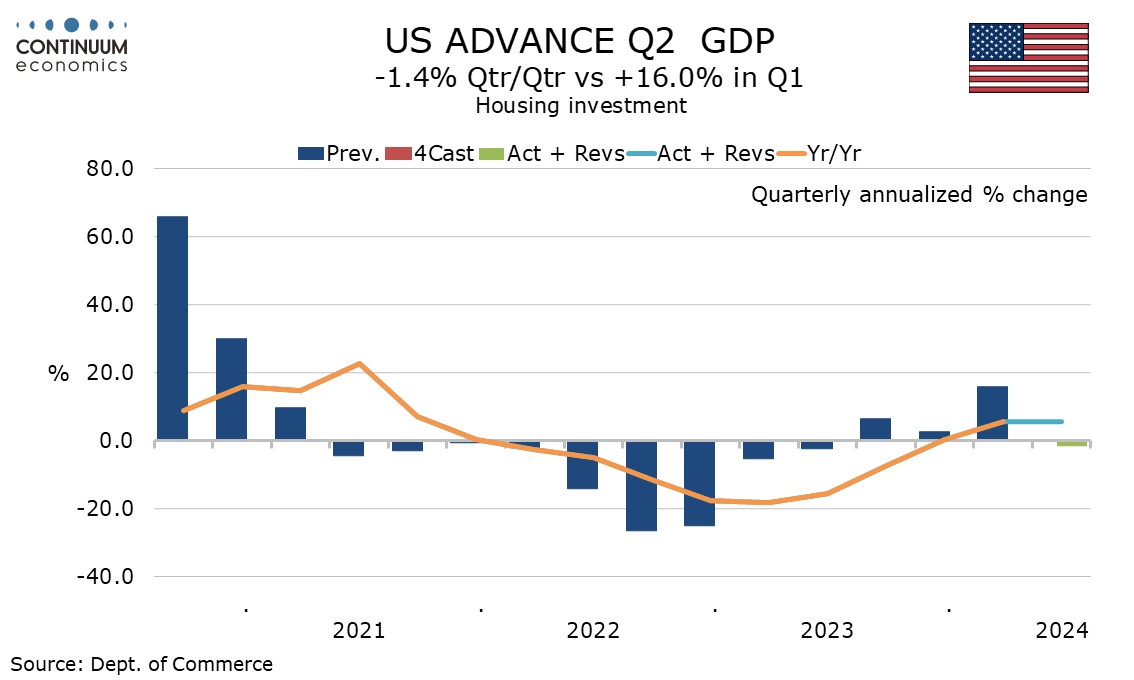

Housing investment at -1.4% saw a marginal correction from a 16.0% surge in Q1, while government with a 3.1% increase picked up from a below trend 1.8% in Q1, defense rising by 5.2% after a 0.9% decline in Q1, probably lifted by renewed support to Ukraine.

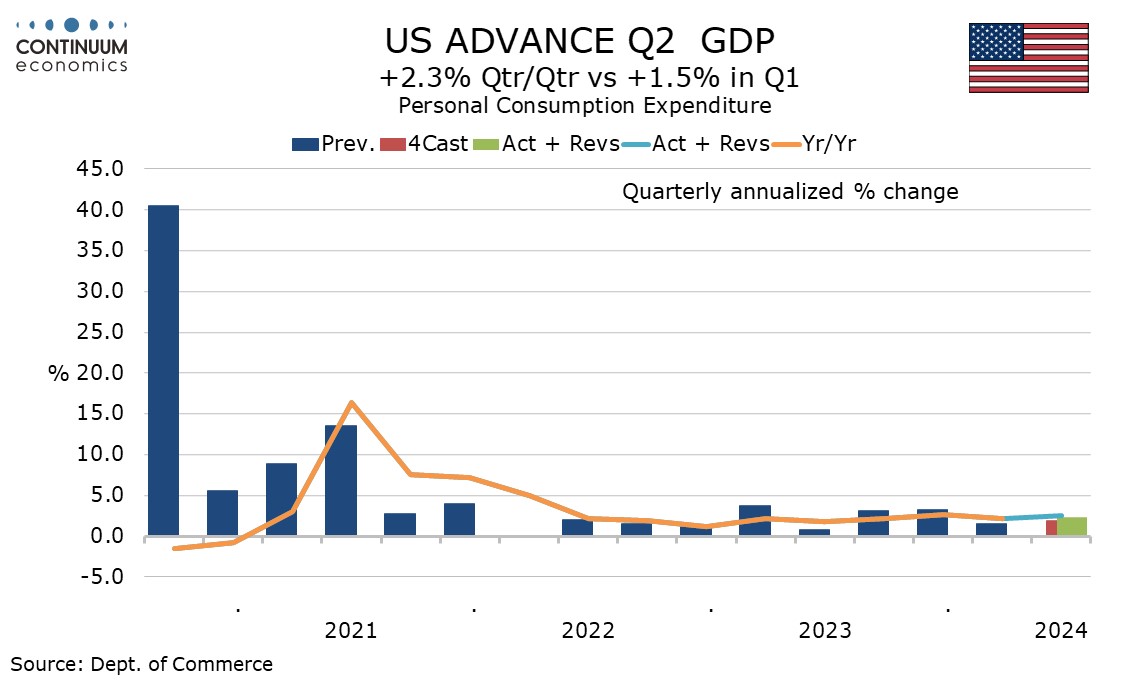

Consumer spending rose by 2.3%, durables at 4.7% reversing a 4.5% Q1 decline, non-durables at 1.4% reversing a 1.1% Q1 decline, and services at 2.2% slowing from two straight gains exceeding 3.0%. While the consumer spending rise was stronger than expected momentum is now quite modest, patricianly with real disposable income up by only 1.0%, similar to the preceding three quarters.

A 2.9% rise in the core PCE price index versus a consensus of 2.7% suggests that either June data will be stronger than the 0.1% core CPI gain or that there will be upward revisions to April or May. Overall PCE prices at 2.6% underperformed the core fate and the GDP price index at 2.3% was slower still. Inflation did slow from a disappointing Q1, but is not yet consistent with target.