FX Daily Strategy: APAC, July 24th

PMIs the main focus on Wednesday

USD strength can extend if relative US PMI strength continues

EUR and GBP may both be vulnerable against the JPY

CAD has upside scope with the market overpricing the risks of a BoC rate cut

PMIs the main focus on Wednesday

USD strength can extend if relative US PMI strength continues

EUR and GBP may both be vulnerable against the JPY

CAD has upside scope with the market overpricing the risks of a BoC rate cut

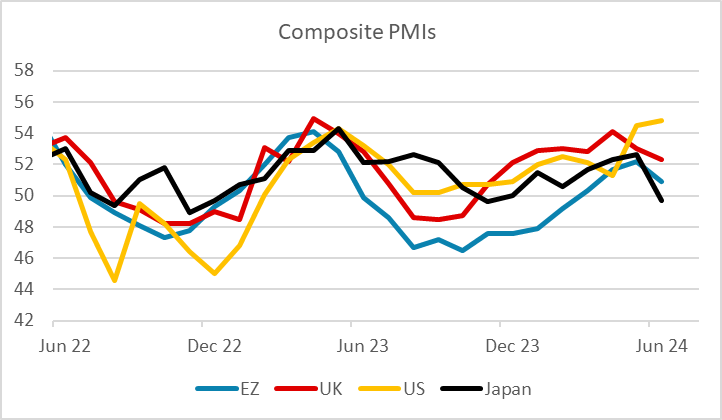

Wednesday is PMI day, with the focus likely to be on whether the recent relative strength of the US PMIs persists, and the relative weakness of the Eurozone manufacturing PMI. Whether these surveys genuinely provide a good guide to GDP is unclear, but the market sees them as one of the better contemporaneous measures, particularly for the Eurozone, so further relative weakness in the Eurozone indices could mean the softer tone in EUR/USD seen through Tuesday is extended.

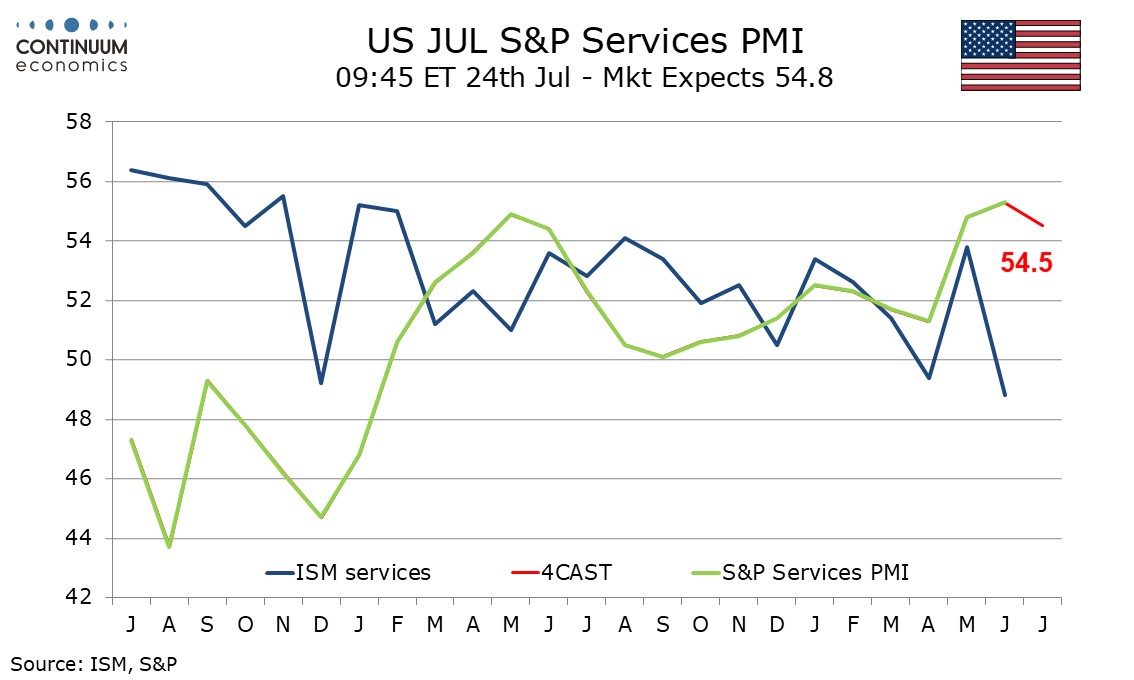

For the US, there is less belief on the PMI survey relative to the ISM survey, which is the more established measure, and the PMI has been clearly stronger than the ISM in recent months. It was particularly noticeable that the ISM services survey dipped sharply in June while the PMI services survey remained strong. The correlation between these two measures of the same thing isn’t great, and creates some doubt about the validity of both. The S and P services index seems quite sensitive to bond yields which suggests a sharp dip is unlikely, so we may continue to see relative US strength. While this may not be a particularly reliable indication of relative US economic strength, it is likely to sustain the firmer USD tone at least until the US Q2 GDP data on Thursday.

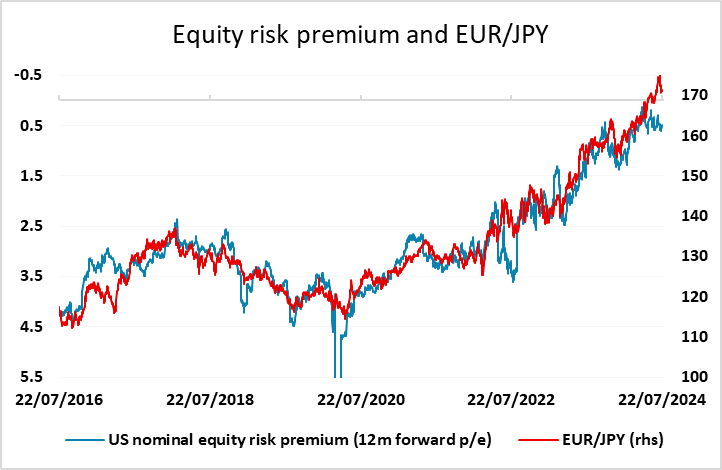

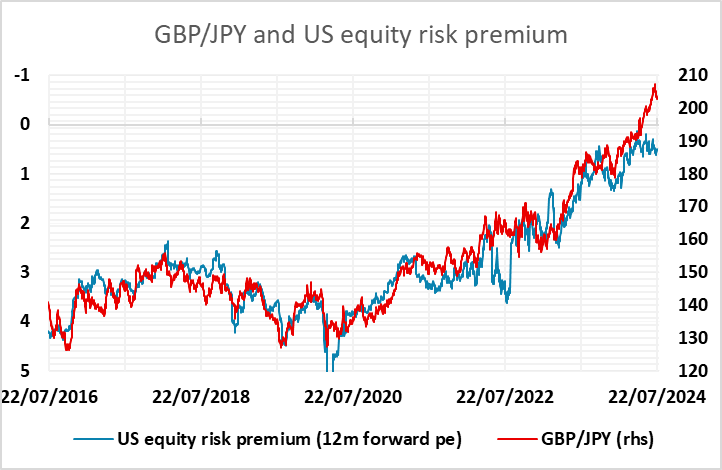

The JPY was once against the strongest of the major currencies on Tuesday, with JPY crosses catching up with the weakness in USD/JPY already seen. For EUR/JPY, the correlation with equity risk premia suggests scope back to the mid-to low 160s, while for GBP/JPY there looks to be scope for a move to the low 190s based on the same correlation. The CFTC data on net speculative positioning in the futures market suggests net long GBP positions are particularly extended, and GBP valuation also looks particularly highs against the EUR and JPY. GBP/JPY could therefore be the most vulnerable to any negative news, either specifically on the UK or more generally on global risk. While there are some reasons for optimism about UK growth prospects under the new government, we doubt there will be much near term pick-up so current sentiment is likely too positive.

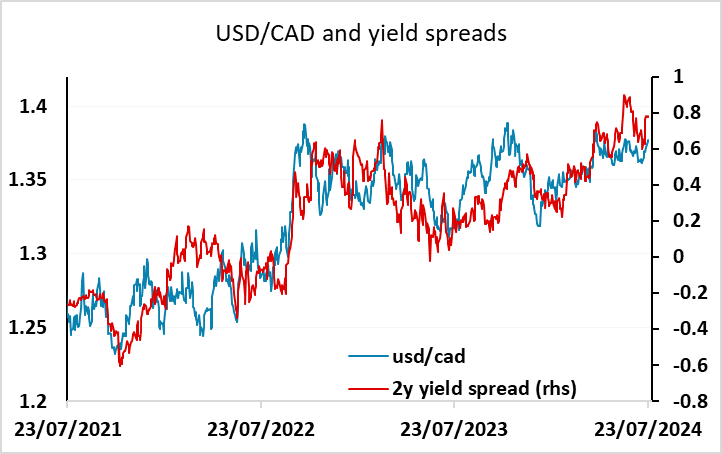

We also have the Bank of Canada meeting on Wednesday. A rate cut is 90% priced for the BoC meeting, and around 75% of forecasters are looking for a rate cut. So there would not be much impact on the market if the BoC do cut rates. But we expect the BoC to surprise the market by leaving rates unchanged. Given market pricing, the risks for USD/CAD should be substantially on the downside, with limited upside on a rate cut, and substantial downside if rates are left unchanged. As it stands, USD/CAD could still have some upside risks based on current yield spreads, but the USD is somewhat expensive from a longer term perspective, and there is scope for USD/CAD to drop a figure or more if the BoC leave rates unchanged.