FX Daily Strategy: APAC, July 23rd

EUR/USD looks stuck near 1.09 for now, but some USD upside risk

JPY upside favoured, USD/JPY upside capped

GBP optimism rising, but positioning might be vulnerable

EUR/USD looks stuck near 1.09 for now, but some USD upside risk

JPY upside favoured, USD/JPY upside capped

GBP optimism rising, but positioning might be vulnerable

Tuesday is another very quiet day on the calendar, with no data at all in Europe and very much second (or third) tier data in the US with existing home sales and the Richmond Fed index. The main data is all in the second half of the week, with PMIs, US GDP and Japanese Tokyo CPI on Wednesday, Thursday and Friday respectively. It’s consequently hard to see any big moves in the main FX pairs.

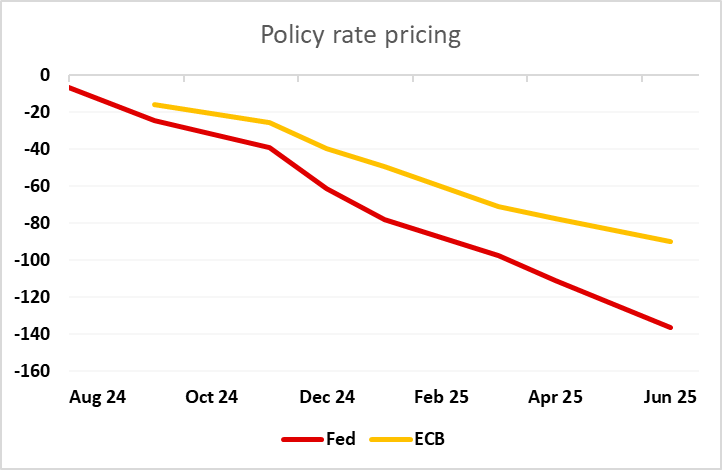

In Europe we do have a speech due from ECB chief economist Lane, but it seems unlikely that he will commit to anything so soon after the ECB meeting with little news of any significance on the Eurozone economy since then. EUR/USD looks quite stuck near 1.09 for the moment, but risk may be to the USD upside in the short term for two reasons. First, there is more easing priced into the USD curve this year than the EUR curve, with a September Fed ease fully priced and an ECB easing only priced as a 60% chance. There looks to be more scope for the market to either move away from a Fed easing or fully price an ECB easing. Second, there is some risk of a significant equity market correction given the high US valuations. While relative equity market moves in favour of Europe will tend to favour the EUR, absolute declines will tend to favour the USD, so this risk is also likely more on the positive USD side. While we still see medium term scope for EUR gains , in the short run the risks may be on the EUR downside, but for this week departures from 1.09 will likely depend on the PMI data on Wednesday and the US GDP data on Thursday.

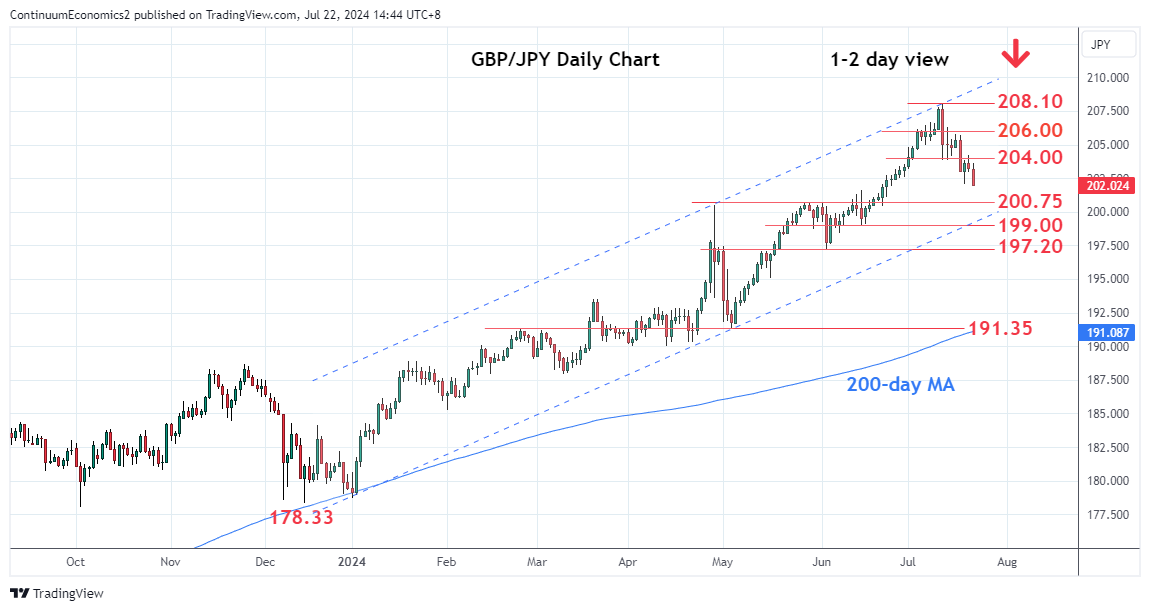

Elsewhere, the JPY continues to look to have the most potential for volatility with a JPY uptrend starting to develop. In the short run we may run up against trendline support in JPY crosses, but valuation and correlation with yield spreads and risk premia all point towards a higher JPY. Additionally, we had comments on Monday from Toshimitsu Motegi, secretary general of the ruling LDP, who said the Bank of Japan should more clearly indicate its resolve to normalise monetary policy, including through steady interest rate hikes, and that excessive yen declines were negative for Japan's economy. While we suspect the BoJ won’t hike rates at the July 31 meeting, and the LDP’s views probably won’t have much impact on monetary policy, the MoF is in control of intervention policy, and such comments from the LDP suggest determination to prevent renewed JPY weakness. There may need to be a trigger for further JPY gains in the form of weaker equities, a BoJ rate hike or a Fed rate cut, but the (probable) recent intervention and these comments from the LDP suggest USD/JPY upside is capped.

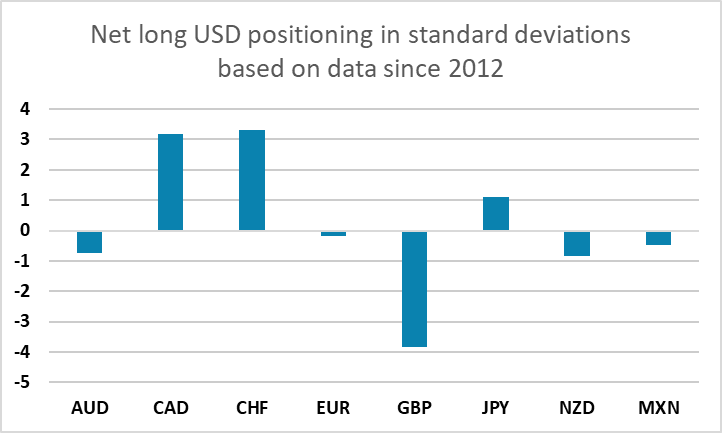

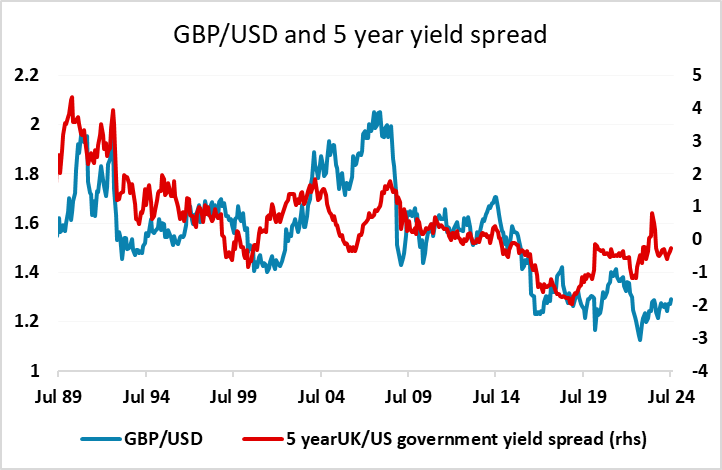

GBP strength has been a feature this year, with GBP the best performer of all the majors. EUR/GBP has dropped 2 figures in the last 3 months even though front end yield spreads have move din the EUR’s favour, likely reflecting some improved sentiment on UK growth related to the new government. But it is hard to justify further gains against the EUR given the high level of GBP in real terms – EUR/GBP is at its lowest since 2015 in real terms. However, the case for GBP gains against the USD is easier to make, since the pound does appear to have been incorporating a risk premium in the last couple of years. This was at its highest in the short-lived Truss administration in 2022, but has never been completely eradicated. Of course, there is a similar case for EUR gains against the USD, but this requires an appear to real terms measures which the market hasn’t been too interest in in recent years (see the JPY decline). We reached record levels of net long speculative GBP positioning in the IMM futures contract as of last Tuesday, and this likely reflects some degree of optimism as well as reflecting the relatively high level of UK yields. But with the CAD and CHF seeing record short positioning, GBP bulls may be vulnerable if the data doesn’t turn out their way.