GBP flows: GBP slightly softer after labour market data

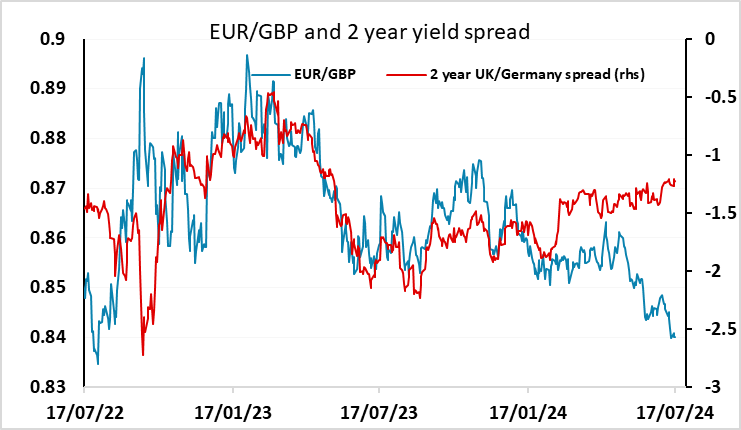

EUR/GBP holds above 0.84 with hawkish BoE already well priced in to the FX market.

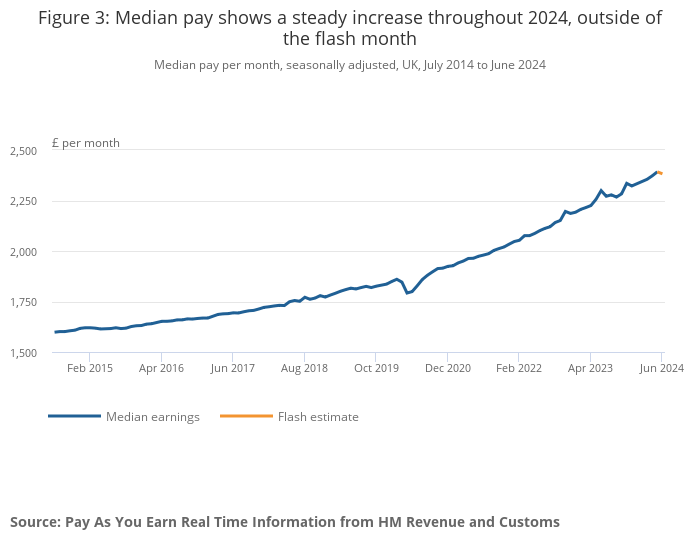

UK labour market data was essentially in line with expectations, with the official ONS May average earnings data at 5.7% and employment up 19k in the 3 months to May. There was a sharp drop in the y/y growth in the June average earnings data based on the HMRC data, but this related mostly to a base effect form June 2023. Even so, there was a m/m decline of 0.4% in June, which suggests some softening. Against this, the HMRC employment data for May was revised up significantly from a decline of 3k to a rise of 54k, while June provisionally showed a 16k increase. The data is consequently much as expected, but with earnings growth still on the high side y/y, the prospect of an August BoE rate cut remains in the balance. The market currently prices a cut as a 40% chance.

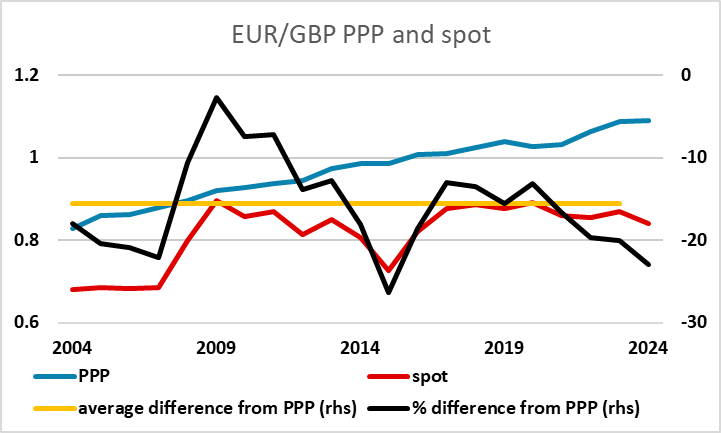

EUR/GBP is a little higher after the data, having bounced strongly after the initial dip on the CPI data on Wednesday. As we have noted before, it may be that UK rates stay higher for longer than rates in the Eurozone (or the US), but GBP is already priced for significantly higher yields than we have now, and is at significantly strong levels relative to long term valuation. Additionally, speculative positioning looks extended judging by the CFTC data. So while a EUR/GBP dip below 0.84 remains possible if the market further reduces its expectation of an August BoE rate cut, significant progress below this level remains hard to justify.