FX Weekly Strategy: July 15th-19th

JPY the main focus after sharp gains Thursday and Friday

Key levels approaching with talk of intervention

EUR risks may be on the downside on ECB meeting

GBP strength could be challenged by UK data

Strategy for the week ahead

JPY the main focus after sharp gains Thursday and Friday

Key levels approaching with talk of intervention

EUR risks may be on the downside on ECB meeting

GBP strength could be challenged by UK data

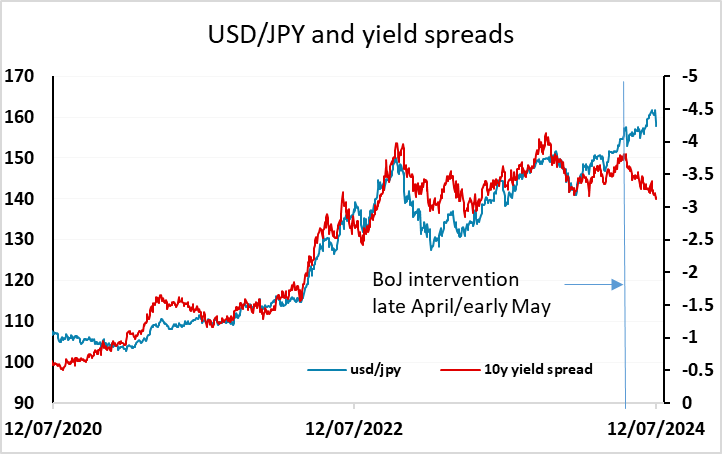

The JPY will be the main focus this week after the sharp gains seen at the end of last week, with some attributing some of the strength to BoJ intervention. The reversal of the JPY weakness in the last couple of days has still only made a small dent in the JPY weakness of recent years and the absolute JPY weakness against measures of fair value. We would expect substantial JPY gains in the coming years, but sharp dips have been seen within the USD/JPY uptrend of the last few years only to be seen as buying opportunities by the JPY bears. The difference this time around is that USD/JPY has been rising against the trend of yield spreads in the last couple of months, essentially since the round of BoJ intervention at the end of April/beginning of May. That it was able to do so may have given confidence to the JPY bears, but it’s hard to believe such a situation can continue when the JPY is already at all-time lows in real terms against all major currencies.

Nevertheless, periods of JPY strength tend to be short and sharp rather than extended, with any decline in volatility tending to be seized upon by carry traders as buying opportunities. So if we see USD/JPY starting quiet on Monday, the JPY bears may once again start to take control. The question will then be whether the Japanese authorities are committed to halting the recent rise. If they are, we could see more intervention early in the week in an attempt to break the uptrend seen this year. This comes in around 157, and a clear break of this could see a big clearout of positions with potential to move down to the levels suggested by current yield spreads below 150. The longer term channel support doesn’t come in until 147, which is broadly in line with the level suggested by yield spreads. There is a Japanese holiday on Monday, but we wouldn’t assume this means that the BoJ can’t get involved.

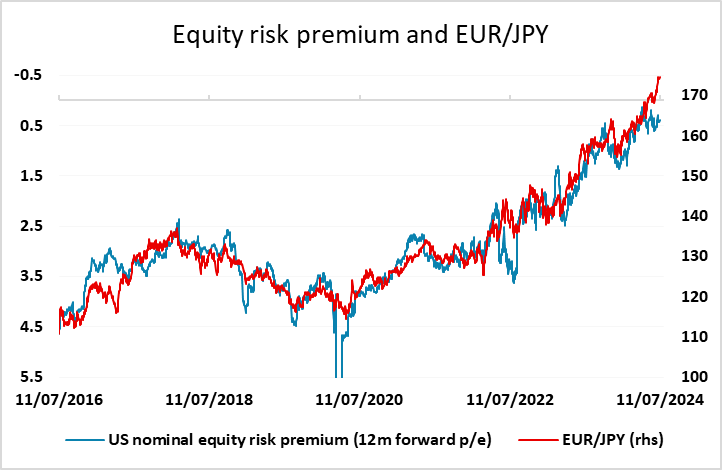

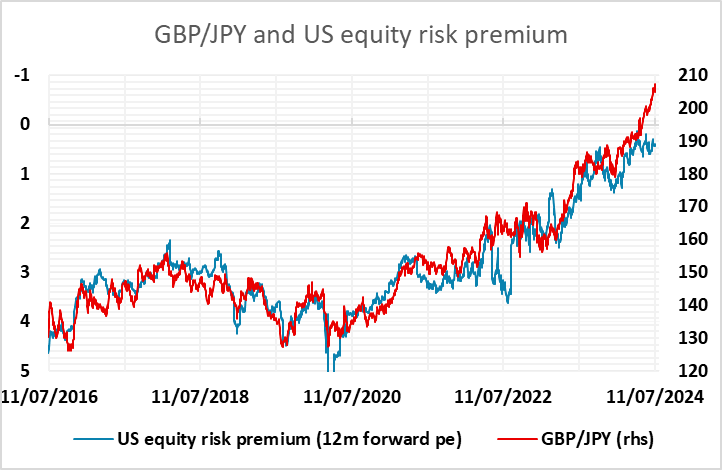

A move below 150 in USD/JPY would also likely mean a move into the mid-160s for EUR/JPY and the mid-190s for GBP/JPY. These crosses have generally been correlated with US equity risk premia, but just as USD/JPY has moved away from the yield spread correlation in recent weeks, so the crosses have exceeded the correlation with risk premia. Market talk suggests some of the BoJ intervention may have been in the crosses in the last couple of days, so if there is a move lower in USD/JPY, it seems likely to be a JPY move rather than a general USD move.

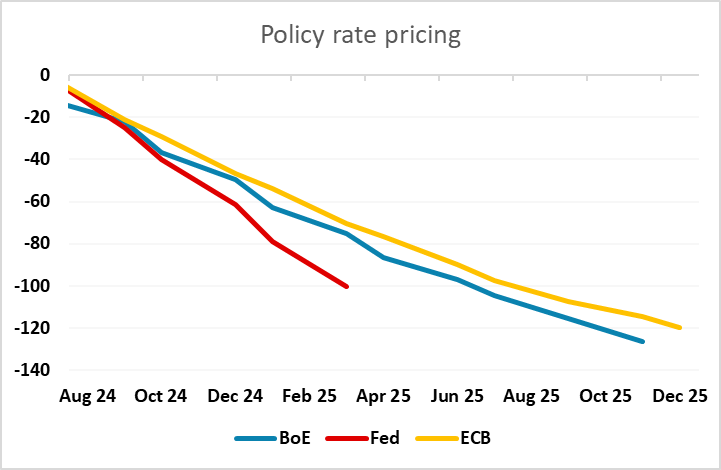

Elsewhere, the ECB meeting is the main focus, but there isn’t much chance of any action this month, with ECB comments making it fairly clear that there won’t be any change in the main policy rates. As usual, it will therefore be more about what the ECB indicate for the coming meetings. A September rate cut is 85% priced, so there is more downside if the ECB suggests September is not a certainty than there is if they confirm that it a September cut is very likely. As it stands, there looks to be more scope for the market to price in more rather than less for the ECB, as there are less than two cuts priced for the ECB against three priced for the Fed by the end of the year. The risks may therefore be on the downside for the EUR.

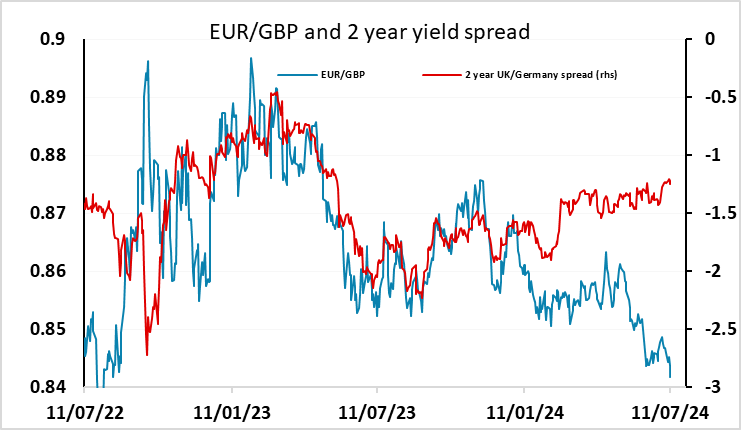

GBP strength in the last week has been a feature, but could be challenged by the UK CPI and labour market data this week. The market has favoured the pound since the Pill speech last week, and EUR/GBP has also been on the back foot since the French election was called. But with an August rate cut only 50% priced for the UK, and yield spreads already suggesting EUR/GBP has fallen too far, there are upside risks for EUR/GBP this week.

Data and events for the week ahead

USA

Monday sees the release of July’s Empire date Manufacturing index and Fed’s Powell will give an interview. Fed’s Daly will also speak. The most significant data release of the week may be June retail sales on Tuesday. We expect a weak month with declines of 0.6% overall, 0.3% ex autos and 0.1% ex auto and gasoline. June import prices are due at the same time. Later May business inventories, for which existing data suggests a stronger 0.5% increase, and July’s NAHB homebuilders’ index, are due. Fed’s Kugler will also speak on Tuesday.

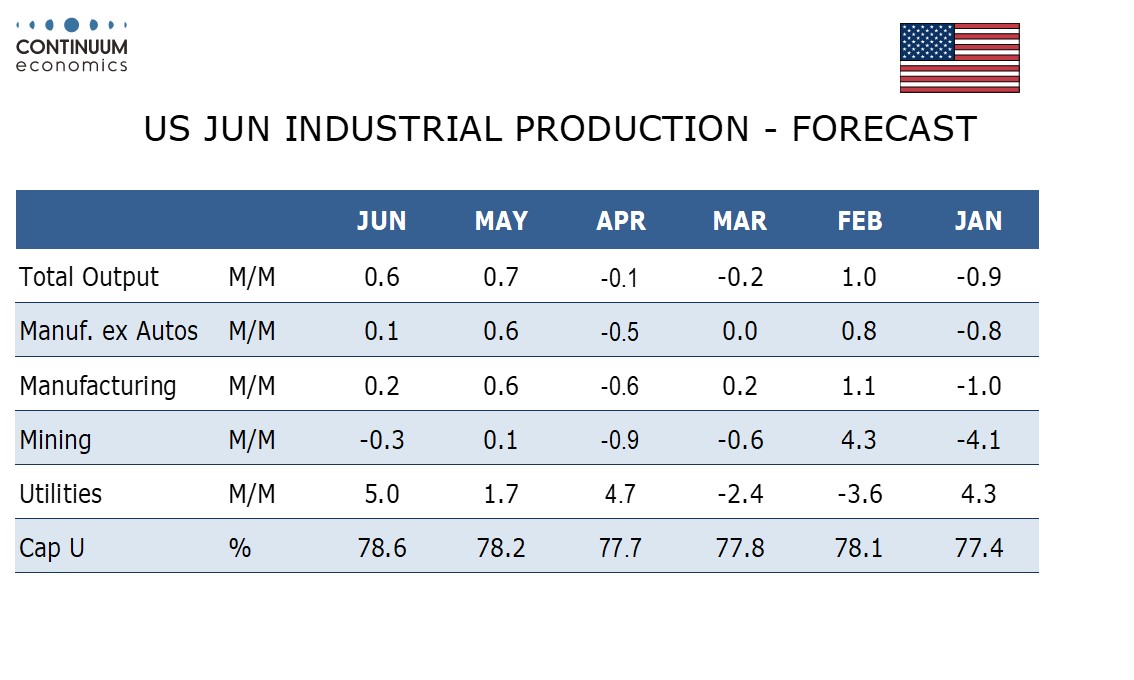

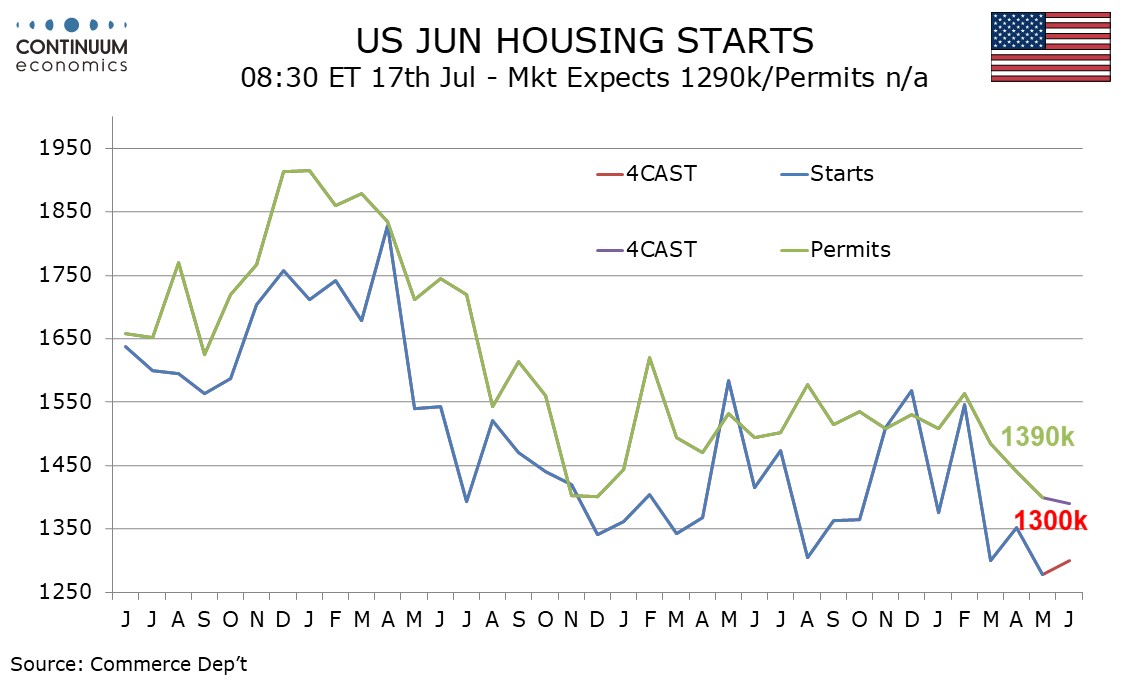

On Wednesday we expect June housing starts to correct higher by 1.8% to 1.30m but permits to maintain a falling trend with a 1.7% decline to 1.39m. Later we expect a weather-related rise in utilities to lead a 0.6% rise in June industrial production, with manufacturing rising by 0.2%. The Fed’s Beige Book follows. Thursday sees weekly initial claims and July’s Philly Fed manufacturing survey while Fed’s Logan, Daly and Bowman are due to speak. Friday’s US data calendar is quiet though Fed’s Williams will speak.

Canada

In Canada, Monday sees May manufacturing and wholesale sales, for which preliminary estimates were for a rise of 0.2% and a decline of 0.9% respectively. The BoC’s quarterly business outlook survey is also due and will be closely watched ahead of the BoC’s July 24 meeting.

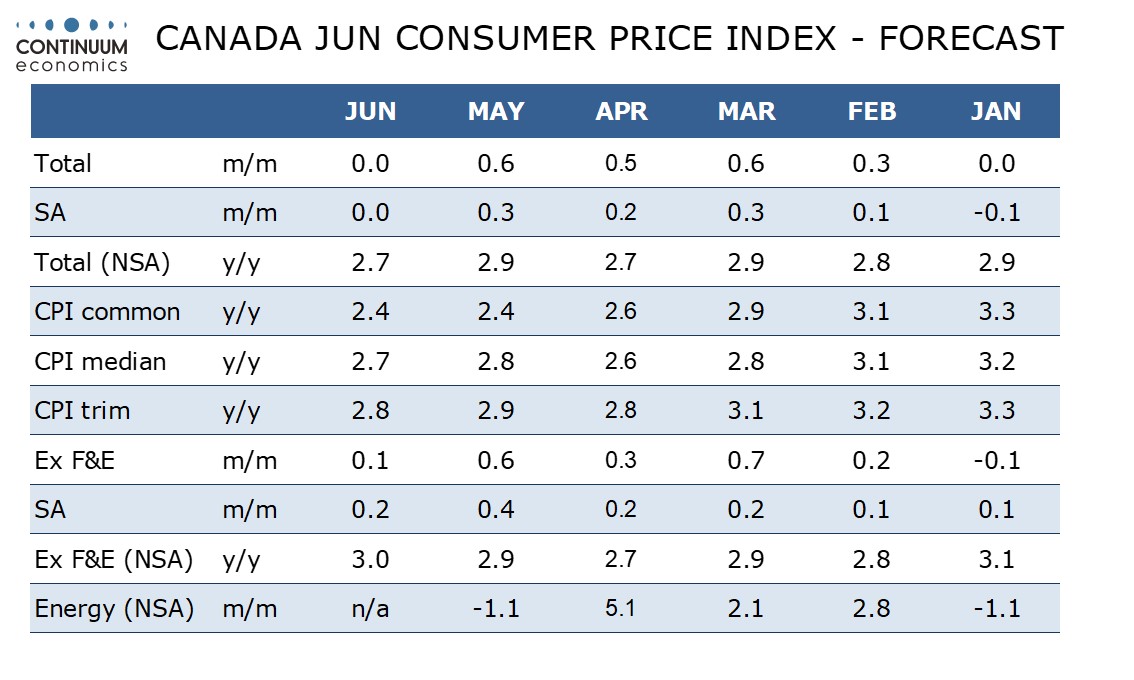

Key for the BoC however will be June CPI on Tuesday. We expect slippage to 2.7% yr/yr, reversing an acceleration to 2.9% in May, with similar corrections lower in the BoC’s core rates. After May’s disappointment however, June data will have to be very soft to make a July easing look likely. June housing starts are also due on Tuesday. Friday sees May retail sales, for which the preliminary estimate was for a 0.6% decline, and June IPPI/RMPI data.

UK

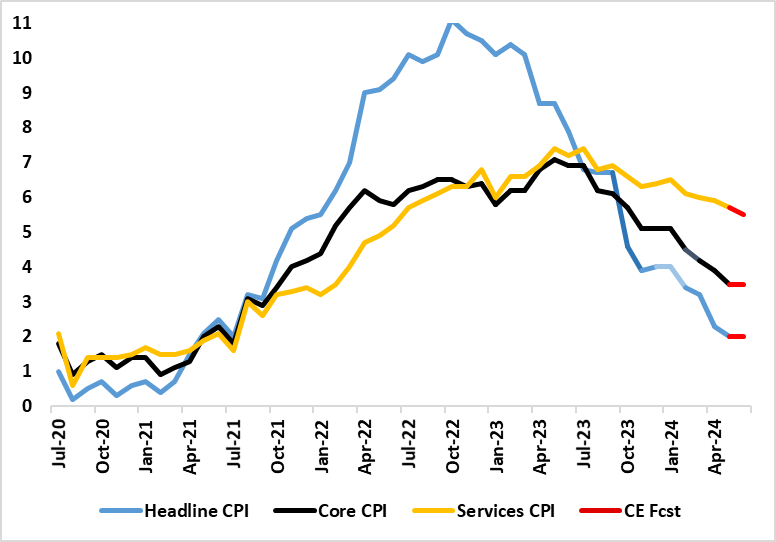

Major data awaits with the June CPI (Wed). We see the headline staying at 2.0% in the June numbers and with a stable core rate of 3.5%, but with services easing only to 5.5% and thus some 0.4 ppt above BoE thinking. The day after sees key labor market data which may show a further rise in the jobless rate and higher inactivity, but there will be as much weight on HMRC numbers regarding job dynamics which have suggested clearer slowing in private sector employment, if not an actual contraction. However, the average earnings figures will be the most closely watched. We see a more discernible slowing in both regular pay growth (3 mth mov avg) down to 5.6% and the headline rate down similarly. Regardless, with even the BoE (belatedly) casting doubt on the validity of these numbers, more attention may be paid to the PAYE pay data where a clear(er) slowing may be on the cards. Notably, this PAYE data also chimes with weaker activity backdrop highlighted by the ONS which showed a marked fall in vacancies alongside increased signs of employment contracting and not just in terms of self-employment. Indeed, the jobs data conflict with the headline pick-up in Q1 GDP growth, albeit more in line with the soggy domestic demand picture those national account data nevertheless highlighted.

Headline and Core Inflation Steady But Services Less Resilient?

Source: ONS, Continuum Economics

Elsewhere, public borrowing data (Fri) may show more signs of flagging receipts, alongside lower-than-expected debt interest costs being offset by higher-than-expected spending on subsidies. Finally, retail sales data (also Fri) may succumb (again) to poor weather which was unsettled, wet and dull through June, with another flat to negative m/m reading. Otherwise, more consumer insight will come from GfK consumer survey numbers.

Eurozone

The ECB Council meeting verdict (Thu) is the stand-out event of the week. As has been the case with many recent ECB verdicts, markets are keener to hear what is being said by the Council rather than what is being done. In regard to the latter, and given the almost unanimous hints from Council members, all policy rates will be held. But markets will be more focused on hints on the speed and timing of further moves, not least after what was a formal dissent, and amid wider reservations, in regard to the cuts seen last time around. Indeed, there seemed to be disagreement within the Council about interpreting data; what is the basis for assessing how data moved relative to expectations and even an implicit objection to the ECB having a symmetric target! A key ingredient will be some recent soft real economy data and also some retort to German Finance Minister Christian Lindner’s publicly-aired doubts this week about the legality of potential ECB crisis aid tools ostensibly for France. But perhaps the key matter will be the still soft credit backdrop, with fresh and potentially very influential insight into the supply side coming from the next Bank Lending Survey due on Tuesday

Datawise, the main interest will be the EZ industrial production data (Mon) which are likely to weak. EZ trade data may show more import weakness while the ZEW data may reflect recent soft data news already seen of late in Germany

Rest of Western Europe

There are no major data or policy events in the coming week

Japan

We will have the national CPI on Friday, we forecast inflation will resume its moderation as the previous spike settles. However, the summer wave of higher energy prices may come in yet it should not begin until July/August. Trade balance on Thursday would also be interesting to assess level of export and domestic demand.

Australia

We only have the labor report and business confidence on Thursday. The Australian employment has surprised to the upside for the past few months. It does not indicate the market is healthy strong but we also do not see the labor market to deteriorate soon.

NZ

Kiwi CPI comes in on Wednesday. The RBNZ has hinted that inflation dynamic is close to approaching target range and one should expect a miss in CPI.