UK GDP Review: More Upside Surprises

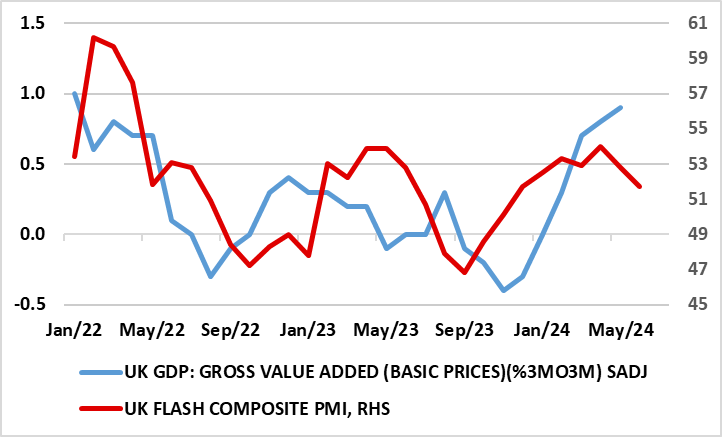

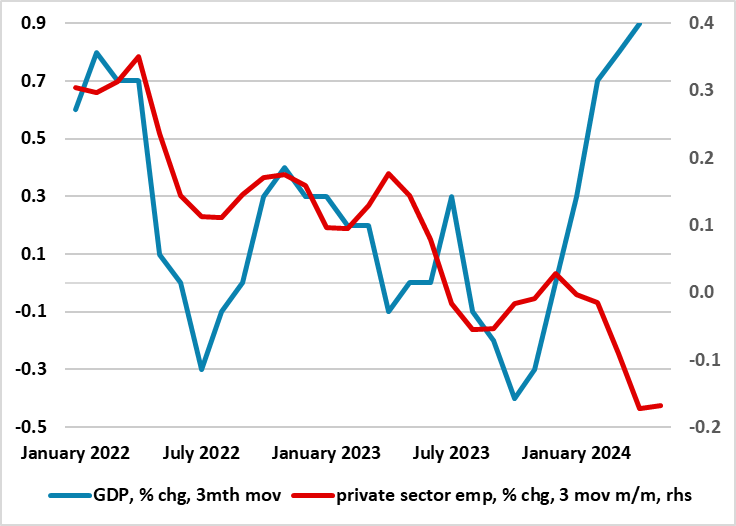

After the mild recession in H2 last year, the ‘recovery’ now evident is much clearer than any expected with GDP growth notably positive, and with less apparent volatility. Indeed, coming in more than expected, GDP rose by 0.4% m/m in May accentuating the bounce in the two months prior to the flat April reading. As a result, this would be consistent with a circa-0.6% Q2 q/q outcome, building and almost matching the strong but possibly misleading Q1 jump. It would also be above BoE thinking for the last quarter and would suggest growth of around 1% for the whole year, double the previous estimate. But the apparent resilience, if not strength, in the GDP data contrasts increasingly with employment weakness (Figure 2) and is partly a result of public sector gains, but also does not appear to be a result of import weakness as was the case in Q1. But the strength in GDP also contrasts with survey data (Figure 1).

Figure 1: Clearer Recovery But Contrast with Survey Volatility?

Source: ONS, Markit CE

A Mixed Momentum Message?

Volatile weather appears to have affected activity in recent months. Rainfall in April was well above average while May was the warmest on record since records began in 1884, according to the Met Office. This may explain the apparent marked bounce in construction, albeit against a backdrop in May which saw broad-based increases in activity

As for the last set of monthly GDP numbers, real gross domestic product (GDP) is estimated to have grown by 0.9% in the three months to May. This is the strongest three-monthly growth since January 2022. Services output was the main contributor, with a growth of 1.1% in this period, while production output showed no growth and construction fell by 0.7%. Overall we are sceptical about the GDP strength, even though it does not appear to be the result of import weakness as was the case in Q1 and before. The GDP data conflicts with both survey data (Figure 1) and with employment (Figure 2). Regardless, it now looks as if GDP growth may be around 1% this year, double the estimate previously and more in line with what we thought may occur for 2025. We do not think the data will have much impact in reshaping BoE thinking, although solid GDP growth may accentuate worries about possible price persistent among the MPC hawks, especially as the relative strength in services output chimes with resilient services inflation.

Figure 2: Clearer Recovery But Contrasts with Labor Market?

Source: ONS, CE