EUR, JPY flows: Weak German data suggest EUR/JPY decline

German industrial production mirrors weaknes sin orders. EUR/JPY more at risk than EUR/USD

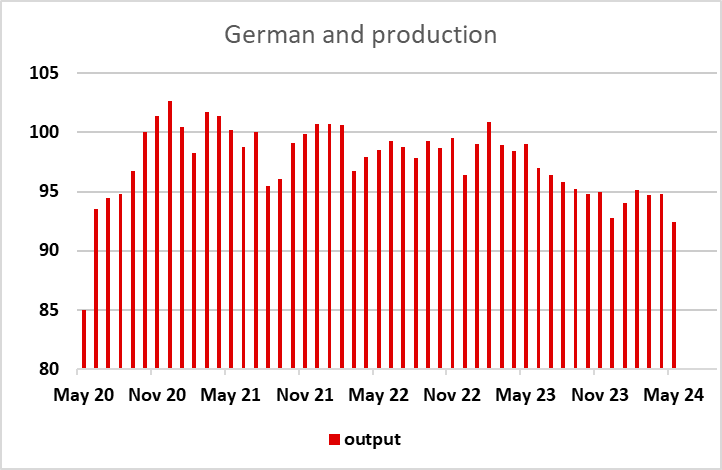

After weak German orders data yesterday we have weak German production data today. As with orders, industrial production is now at its lowest level since the pandemic. There has been little market reaction, but while it is the case that Germany is underperforming the rest of the Eurozone, the weakness in German manufacturing does create some concern about the sustainability of any Eurozone recovery. It also increases the chance of faster and/or deeper ECB rate cuts, especially given the continued weakness in money and credit data. At this stage the market is only pricing (slightly less than) two further ECB rate cuts this year, but we see scope for this to increase, with the terminal rate of 2.5% seen in 2026 also having potential to fall further.

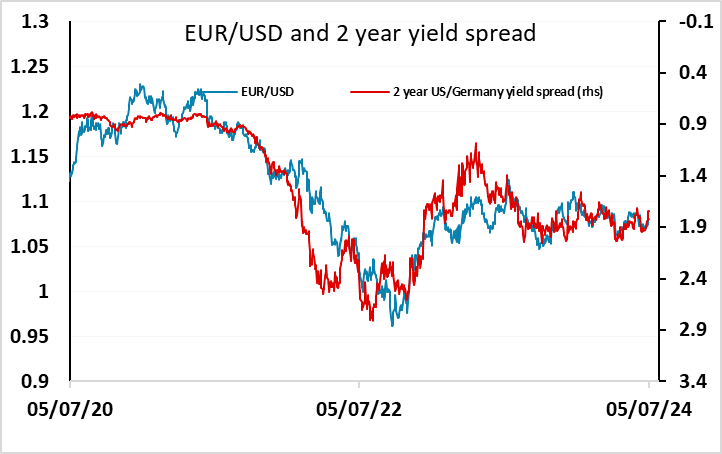

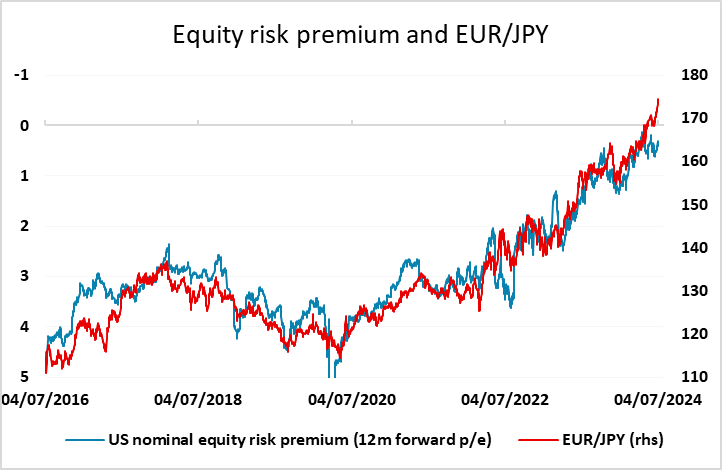

We don’t see this as necessarily being negative for EUR/USD, as we see similar if not greater potential for lower US rates, but it ought to weaken the EUR against countries where rate cuts are less likely, notably the JPY but also the AUD. The JPY has corrected a little higher overnight, but remains very weak and out of line with all correlations with measures like yield spreads and risk premia that have previously provided a guide to valuation. There is consequently potential for substantial EUR/JPY declines if the momentum driven JPY weakness of the last few weeks is reversed.