GBP flows: Little impact from election result

GBP unchanged as Labour wins UK election

GBP is essentially unchanged following Thursday’s UK election victory for Labour. The Labour majority is large, albeit not quite as large as the polls had predicted, and the Conservative party losses are also large but slightly less than predicted. It is notable that Labour’s share of the vote has not changed a great deal. The big victory is a consequence of a split in the right wing vote, with the new Reform party gaining 12% of the vote and the Conservatives losing 20%. The Liberal Democrats took a lot of Conservative seats despite little change in their share of the vote.

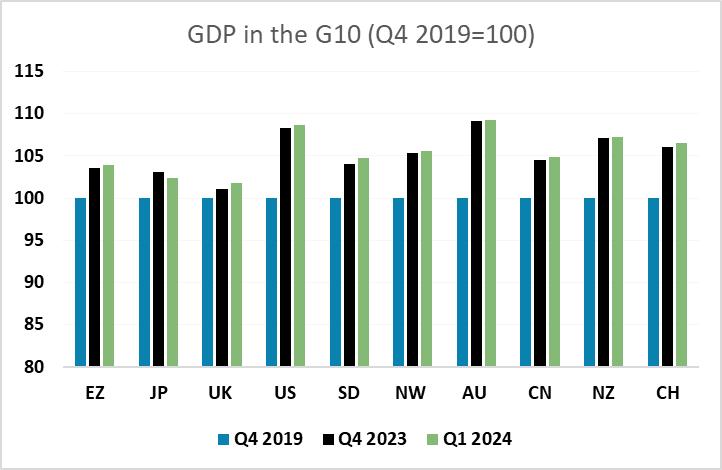

However, the details are of limited significance for the pound. The Labour manifesto commitments are not seen as particularly radical, and while there is some potential for surprises, any change in the UK’s underlying economic performance is unlikely to happen quickly. The UK has shown the least growth of any G10 nation since Q4 2019 – the last quarter before the pandemic – and Labour will attempt to improve growth prospects. But for GBP, the market will be more interested in what the BoE do at the August meeting. This is currently priced as offering a 57% chance of a rate cut, and the data between now and then will probably be more important than any Labour policy decisions. But watch out for surprises.