FOMC Minutes from June 12 - Economy Seen Cooling But Little Discussion of Easing

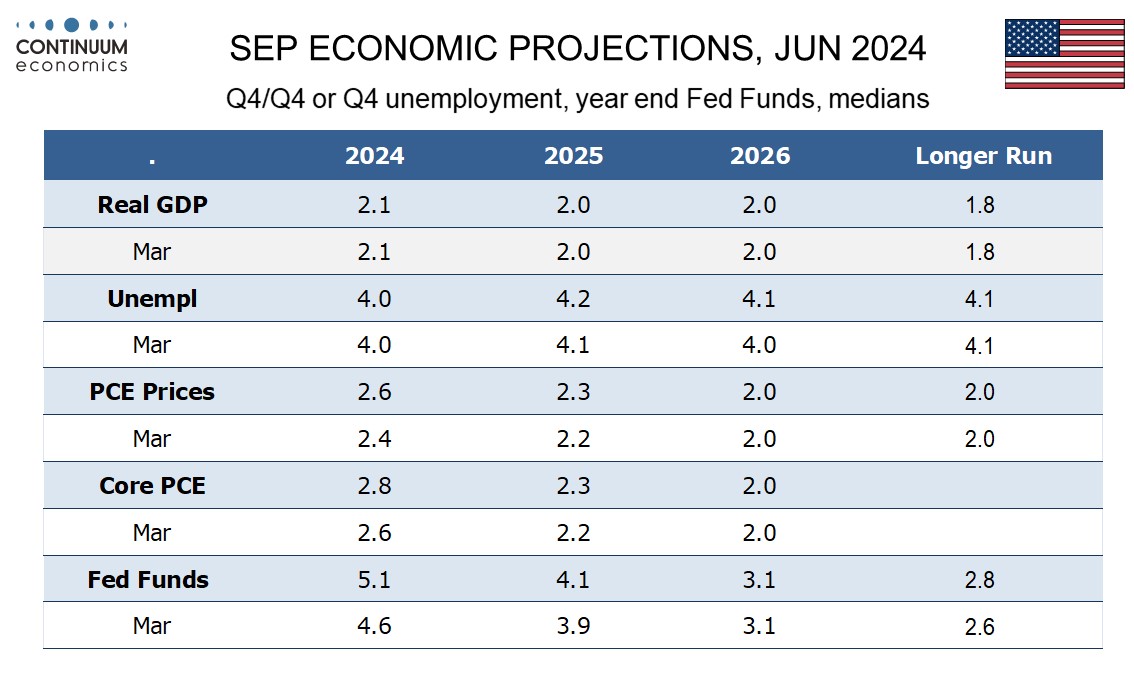

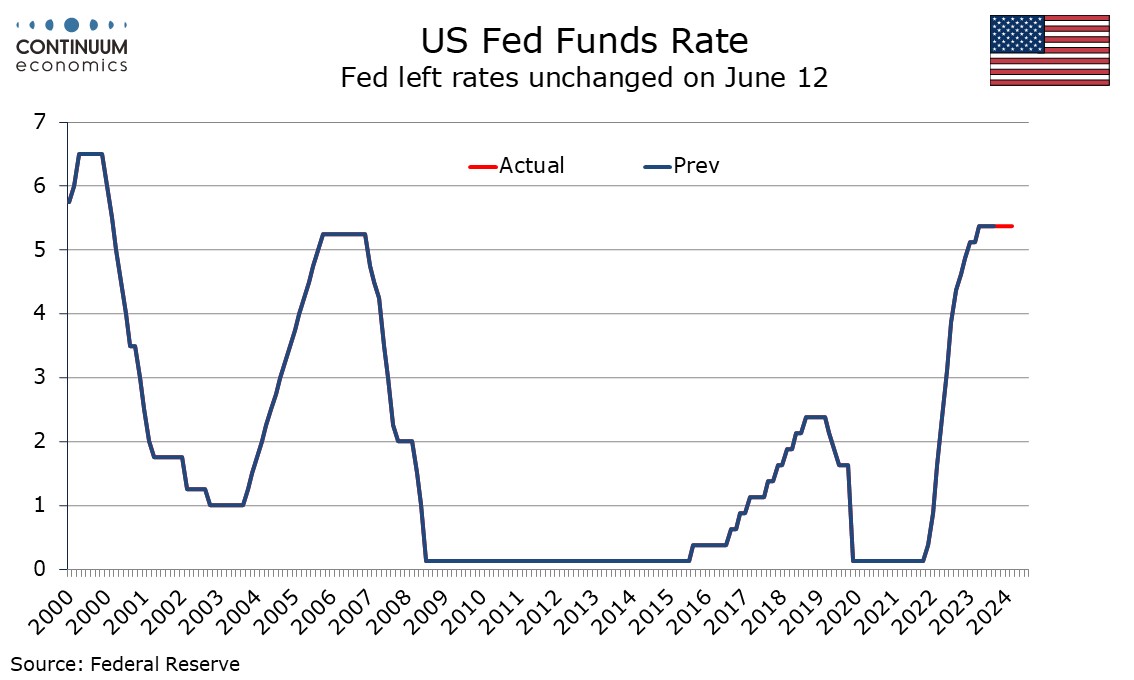

FOMC minutes from June 12 show that the vast majority assessed that growth in economic activity appeared to be gradually cooling and the views expressed on inflation are cautiously optimistic. However there was agreement that easing would not be appropriate until they had gained greater confidence on inflation moving sustainably to 2%.

There is in fact little discussion on easing in response to the cautious optimism on inflation, though a number remarked that policy should stand ready to respond to unexpected economic weakness, while several emphasized that with the labor market normalizing a further weakening of demand could generate a larger unemployment response than in the recent past. However some emphasized the need for patience in allowing restrictive policy to restrain aggregate demand and several observed that were inflation to persist at an elevated level or to incase further, rates might need to be raised. This suggests the risk of tightening might be greater than most recent Fed comments have suggested.

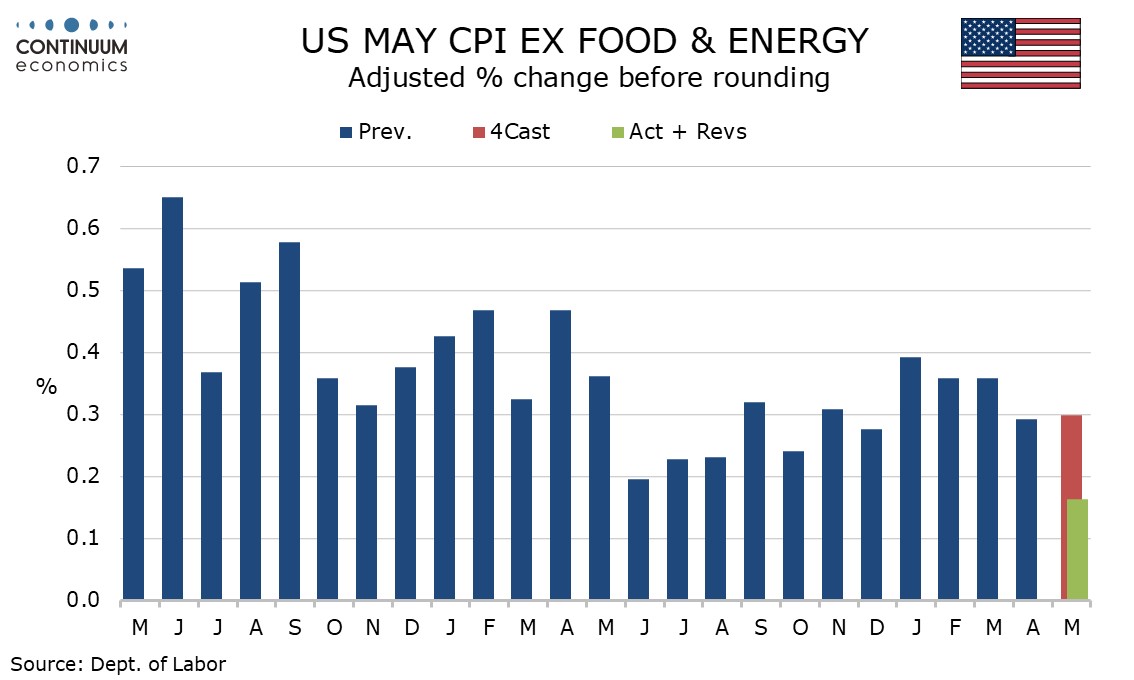

However, it is clear that the conditions that might prompt further tightening are not what the FOMC is expecting. Participants judged that while inflation remained elevated that there had been modest progress towards to 2% goal in recent months, with the May CPI that was released on the day of the decision noted. Participants suggested that a number of developments in the labor and product markets supported their judgement that price pressures were diminishing. These include easing of demand-supply pressures, delayed response of shelter prices to rental developments and prospect of additional supply-side improvements.

Views given on the labor market are not hawkish, which was seen as coming into better balance. Some felt that the monthly pace of employment growth consistent with labor market equilibrium might have increased due to immigration and several felt that non-farm payroll data might be overstating job growth. While risks were seen as moving into better balance the risks to economic activity cited were mostly on the downside, though risks cited to the inflation outlook were largely on the upside. This suggests the Fed is not in a hurry to ease on softer inflation data, of which more is still required, but the FOMC could respond quite quickly to any unanticipated labor market weakness.