UK GDP Preview (Jul 11): Questions Continue Regarding How Resilient is the Economy?

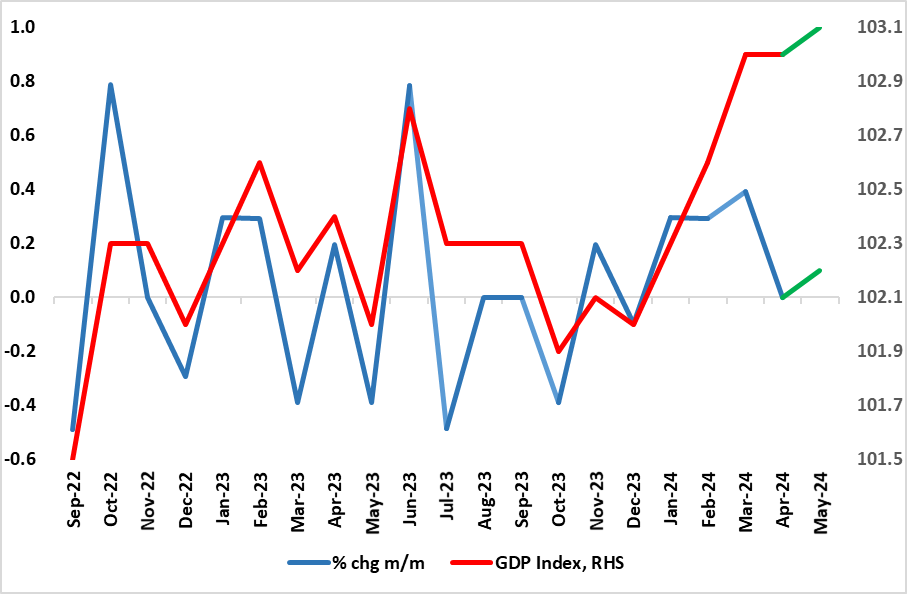

The economy may have been in only mild recession in H2 last year, but the ‘recovery’ now evident is seemingly much clearer than any expected with GDP growth notably positive, albeit with some continued volatility. Indeed, coming in more than expected, and despite industrial action, GDP rose by 0.4% m/m in March accentuating the upgraded bounce in the two previous months, with the fresh April numbers showing no change, also better than the small drop widely expected, despite the adverse impact of yet more unseasonable weather. Looming May GDP data, with a 0.1% m/m rise anticipated, should accentuate this picture, especially as it should encompass upward revisions to the Q1 backdrop. As a result, this would be consistent with a circa-0.3% Q2 q/q-plus outcome (Figure 1), building on the strong but possibly misleading Q1 jump but would also be below BoE thinking for the last quarter. But the apparent resilience, if not strength, in the GDP data contrasts increasingly with employment weakness and is partly a result of public sector gains (Figure 2).

Figure 1: Clearer Recovery But Contrast with Jobs Weakness?

Source: ONS, CE

Mixed Momentum Messages?

There are several positive aspects from data already available in assessing May GDP. Retail, sales, car production and property transactions were all very positive, all coming alongside and probably reflecting the warmest May on record, that could also boost constriction. Regardless, there are still areas of concern, with the latest BoE Agents survey pointing to weakness in consumer spending on goods and services in Q1 and as a result revising down their expectations of growth for 2024.

As for the last set of monthly GDP numbers, Real gross domestic product (GDP) is estimated to have grown by 0.7% in the three months to April 2024, compared with the three months to January 2024. Services output was the main contributor with a growth of 0.9% in this period, while production output rose by 0.7% and construction fell by 2.2%. Monthly real gross domestic product (GDP) is estimated to have shown no growth in April 2024, following a growth of 0.4% in March 2024. Construction and manufacturing saw clear m/m falls, the former possible a result of poor weather.

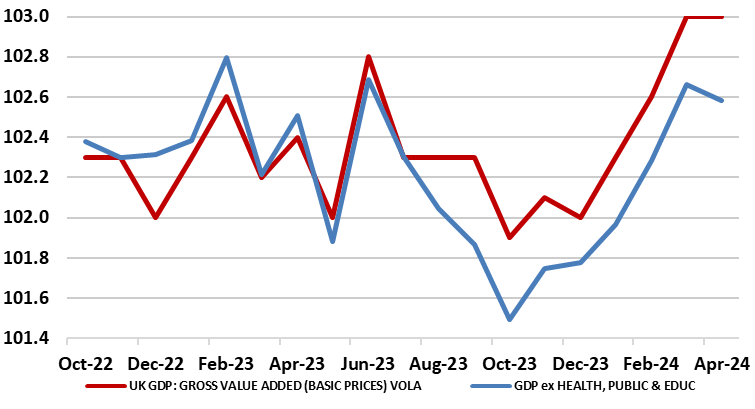

Figure 2: Clearer Recovery But More in Public than Private Sector?

Source: ONS, CE

Otherwise, there was a fresh rise in utility production, also possibly weather related but also gains in education and health. Notably, private sector GDP has been lagging clearly behind overall GDP (Figure 2). In addition, the GDP data are very much running in contrast to what labor market data show, even those more authoritative numbers offered by HMRC as opposed to the official ONS numbers. All of which maintains a certain degree of circumspection about the data. As for the BoE, these GDP numbers will count for little, with the labor market numbers possibly more influential.