U.S. May Personal Income and Spending - PCE Prices slowing, Spending lagging Income in Q2

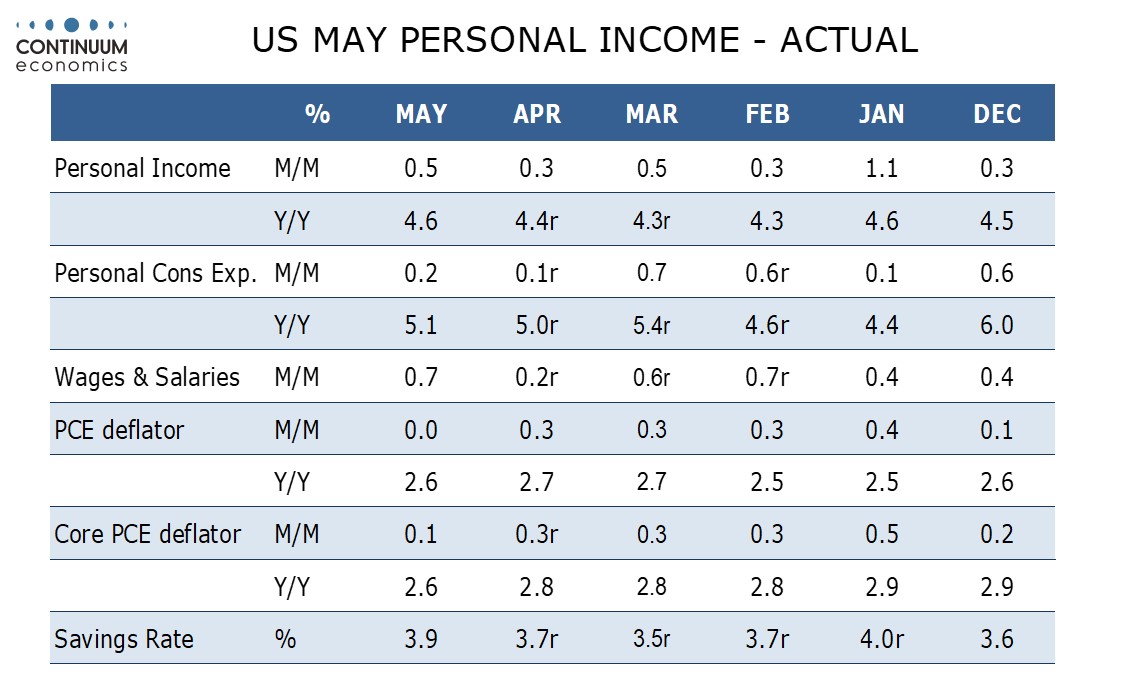

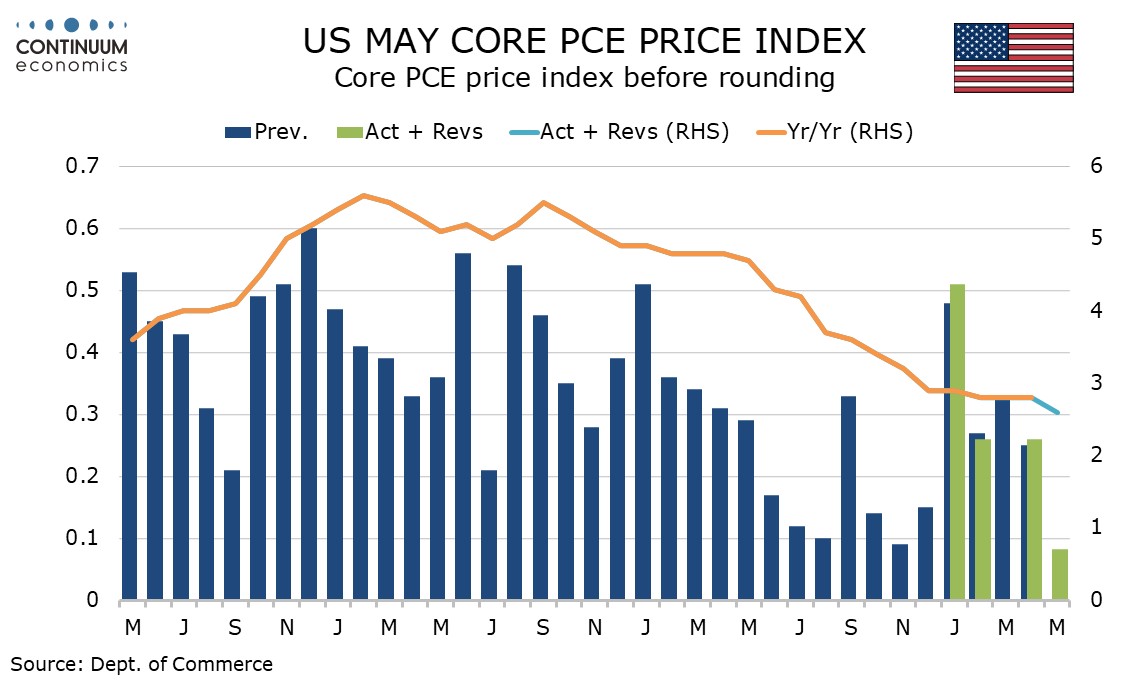

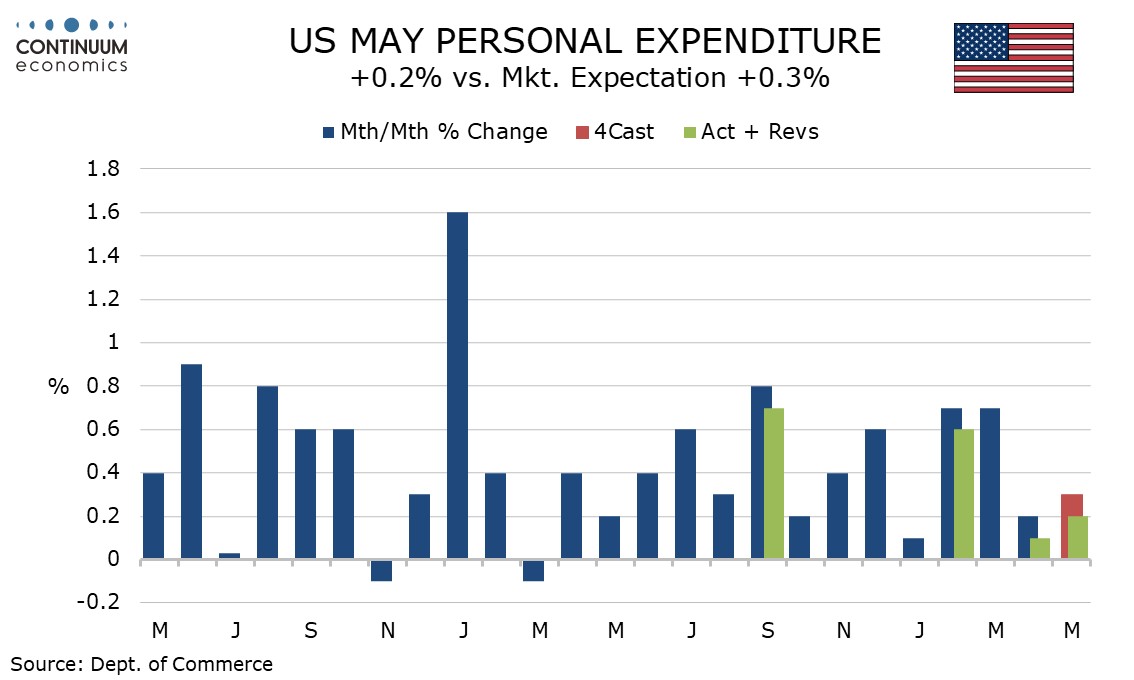

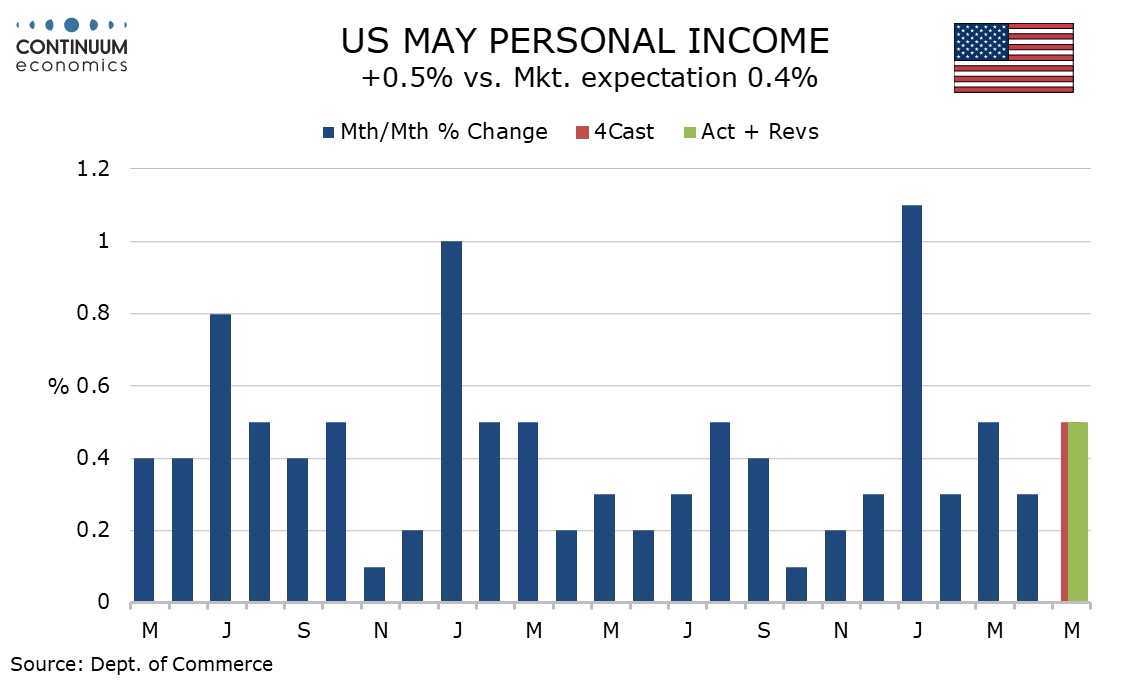

May core PCE prices are very soft, the 0.1% rise is on consensus but the gain was only 0.083% before rounding while the overall PCE price index was flat. Spending is losing momentum, with May’s rise only 0.2% and downward back revisions, this falling behind a stronger than expected 0.5% rise in personal income.

May’s core CPI had risen by 0.2% and 0.16% before rounding so both core PCE prices and core CPI have slowed significantly from the first four months of the year. 2003 also saw a strong start to the year before fading and we expect the subdued tone of May data will continue into the second half of the year.

Yr/yr overall and core PCE prices were as expected at 2.6%, down from 2.7% and 2.8% respectively in April. April core PCE prices were revised up to 0.3% from 0.249%, but the revision before rounding was marginal to 0.259% from 0.249%. We saw with yesterday’s GDP report that Q1 had been revised up to 3.7% annualized from 3.6%.

The GDP report also saw real personal spending revised down in Q1 to 1.5% annualized from 2.0%, meaning that May’s subdued 0.2% nominal gain with April revised down to 0.1% from 0.2% leaves a subdued picture, though May rose by 0.3% in real terms after a 0.1% decline in April. The personal spending detail showed retail sales correcting from a weak April but service spending rising by only 0.1% in real terms for a second straight month, a clear loss of momentum from recent trend.

With personal income up by 0.5% the savings rate has increased to 3.9% in May from 3.5% in March, Wages and salaries with a 0.7% increase matched the positive signals from May’s non-farm payrolls and average hourly earnings data. The other components of personal income rose in line with recent trend other than a very strong gain in January.