FOMC Minutes from June 12 to Look Less Hawkish Than Those from May 1

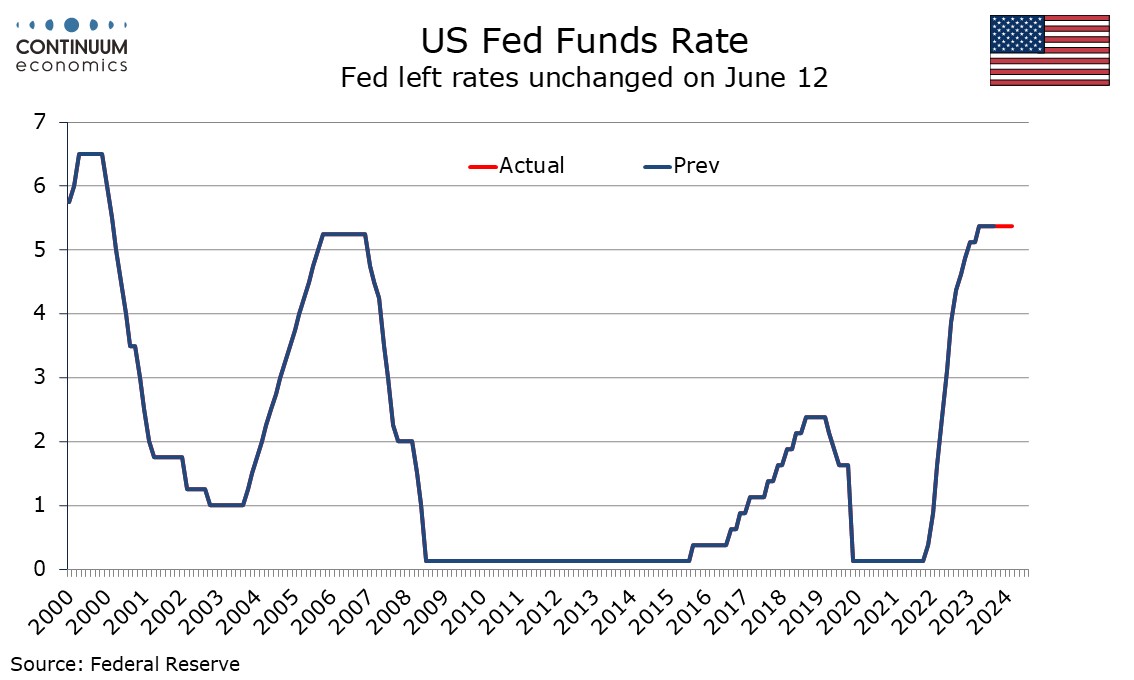

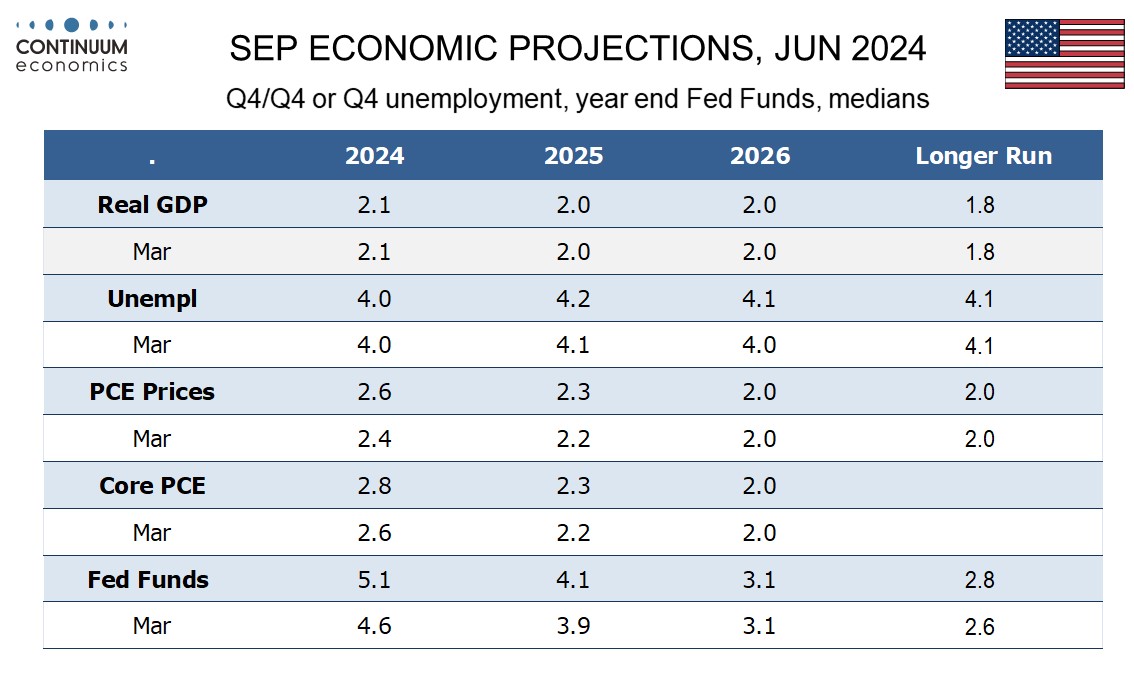

FOMC minutes from June 12 are due on July 3. We expect less alarming inflation data seen since the previous meeting on May 1 will see the tone of the minutes less hawkish than those from May 1. That could support a view that the Fed might ease by more this year than the one 25bps move seen in the latest dots. However the Fed will remain cautious and data dependent at this point.

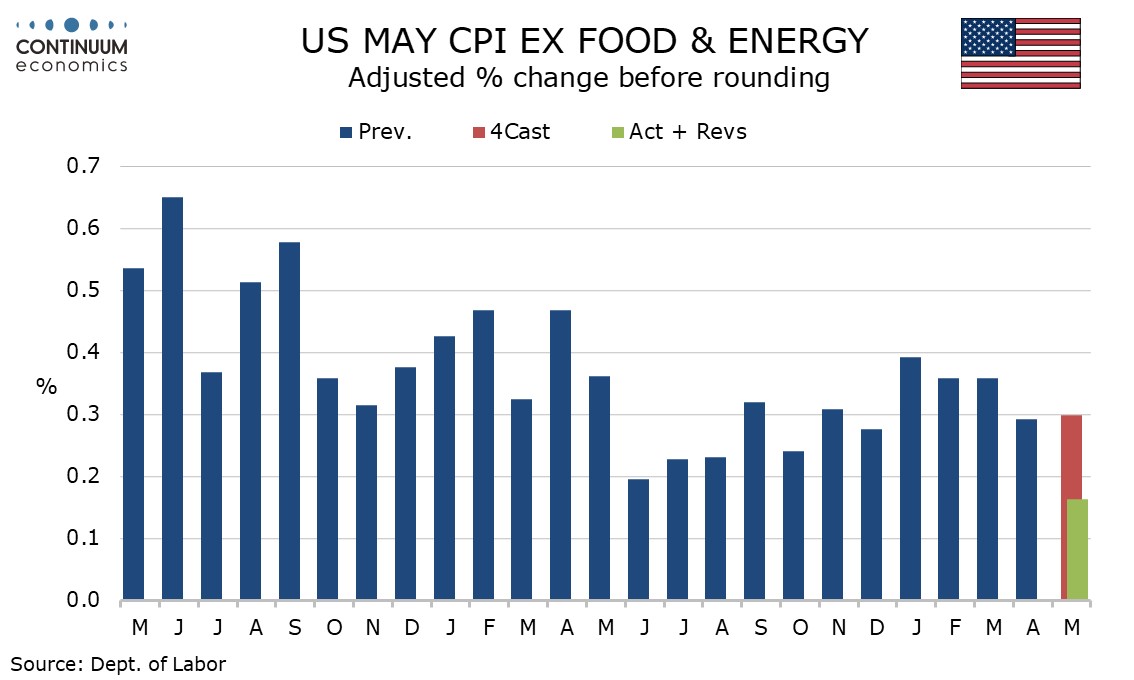

After the May 1 meeting we had seen disappointing inflation data for January, February and March, but not the less alarming releases for April and particularly May. May’s CPI data was released on June 12, the day of the FOMC decision. While June’s dots were more hawkish, with only one 25bps easing seen in 2024 rather than the three seen in March, May’s meeting may mark the peak level of the concern generated by the Q1 data.

Even May’s minutes were still not strikingly hawkish, with inflation and the economy still expected to slow, a view that is likely to have been strengthened by data released before and during the June meeting. Many in May did express a willingness to tighten policy further and we may find a reduced number thinking seriously about tightening in the forthcoming minutes, though one FOMC voter, Governor Michelle Bowman, recently warned this may be necessary if inflationary progress stalls.

However in May’s minutes there was more talk about keeping rates higher for longer than of tightening. The message this time may be that if inflation is stubborn, rates are likely to be kept steady, but if more encouraging data is seen, easing will be considered. May’s minutes did suggested that easing could be seen if the labor market weakened. The labor market still looks strong so there is no clear case for near term easing, but that May’s minutes considered the possibility of labor market weakness prompting easing despite the significant inflation concerns seen at the time suggests this is not a hawkish Fed.

The recent encouraging data will be treated cautiously, and the minutes are likely to suggest that several more months of encouraging data are needed before the Fed can feel sufficiently confident to start easing rates. That will make a July easing, when only one more CPI release (for June) will be seen, very unlikely, but a move in September (by when July and August CPI data will have been released) should not be ruled out. Data has potential to move the Fed from its current median dots on either side, but the bar for tightening looks quite high, meaning the Fed may be more responsive should data come in softer than expected.