CHF, GBP flows: Some downside risks for CHF and GBP

SNB and BoE monetary policy decisions today carry some risk of easier than expected policy and weaker currencies

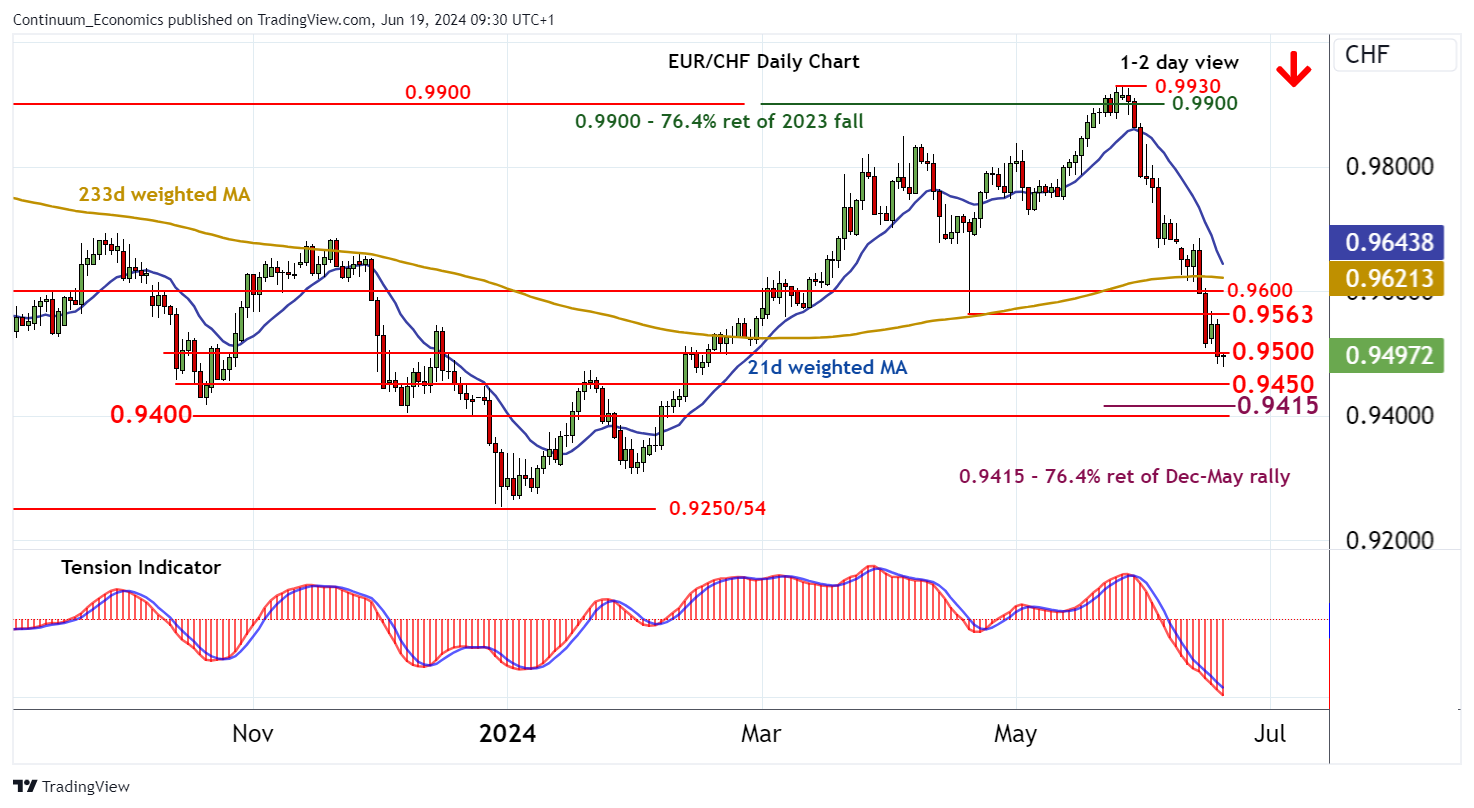

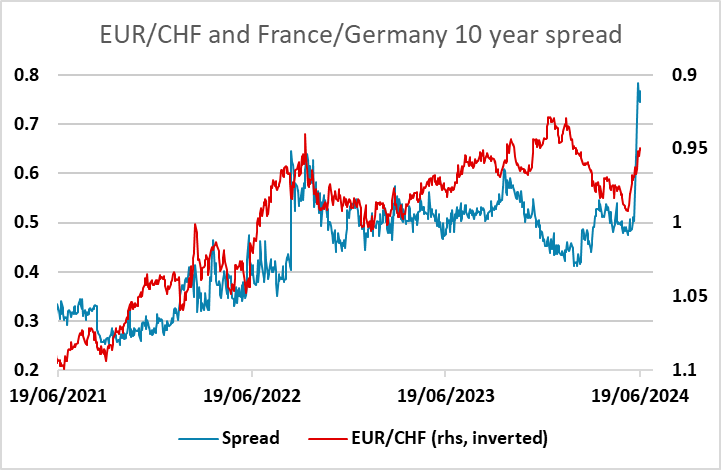

The monetary policy meetings in Switzerland and the UK are the main focuses for Thursday. The SNB is expected to cut rates another 25bs at the 08:30 BST meeting, but it is not entirely priced in, with the market only pricing a 25bp cut as around a 65% chance. Similarly, around two thirds of forecasters are looking for a cut in rates. The strength of the CHF in the last few weeks ought to help ensure that the SNB do cut, and we see upside risks in EUR/CHF from the 0.9480 retracement area hit in the last couple of days. While the level of the France/Germany 10 year spread may still be seen by some as a reason for further CHF strength, the spread has stabilised in recent days and we see scope for a corrective EUR/CHF rally above 0.95.

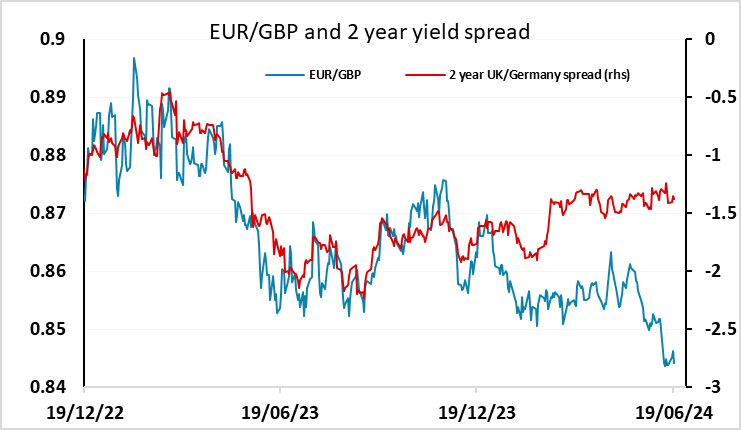

The market is more unified on the BoE decision later, with nothing priced in and no forecasters looking for a cut. We also see no cut, although we don’t see the risk as zero. But the focus will be more on the tone of the statement and the press conference which should provide some guide on whether a rate cut is possible at the August meeting. This is currently only priced as around a 20% chance, so we see the risks as very much on the downside for UK yields and GBP.