FOMC delivers hawkish 2024 dots, but statement slightly more optimistic on inflation

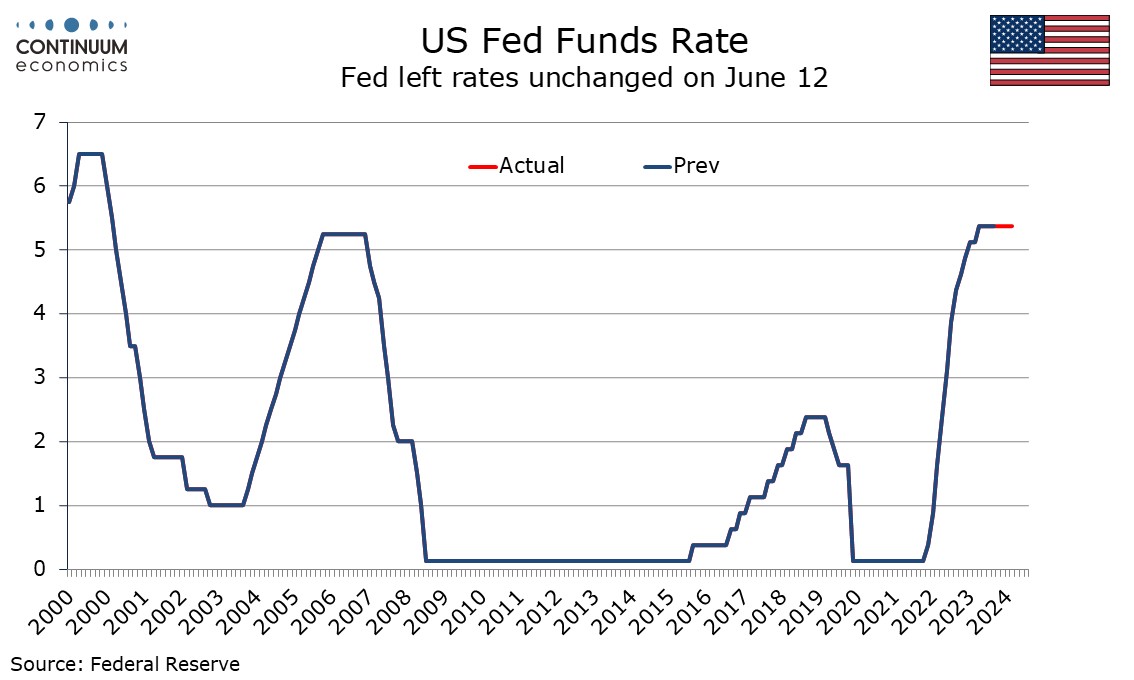

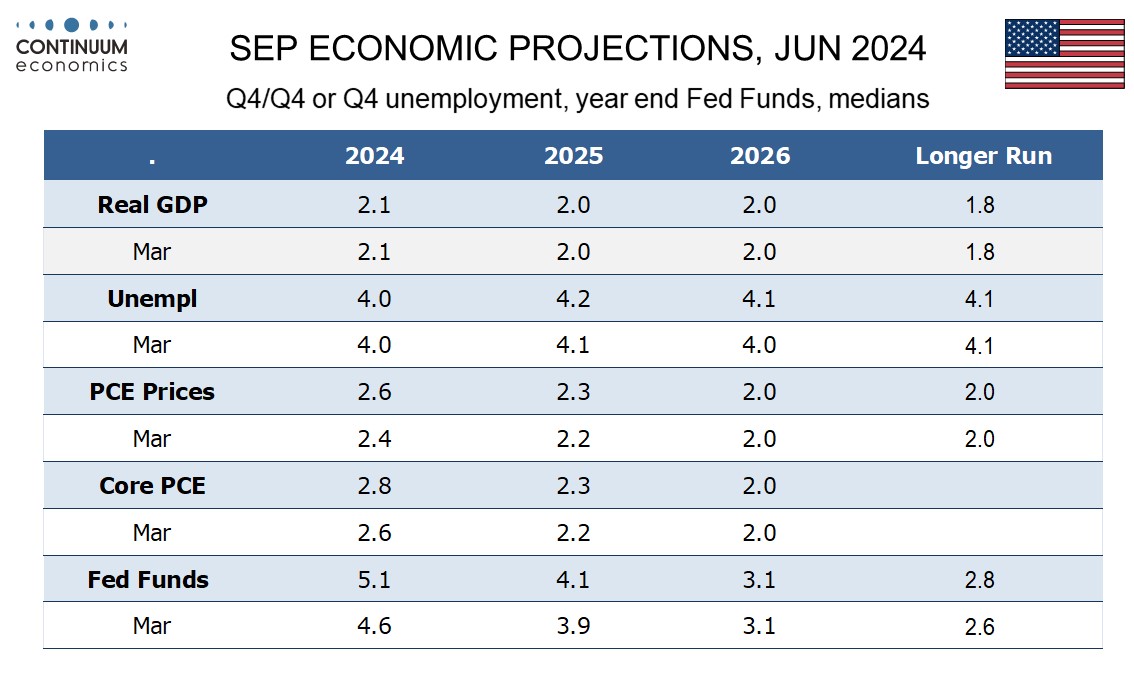

The Fed’s statement is slightly more optimistic on inflation on June than in May, tough continues to require greater confidence that it is moving towards target before easing. The dots are significantly more hawkish than in March, with a median of only one 25bps easing in 2024 rather than three, though 100bps rather than 75bps are now seen in both 2025 and 2026.

The details of the dot plot show seven on the median for one move in 2024, with four seeing no moves and eight seeing two, meaning only a modest negative skew and none on the March median which saw three moves. This is more hawkish than expected. The 2025 and 2025 dot plots are reasonably balanced with the median clearly the most popular option in both, though there is a marginal upside skew. This leaves the end 2026 median as it was in March though the neutral rate has been nudged up to 2.8% from 2.6%.

GDP views have not been changed at all despite a weaker Q1 outcome but unemployment has been nudged marginally higher in 2025 and 2026. The 2024 inflation view has been lifted by 0.2%, the 2025 view lifted by 0.1%, and the 2026 view, when inflation is seen returning to the 2.0% target, is left as it was.

The main change to the statement has been that they now see modest further progress on inflation in recent months rather than a lack of further progress, and this may reflect the May CPI data released today. It is unclear whether May CPI was fully taken into account in the production of the dots. The statement continues to state that the Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2%. There was no dissent from the decision to leave rates unchanged.