UK GDP Preview (Jun 12): Fresh Correction on the Cards?

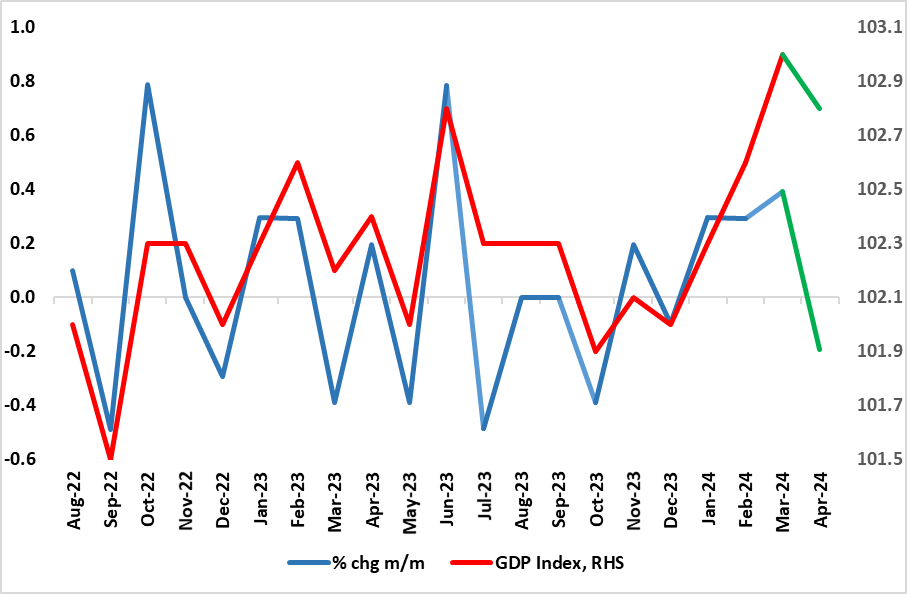

The economy may have been in only mild recession in H2 last year, but the ‘recovery’ now evident is much clearer than any expected with GDP growth notably positive. Indeed, coming in more than expected, and despite industrial action, GDP rose by 0.4% m/m in March accentuating the upgraded bounce in the two previous months, a result that is seemingly a move away from of the monthly swings seen of late. But that conclusion may be premature as April data (on the back of a slump in retail sales and weak car production) may see a fresh correction back of 0.2%, this accentuated by more unseasonable weather. This projection would be consistent with a circa-zero Q2 q/q outcome, a clear contrast to the strong but possibly misleading Q1 jump and would also be below BoE thinking for the current quarter.

Figure 1: Clearer Recovery But Still Fragile?

Source: ONS, CE

A Mixed Momentum Message?

The March data resulted in a very clear end to the modest recession seen in H2 last year and also exceeded BoE thinking as Q1 growth jumped by 0.6%, an outcome dominated by a boost from net trade, mainly a sharp fall in imports, hardly indicative if firmer demand. Regardless, there are still areas of concern, with the latest BoE Agents survey pointing to weakness in consumer spending on goods and services in Q1 and as a result revising down their expectations of growth for 2024.

As for the last set of monthly GDP numbers, GDP is estimated to have grown by 0.4% in March 2024, following growth of 0.2% in February 2024 (revised up from 0.1%) and an unrevised growth of 0.3% in January 2024. Services output was the largest contributor to the growth in GDP on both the month and the three months to March 2024. Production output grew by 0.2% in March 2024, following growth of 1.0% in February 2024 (revised down from 1.1% in our previous publication), and grew by 0.8% in the three months to March 2024. Construction output fell by 0.4% in March 2024, following a fall of 2.0% in February 2024 (revised down from a 1.9% fall in our previous publication), and fell by 0.9% in the three months to March 2024.

This, alongside some better business survey readings, may be something that the BoE hawks use as a rationale to argue for no near-term rate cut, especially given the lection’s proximity and the higher-than-expected last set of CPI data. But any fresh weakness in March data due just a week before he next MPC decision may have some impact on MPC thinking, especially if the May CPI data due on June 19 correct the upside Aril surprise. .