Mexico Elections Update: Sheimbaum to Confirm Government Continuity

On June 2, Mexicans will vote for a new President, 500 deputies, and 128 senators. Claudia Sheinbaum from MORENA is favored to win, supported by incumbent President Lopez-Obrador's high approval rating. However, MORENA is unlikely to secure a two-thirds majority in Congress, limiting drastic policy changes. Market reactions are expected to be minimal unless MORENA gains a constitutional majority. Fiscal policy uncertainty persists, especially regarding PEMEX’s liquidity issues. U.S. election outcomes also critically impact Mexico’s growth prospects.

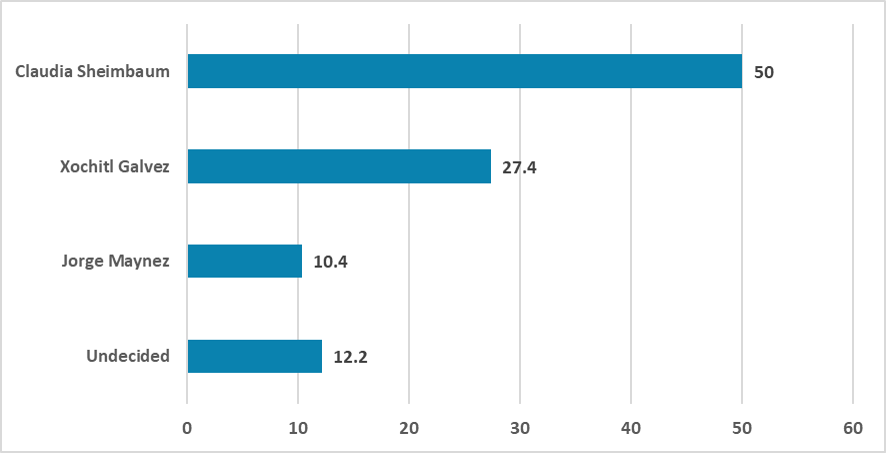

Figure 1: Vote Intentions for President (%)

Source: Mitofsky

The Mexican population will go to the polls on June 2 to decide the next President, elect 500 deputies, and renew the 128 seats in the Senate. Claudia Sheinbaum from MORENA, Xochitl Galvez from a unified front of PAN and PRI, and Jorge Maynez from Movimiento Ciudadano are contesting the Presidential seat for a 6-year mandate.

It is widely expected that the incumbent President Lopez-Obrador will be able to influence the election of his successor. Lopez-Obrador holds a 60% approval rating, which is likely to translate into votes for his candidate, Claudia Sheinbaum. Most polls indicate that a first-round win is the most likely scenario.

Less clear is how the legislative houses will be composed. In the last election, MORENA was able to hold a simple majority in both houses but fell short of the two-thirds constitutional majority needed to make amendments to the Constitution without the aid of other parties. This prevented the current administration from making significant changes to the current pro-market Mexican institutional environment. Although changes were made in laws, one of the most controversial laws, regarding the Mexican electricity sector, was vetoed by the Supreme Court.

What can we expect on Sunday? The most likely scenario is that Sheinbaum will win the election, and MORENA will again fall short of holding the constitutional majority, a situation similar to that seen in 2019. This scenario will likely mean not much reaction from the market, as they expect that most of the current policies will be maintained. Radical changes to the current Mexican institutional framework would be counterbalanced by both Congress and the Supreme Court, and policy continuity from Lopez-Obrador would be maintained.

Another scenario, which has a small probability of occurring, is the MORENA coalition securing a constitutional majority, which would allow MORENA to implement significant changes in Mexico. We foresee markets reacting negatively to this scenario, and a possible government with this configuration could mean Sheinbaum implementing more interventionist policies in the Mexican energy sector, increasing expenditures, and making some incursions against the Supreme Court.

Regardless of the two scenarios, there will still be some uncertainty around fiscal policy. In 2024, the government opted to deviate from past fiscal discipline, increasing investment and aiming for a 4% fiscal deficit. It is expected that in 2025 Mexico will revert to past fiscal discipline, but some doubts remain. Furthermore, PEMEX is facing severe liquidity problems, which indicates that some government aid will be needed, implying additional fiscal costs.

Additionally, what is most important for Mexico's growth will be who wins the U.S. election. The current Biden administration is friendly with the Lopez-Obrador administration and is supportive of substituting Asian imports with Mexican ones. However, a scenario in which Trump wins and favors looking inward rather than towards Mexico could affect Mexico’s long-term growth prospects.