UK Sales Weakness Curbing Pricing Power?

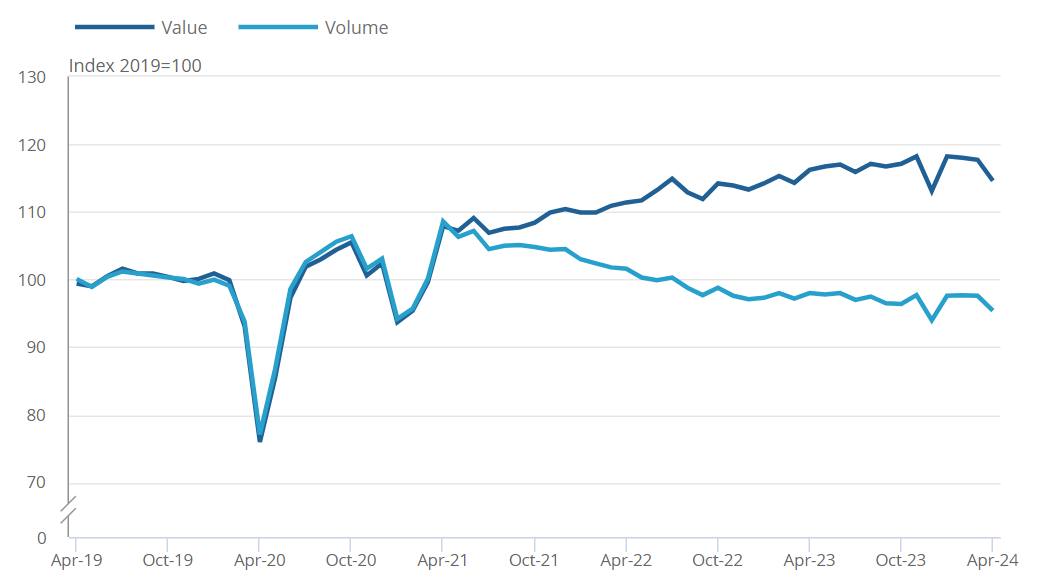

Ending an interesting week of UK data, retail sales slumped in April, partly due to what was a wet month. Notably, sales volumes fell by 2.3% m/m following a broadly flat February and March 2024 and were down by 2.7% y/y and 3.8% below their pre-pandemic level. This weaker-than-expected outcome continued a downtrend in sales volumes dating back three years (Figure 1) and came after a surprise drop in the May PMI numbers. The question is whether this sales weakness is accentuating ever-clearer restrictions in company pricing power. Indeed, the PMI update is possibly more notable for a reported fall back in price pressures that was concentrated in services, thereby offering a softer inflation message very much in contrast to what the CPI data reported earlier this week suggested and hinting that the May CPI numbers (due just before the June 20 MPC decision) may offer a much softer backdrop.

Figure 1: Sales Volumes Trending Down

Source: ONS, % chg y/y

UK sales data have been volatile but with a clearly weak undertone. Non-food stores sales volumes (the total of department, clothing, household and other non-food stores) fell by 4.1% in April. This was the joint largest m/m fall (shared with December 2023) since January 2021. Within non-food, falls were strongest within clothing retailers, sports equipment, games and toys stores, and furniture stores, with retailers reporting poor weather and inter-related low footfall as the main reasons. The data add to a softer picture regarding activity portrayed by PMI data the latter now covering the retailing sector.

Perhaps most notable within the PMI survey was the message regarding prices. Indeed, UK businesses reported the softest increase in average selling prices for over three years in May, partly linked to a slowdown in input cost inflation after April’s increase in the National Living Wage, with services firms especially seeing a drop in input price inflation. Indeed, amid the softer rise in input costs, private sector firms increased their selling prices to a weaker extent for the third month running in May, leading prices charged inflation to fall to its lowest level since February 2021, a time when headline CPI inflation was barely positive and services inflation well below 2%! This apparent slowing was solely driven by the service sector and thus contrasts with the CPI data released earlier this week which very suggested a conflicting picture namely resilient prices predominately in services.

Indeed, by thereby offering a softer inflation message which is very much in contrast to what the CPI data reported earlier this week hints that the May CPI numbers (due just before the June 20 MPC decision) may offer a much softer backdrop. This keeps the June meeting live as far as rate cuts are concerned, with perhaps the proximity if the July 4 election more important in possibly deterring the BoE from staring an easing cycle at that juncture.