UK CPI Inflation Review: Inflation Falls Further Amid More Signs of Price Persistence

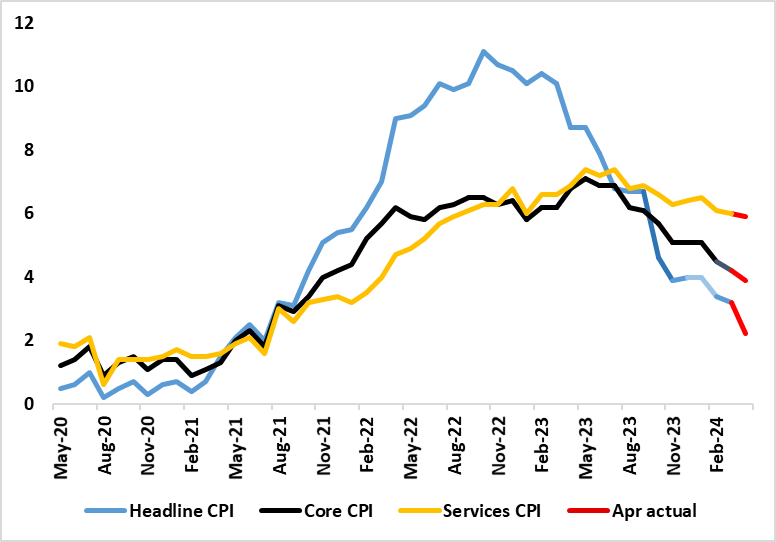

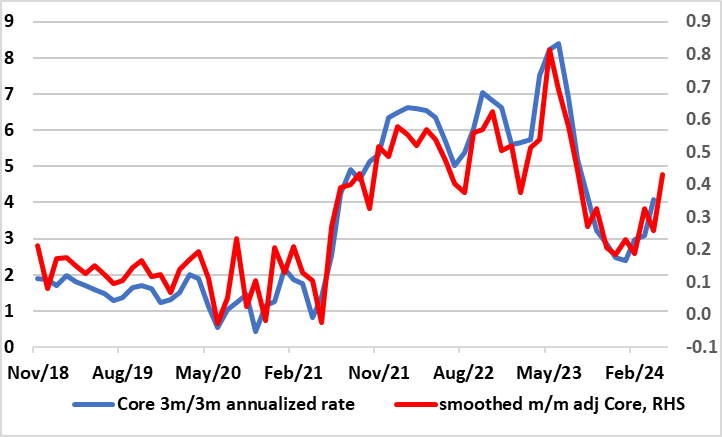

It is very clear that labor market and CPI data are crucial to BoE thinking about the timing and even the existence of any start to an easing cycle. But perhaps the CPI data is the most crucial with more signs of resilient services (and particularly in regard to eating out) very much questioning whether a rate cut from the MPC will come as soon as the verdict due on June 20. What the bar of acceptability is for the MPC in terms of the CPI picture is unclear; do they just have to hit the forecasts laid out in the recent Monetary Policy Report, or undershoot, this assessment made all the more awkward as another set of CPI data are due the day before that next MPC decision. As for the April numbers, helped by favourable base effects and the drop in the energy cap, led to a decisive but lower-than expected fall in the April headline of 0.9 ppt to 2.3% (the lowest since July 2021) but just 0.1 ppt for services (Figure 1), the latter likely to accentuate the MPC hawks’ emphasis on persistent price pressures. Indeed, in this regard, the core was down 0.3 ppt, this outcome consistent with an m/m adjusted reading even more above a rate consistent with target (Figure 2).

Figure 1: Headline and Core Inflation Drop to Continue But Services Still Resilient?

Source: ONS, Continuum Economics

The April outcomes exceed BoE thinking which saw the headline at 2.1% and services down to 5.5%. The April data was dominated by a drop in energy costs due a fall in the OFGEM energy cap, but this was partly offset by a rise in petrol costs and eating out. But despite base effects, and a drop in over half the 12 CPI main components, services inflation hardly buckled, a development highlighted by the fresh rise in restaurant inflation – often considered to be a leading indicator of persistent inflation swings.

Looking Ahead

Notably, and as suggested above, these April data are only part of the inflation story that will unfold ahead of the next MPC decision. The BoE envisages the headline falling to a below-target 1.9% in May and services then down to 5.3%, numbers we agree for the headline but see more of an undershoot for services, albeit where we also see a small rise back occurring in June – albeit solely for the headline though. But our projection looks less authoritative given these April numbers, not least the fresh rise in restaurant inflation, albeit where this may reflect the one-off impact of the rise in minimum pay last month.

Policy Perspectives

Regardless, context is needed. UK headline and core inflation have been on a clear downward trajectory in the last few months, the former having peaked above 10% in February last year and the latter at 7.1% In May. After a pause in the preceding three months, this downtrend seemingly resumed in the February CPI numbers and continued in March CPI data, albeit with more signs of resilient services inflation alongside additional hints that core inflation is also showing some resilience, at least in adjusted m/m numbers. This backdrop has made the BoE reassess the inflation outlook. Indeed, in this month’s MPR came two key MPC reassessments. Firstly, came an acknowledgement that the feed-though from the recent surge in import prices has occurred faster than previously assumed and thus is now likely to have less of a further potential inflationary impact ahead. Secondly, the BoE seems to think any second-round effects from high CPI inflation into wages may now fade faster than previously thought, this backed up by its own survey data suggesting companies are becoming less able to pass on higher costs to consumers. All of which helps explain the overall greater overall BoE confidence in a softer inflation outlook and with risks much more balanced. But this latest data may only harden clear splits evident within the MPC

Overall, and given what we think was far more mixed Q1 GDP than the media considered, we still think the current thrust of data still leaves open the case and momentum for a BoE rate as soon as next month and further moves in H2 and then through 2025. This partly reflects BoE Governor Bailey choosing to underscore that (more supply-side) UK inflation dynamics are different enough to those in the U.S. to allow a possible cut before anything made by the Fed and thus instead chime with ever-clearer ECB policy leanings. Moreover, the MPR updated projections at least validated the rate path discounted by markets, with below target inflation, this possibly suggesting larger easing than the two moves this year, something that even the IMF are now suggesting may be too cautious.

Figure 2: Adjusted Core CPI Pressures No Longer Falling?

Source: ONS, Continuum Economics, smoothed is 3 mth mov average