GBP flows: GBP up as CPI falls less than expected

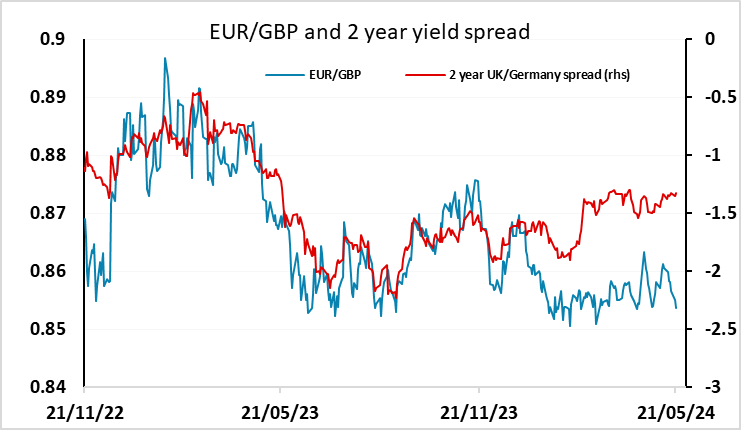

EUR/GBP looks likely to test 0.85 as UK services inflation remains stubbornly high

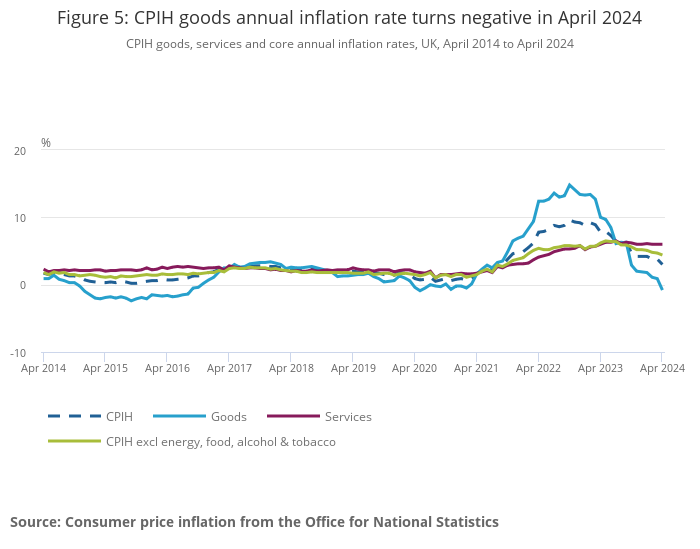

Stronger than expected April UK CPI data significantly reduce if not completely rule out a rate cut from the Bank of England at the June meeting, and GBP has rallied in response, with EUR/GBP losing 20 pips to trade below 0.8520 for the first time since March. There is still strong support down to 0.85, and even though UK yields will edge higher after the data, yield spreads won’t provide a clear rationale for a break. This is still only one number, and the headline inflation print of 2.3% is the lowest since July 2021, albeit helped a lot by base effects. The core CPI decline to 3.9% y/y was also disappointing, with a market expectation of a dip to 3.6%, but this was also the lowest since October 2021. Of particular concern to the MPC hawks will be the stubbornness of services inflation, which held at 6.0% in April. This is seen as a better indicator of the underlying inflation pressure, linked to the strength of wage growth, and while headline inflation has fallen because of the decline in gas and electricity prices n a y/y basis, these base effects will soon drop out and inflation will rise again unless services inflation falls.

The June meeting therefore looks unlikely to deliver a rate cut. The MPC will want to see at least some decline in services inflation before pulling the trigger. With the ECB likely to cut in June, the short term risks are therefore now on the downside for EUR/GBP, even though yield spreads don’t provide a clear rationale for GBP strength. Longer term the risks are more balanced as in the end we see UK yields as likely to fall to similar levels to yields in the Eurozone, and GBP remains somewhat overvalued from a longer term perspective. So a dip sub-0.85 looks to be on the cards, with the 0.8492-0.8500 the initial target but scope beyond there to 0.8450 on a break. However, such losses may not last long.