JPY, GBP flows: JPY soft, GBP awaits Mann speech

USD/JPY higher after Ueda and BoJ operations discourage tightening expectations. BoE hawk Mann has more power to weaken than strengthen GBP

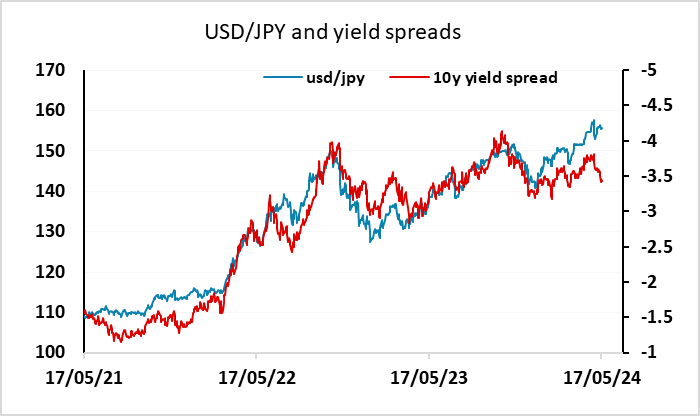

A quiet start in Europe in what looks like being a fairly newless session. USD/JPY is a little firmer overnight after comments from Ueda indicating no plans to sell ETF holdings and the latest BoJ JGB purchase operation sees no change to the amount purchased. Nevertheless, yield spreads still suggests risks are on the downside.

In Europe, there is no data of note with the final Eurozone April CPI data unlikely to carry any surprises. There is a speech scheduled from the UK MPC’s Mann, in which she is likely to reiterate her hawkish stance. However, given her established hawk status, there is unlikely to be much market impact from such a restatement of her views, but any indication that she is wavering could be expected to boost expectations of a June rate cut from the BoE and trigger some GBP weakness. But this looks quite unlikely after the strong average earnings data this week.