SEK, JPY, EUR flows: SEK softer after CPI, JPY shorts at risk

SEK softer after slightly lower than expected CPI; NOK/SEK has potential for gains. JPY weakness overextended

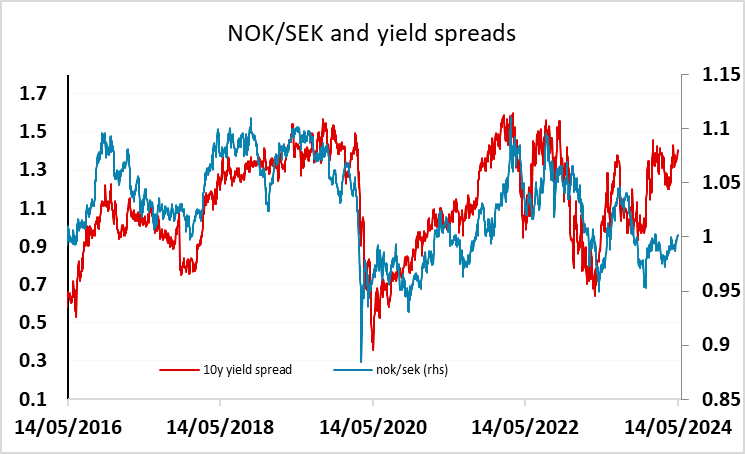

Swedish April CPI has come in slightly weaker than expected, triggering a small SEK decline. With the Riksbank having already cut rates, this probably doesn’t make a lot of difference for market expectations of Riksbank policy, but the SEK continues to look vulnerable to losses against the NOK. NOK/SEK has recovered in the last couple of months, and now may form a base at parity, with yield spreads suggesting scope for a move up as far as 1.05.

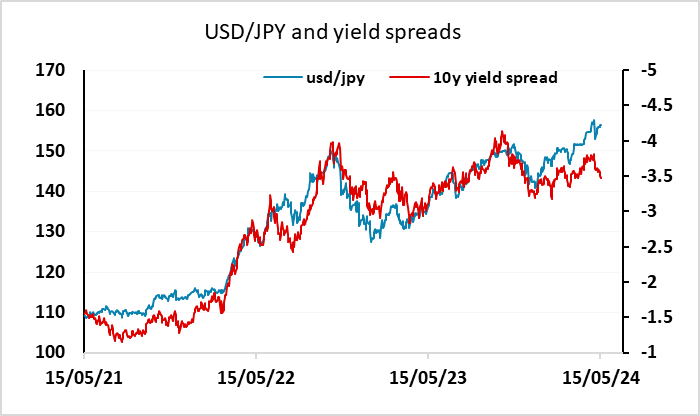

Otherwise it has been a fairly quiet overnight session. However, yield spreads continue to move against the USD. Particularly against USD/JPY, so unless we see stronger than expected US CPI today to push US yields back up, USD/JPY is at risk of a significant drop, possibly aided by intervention from the Japanese authorities. EUR/JPY has also managed 7 consecutive days of gains for the first time since June last year, which suggests positioning is overextended, especially since we have hit the resu=istance level at 169.40. Even if US CPI is strong, we could see JPY gains if the resultant rise in US yields hits equities.