GBP flows: GBP weakens as 2 MPC members vote for a rate cut

UK rates left unchanged, but deputy governor Ramsden joins Dhingra in voting for a cut.

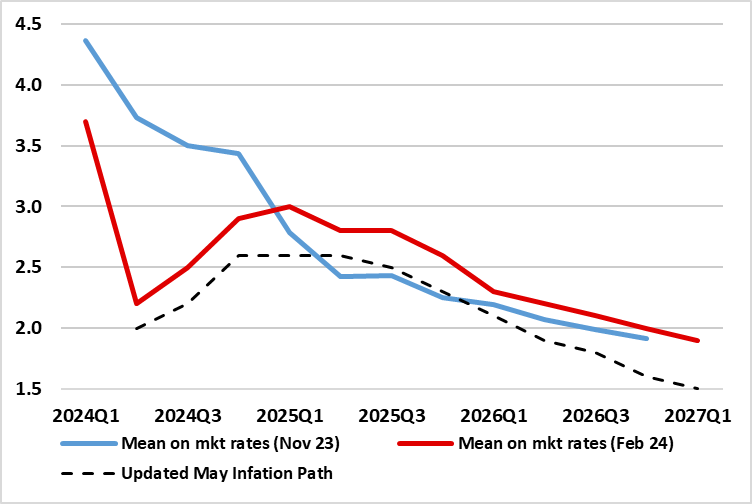

A clear dovish signal from the Bank of England with a 7-2 vote for no change in rates, with deputy governor Ramsden joining Dhingra in voting for a 25bp cut in rates. The Bank’s CPI forecast for 2 and 3 years’ time are both down significantly from the February MPR, and both below 2% at 1.9% and 1.6% respectively, due in part to the higher market rate profile since February. However, the extra vote for a cut and the lower forecasts suggests that a moderate April inflation number (released May 22) may be the last piece required to secure a June rate cut.

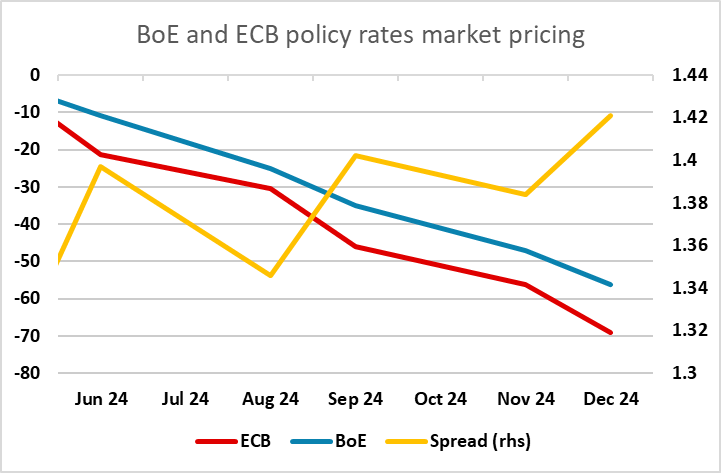

EUR/GBP is up around 25 pips on the news, but UK 2 year yields are only down a couple of basis points, and there has been no significant shift as yet in the pricing of a June rate cut, which is still priced at around a 45% chance. If expectations of a cut gain ground in the coming days and week, or even after the BoE press conference, there should be scope for further EUR/GBP gains as market expectations of BoE easing starts to move closer to expectations for the ECB. Based on recent yield spread correlations, there is already some case for a higher EUR/GBP, although bigger picture views are less clear. Nevertheless, we do see the EUR/GBP risks as being mainly on the upside.