JPY flows: JPY still soft despite hawkish BoJ

Boj sounded hawkish, but JPY softer as cash earnings disappoint.

A fairly quiet overnight session has seen most pairs fairly steady, but the JPY has softened a little early in Europe, perhaps in response to the weaker than expected Japanese cash earnings data for March released overnight. However, while wage negotiations were in progress in March, the larger wage rises agreed are unlikely to show up in the data until at least April, so we wouldn’t see the data as being likely to prevent BoJ tightening. Additionally, the BoJ summary of opinions released overnight showed a hawkish tone to the April meeting, and JGB yields have edged higher overnight. Many in the nine-member board called for steady rate hikes on prospects that inflation could durably stay, or even exceed, the central bank's 2% target, the summary showed.

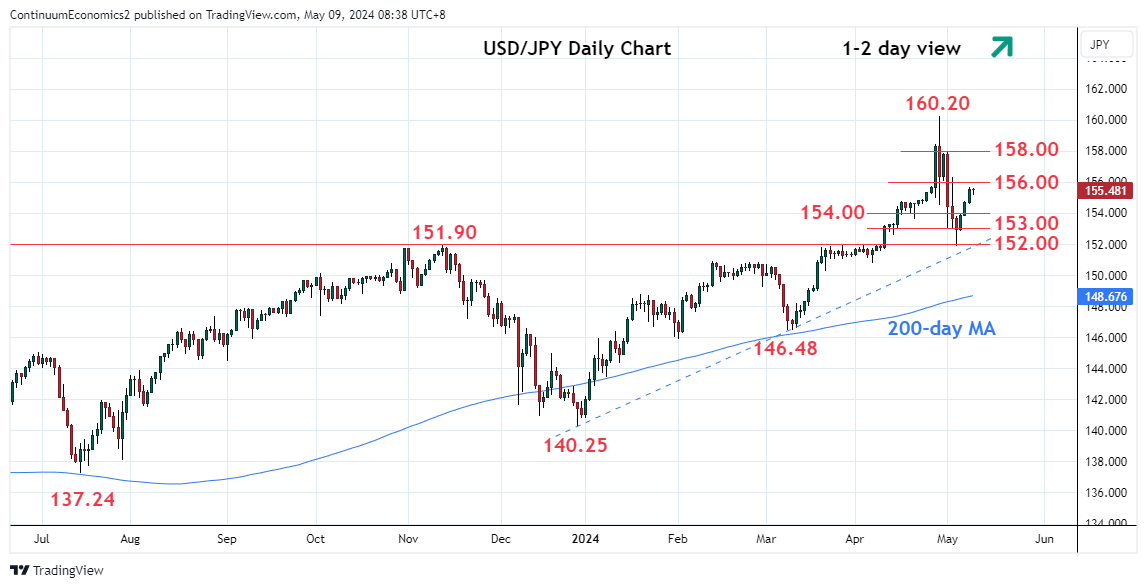

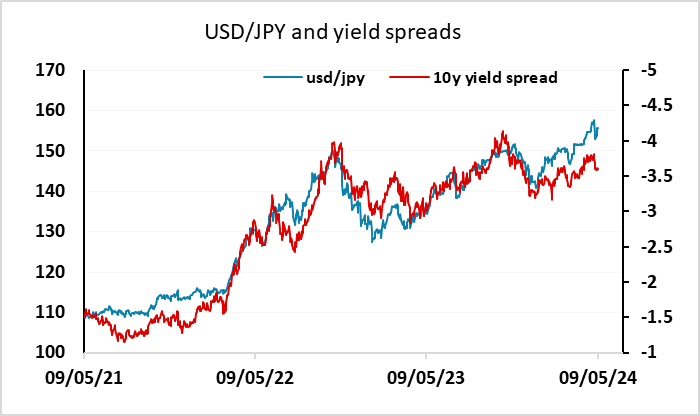

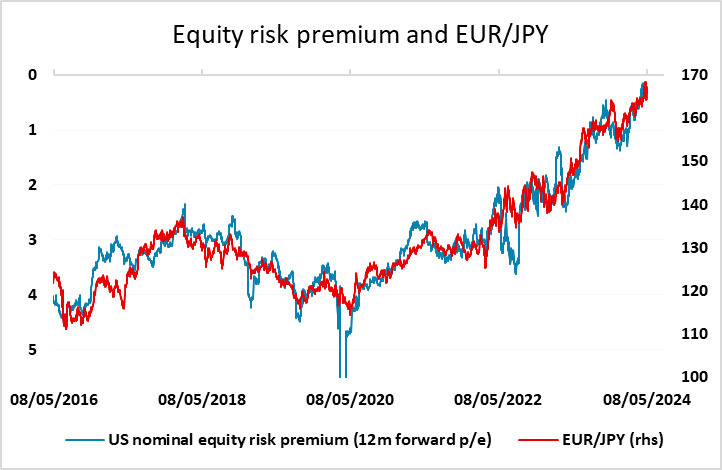

In any case, the bigger issues for the JPY are the moves in US yields, equity market performance and the willingness of the authorities to intervene. The current corrective move higher in USD/JPY has targets at 156 and 157, and we doubt the Japanese authorities will allow progress through 157 without further action. Meanwhile, US yields have fallen sufficiently to suggest scope for an organic decline in USD/JPY, but still low equity risk premia are still tending to limit the scope for JPY gains on the crosses. So USD/JPY declines may not come without USD weakness elsewhere unless we see some further declines in US yields and/or some weaker US equity market performance.