GBP flows: GBP up after Pill comments, but...

Pill comments taken as hawkish, but don't rule out June rate cut

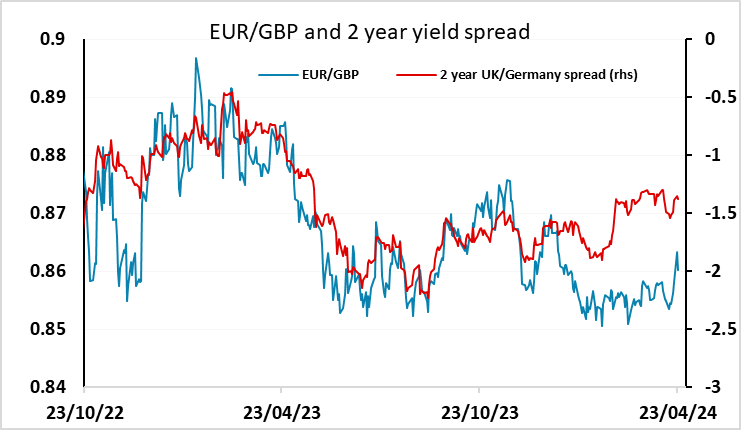

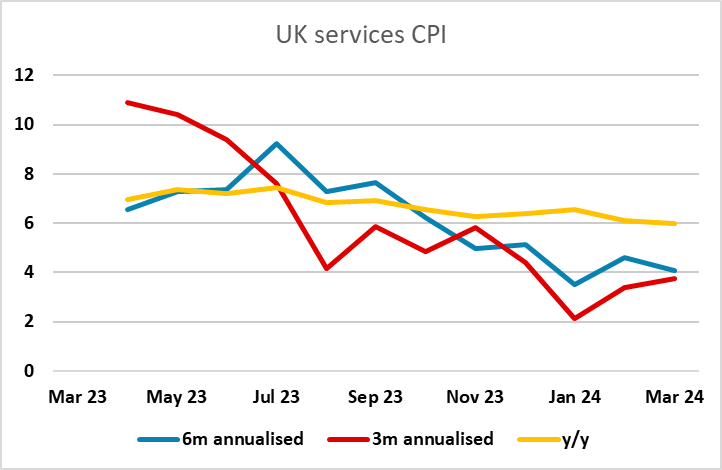

Comments from BoE chief economist Huw Pill have been taken as slightly hawkish by the markets and GBP has risen in response, with EUR/GBP testing down towards the 0.86 level, with UK 2 year yields rising around 5bps in response. Still, EUR/GBP remains above where it was before BoE deputy governor Ramsden spoke last Friday, with UK 2 year yields also still significantly below the levels seen before Ramsden spoke. Pill’s comments didn’t encourage ay expectation of a rate cut in May, and indicated that given the Bank’s distrusts of the labour market data, they will need to see services inflation sub-4% before they are comfortable with cutting rates. On the face of it, this is a long way off, as currently services inflation is running at 6% y/y. But there is a clear slowdown in recent months with annualised CPI services inflation running close to 4% in the last 6 months, and between 3 and 4% in the last 3 months. So we may already be at levels that are consistent with lower rates. While Pill’s comments make a May cut unlikely, softish inflation numbers in April and May could be enough to see a June cut.