JPY, AUD flows: JPY weakness reaching pain threshold

JPY weakness still being driven by declining risk premia, but some action needed from Japanese authorities soon if they are to avoid losing credibility.

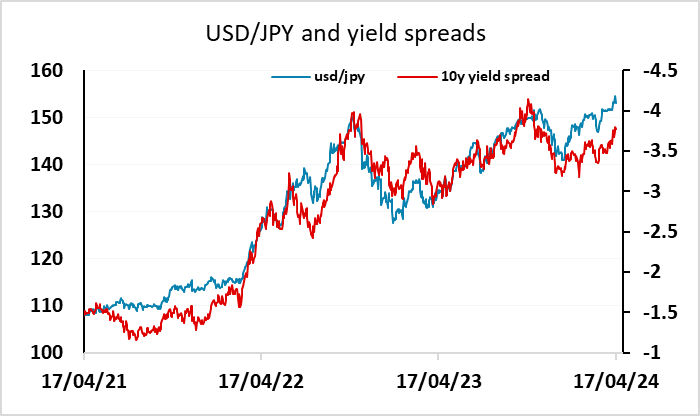

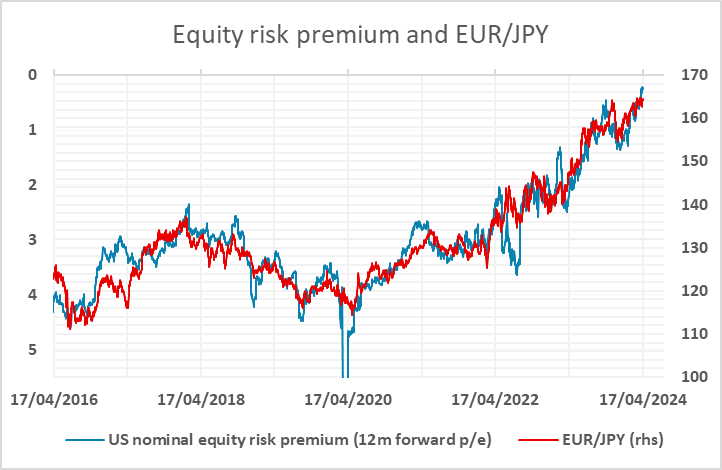

A quiet afternoon session but the theme of the week so far has been JPY and AUD weakness, with declines against both the USD and EUR. Rising yields in the US are the prime cause of this. Although the AUD is seen as a risk positive currency and the JPY as a risk negative currency, higher US yields tend to hurt both. Of course they both suffer from yield spread moves against them, but while the AUD tends to weaken when equities fall, the JPY tends to weaken when equity risk premia fall. Higher US yields tends to mean both lower equities and lower risk premia, as the equity decline is not usually sufficient for equity yields to rise as much as bond yields. This has been the case in the latest US yields rise. While equities are lower, equity risk premia have continue to fall, and this is weighing on the JPY on the crosses.

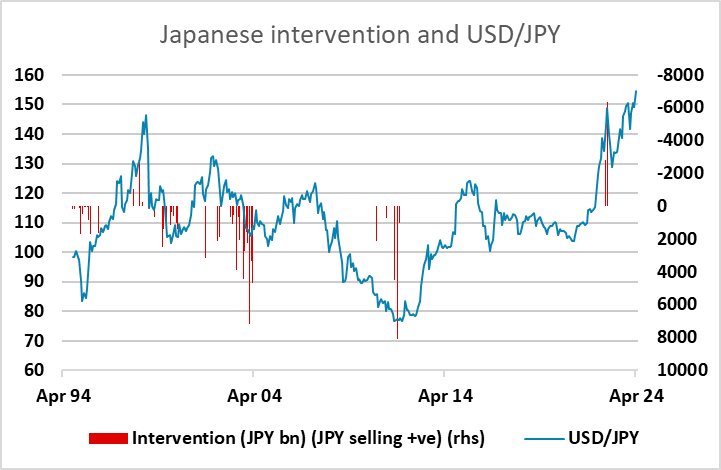

Of course, while widening yield spreads do provide a fundamental reason for JPY weakness, the correlation of JPY weakness with declining equity risk premia is not a fundamental necessity, and doesn’t always hold. But the correlation of JPY crosses with equity risk premia has been very strong in the last 8 years or so, and continues to point to a lower JPY. The problem for the Japanese authorities is that this has led to the JPY hitting its lowest real terms level in the floating era, partly because the market is ignoring the impact of relatively low Japanese inflation on valuation. The protests from Japanese finance minister Suzuki and currency official Kanda have become louder of late, and if they allow the JPY to continue to decline in line with the decline in risk premia, they risk losing credibility. Something therefore has to give, and we would expect some action from the Japanese authorities if we see USD/JPY above 155 and EUR/JPY above 165. Historically, intervention from the BoJ at valuation extremes has been successful, so we would be wary of following the current trend of JPY weakness.