U.S. March Retail Sales allow Q1 to come in marginally positive despite a weak start in January

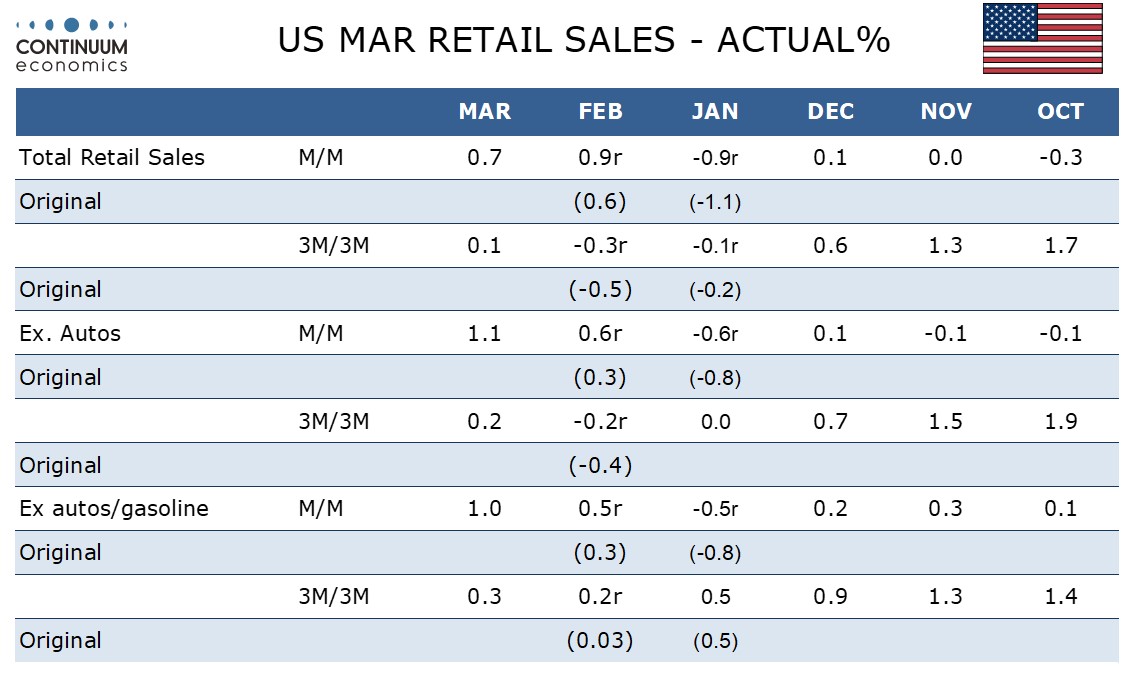

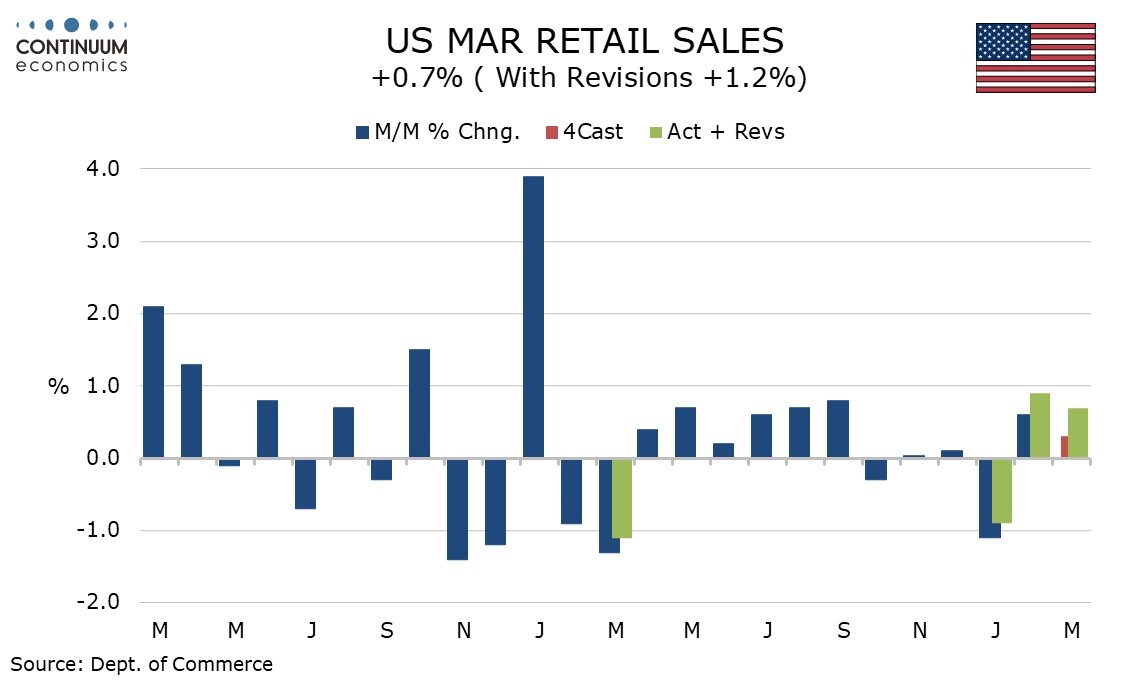

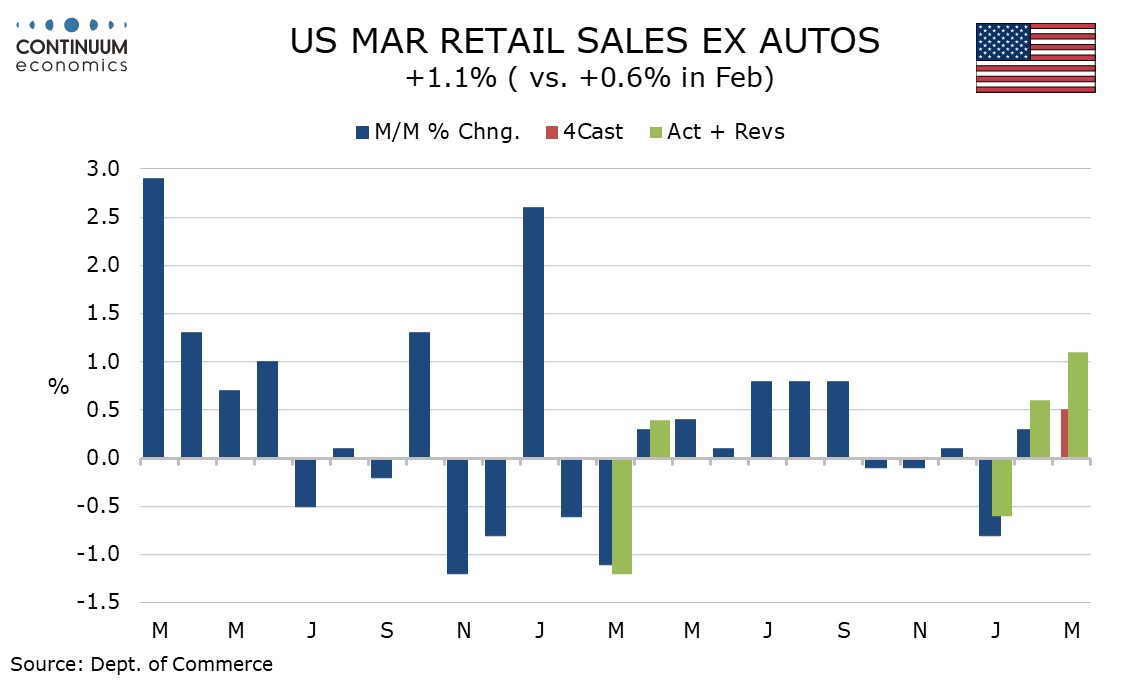

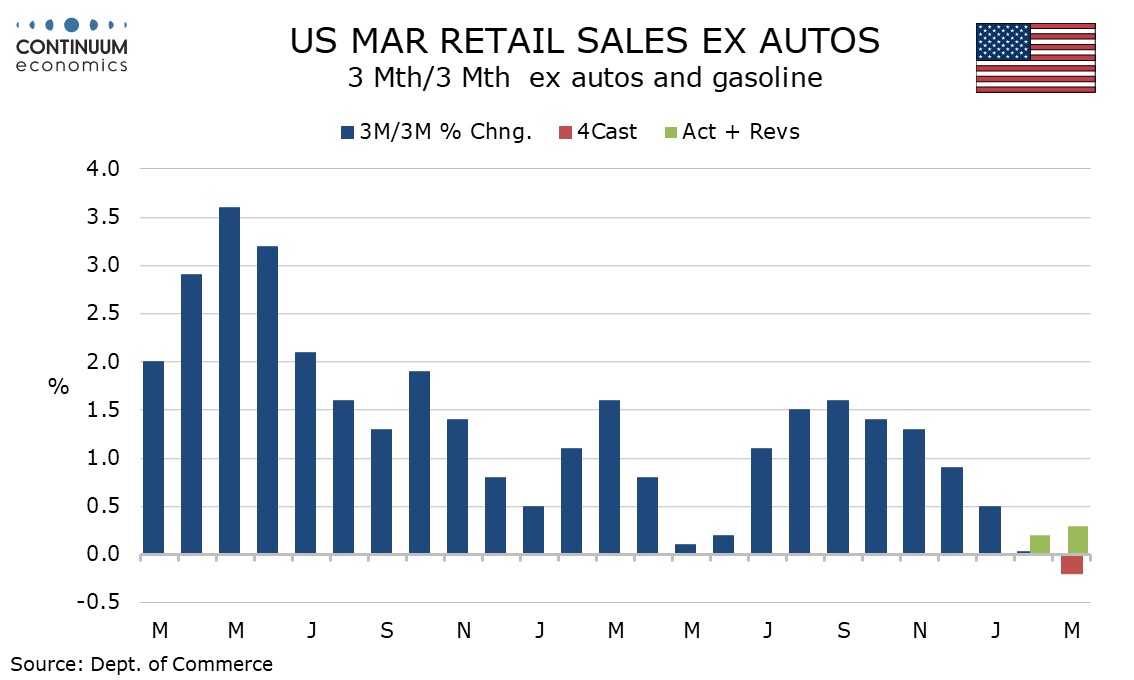

March retail sales with a 0.7% increase have exceeded expectations despite an expected negative contribution from autos, with sales up by 1.1% both ex autos and in the control group that contributes to GDP, and by 1.0% ex autos and gasoline. This suggest continued consumer momentum entering Q2.

The ex auto increase is a 14-month high. Revisions were positive too, with February revised to 0.9% rise from 0.6% and January’s weather impacted decline revised to -0.9% from -1.1%. Similar upward revisions were seen in the ex auto data.

Given a weak January this leaves only a marginally positive quarter with overall sales up 0.1% not annualized) with sales ex auto up by 0.2% and ex auto and gasoline up 0.3%. Still with service consumption having been strong in February a healthy Q1 from consumer spending looks likely unless March services data is very weak. The positive March retail sales also means Q2 will be starting well above the Q1 average given the weak January.

Details of the March data are mixed with a positive in building materials and a strong 1.1% increase in general merchandise. A 2.1% rise in gasoline was price-assisted but with the CPI having shown commodity prices up only 0.1% most of the retail sales gain comes from volumes. Apparel was weak at -1.6% and auto sales slipped as industry data had implied.

The April Empire State manufacturing survey at -14.3 remains weak though less so than March’s -20.9. Most components remain weak on the month while six month expectations slipped to a still positive 16.7 from 21.6. Prices paid at 33.7 from 28.7 are at their highest since May 2023. Prices received slipped to 16.9 from March's 10-month high of 17.8.