India Inflation: Risks Tilted to the Upside

India's inflation trajectory in March 2024 showcased divergent trends in both consumer and wholesale price indices. While consumer inflation dipped to its lowest in ten months at 4.9% y/y, wholesale inflation rose to 0.5% y/y, driven by surging food prices. The outlook suggests gradual WPI escalation and sustained, sticky retail prices. However, risks are tilted to the upside from the potential uptick in global commodity prices stemming from geopolitical tensions. A favourable monsoon though will help offset some price pressure.

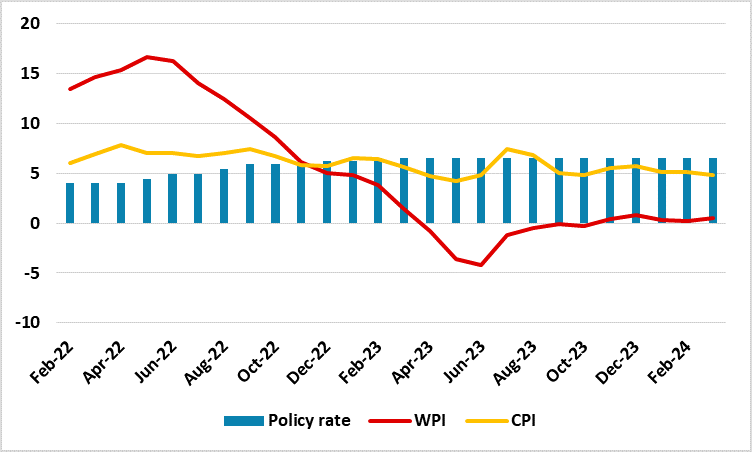

Figure 1: India Retail and Wholesale Prices and Policy Rate

Source: Continuum Economics

India's inflation dynamics, both in terms of consumer and wholesale prices, underwent notable shifts in March 2024, revealing nuances that are pivotal for future rate setting. As per data released by the Ministry of Statistics and Programme Implementation, India's headline inflation rate witnessed a decline to its lowest level in ten months, standing at 4.9% yr/yr in March, down from 5.1% yr/yr recorded in February. This downturn marked the lowest retail inflation rate since May 2023, reflecting a long battle against price pressures.

Consumer Price Index (CPI) Insights

Despite easing, the CPI although within the Reserve Bank of India's (RBI) tolerance band of 2-6% remained above the 4% medium term target for the 54th consecutive month. March's CPI breakdown unveils a marginal easing in food inflation, with the index registering 8.5% yr/yr growth compared to 8.6% y/y in February. Notable increases were observed in cereal prices and the price of meat and fish. Pulses, however, witnessed a slight decline, offering a glimmer of relief amidst India's ongoing efforts to balance domestic needs with imports. Overall, food and beverages inflation stood at 7.6% yr/yr in March. Additionally, fuel and light inflation experienced a further decline from -0.7% yr/yr in February to -3.2% yr/yr in March, while housing inflation moderated marginally to 2.8% yr/yr from 2.9% yr/yr.

Wholesale Price Index (WPI) Perspectives

Contrary to the trend in CPI, India observed an uptick in Wholesale Price Index (WPI)-based inflation, reaching 0.5% yr/yr in March, its highest in three months, as per data from the Ministry of Commerce and Industry. This increase was predominantly fueled by escalating food prices, particularly the surge in onion and potato prices. The scenario marks a notable departure from the previous surplus situation, signalling potential supply constraints in the near term. This uptick in WPI will likely be observed in the upcoming month's CPI figures as well.

Looking ahead, it is anticipated that WPI inflation may gradually escalate in the coming months with the base effects dropping out of the equation. The recent surge in global commodity prices, particularly propelled by higher crude oil prices, is expected to exert upward pressure on WPI. However, prospects of a normal monsoon, coupled with diminishing El Niño conditions and a rebound in rabi sowing, present a positive outlook for agricultural production and subsequently for food inflation. This, in turn, is anticipated to mitigate some of the rising price pressures. Similar choppy trend is expected in retail prices as well.

This release coincides with the Reserve Bank of India's (RBI) Monetary Policy Committee (MPC) decision on April 5 to maintain the policy repo rate at 6.5% for the seventh consecutive time. The central bank's latest projection places CPI inflation at 4.5% y/y for FY25. The central bank's cautious stance is aligned with our expectation of increased upside risks to inflation over the coming months.

The diverging trajectory of inflation in India, as evidenced by both CPI and WPI metrics, underscores the complex interplay of domestic and global factors shaping the country's economic landscape. While challenges persist, including persistent food price pressures and external commodity price volatility, proactive policy measures and favorable agricultural prospects offer a glimmer of hope for maintaining inflationary stability in the foreseeable future. Given these inflation dynamics, our forecast for no rate cut in H1-2024 remains unchanged. A 25bps rate cut is likely in end-Q3 2024, followed by another similar cut in end-2024.