Brazil CPI Review: Inflation Decelerates in March

The latest CPI data from Brazil reveals a modest increase of 0.16% (m/m) in March, slightly below market forecasts. Despite this, the year-on-year CPI has dropped to 3.9%, remaining within the BCB bands but above the central target. Notably, the Food and Beverages group saw the most significant rise, while Transports experienced negative growth, largely due to reduced airfare prices.

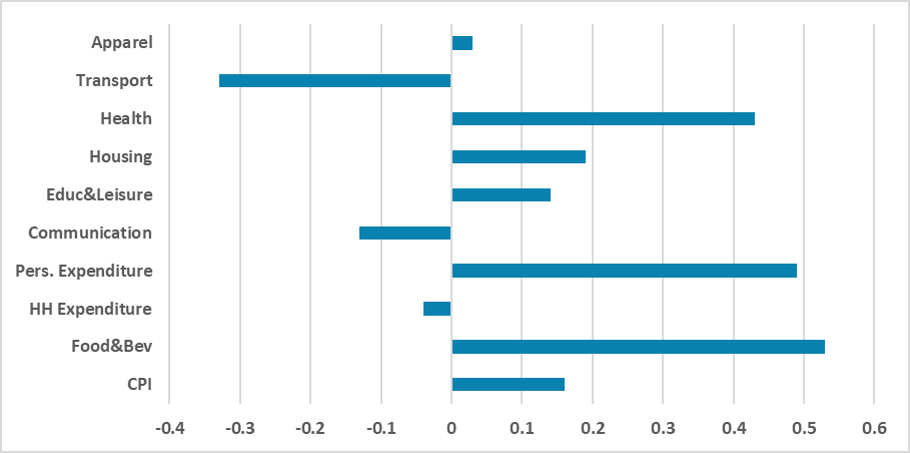

Figure 1: Brazil CPI by Groups (%, m/m)

Source: IBGE

The Brazilian Statistics Institute (IBGE) has released the CPI data for March. The data shows that the CPI has increased by 0.16% (m/m), slightly below market expectations of 0.25% (according to the Bloomberg Survey). Therefore, Y/Y CPI has dropped to 3.9% from 4.5% in February, and it is at the moment quite inside the BCB bands (1.5%-4.5%), although above the central target (3.0%). The biggest rise occurred in the Food and Beverages group, which grew 0.5% (m/m) in the month, influenced by the rise in onions (14.3%), tomatoes (9.8%), and eggs (4.6%).

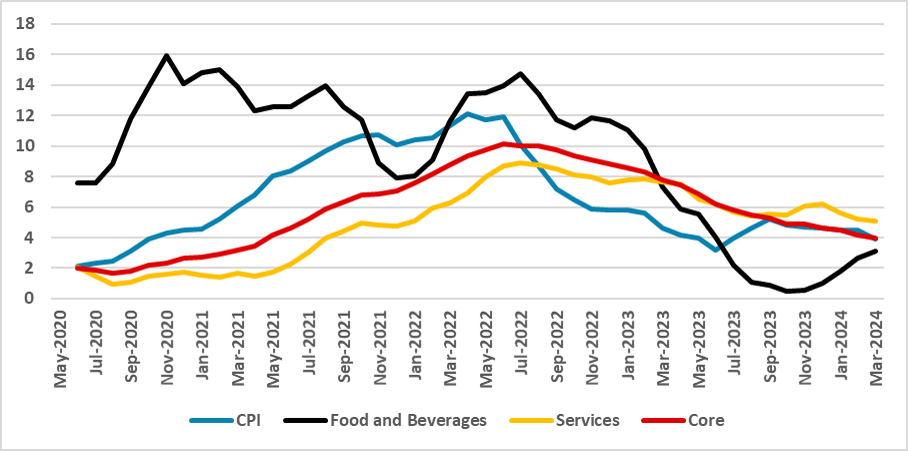

Figure 2: Brazil’s CPI (%, Y/Y)

Source: IBGE and BCB

Looking at other groups, Transports have registered negative CPI growth, influenced mainly by the retraction of prices on airfare tickets (-9.1%). Still, we believe Transports tend to register some growth in the next months as Gasoline prices are misaligned in relation to international prices, some suggesting it is 17% below its aligned price. Therefore, we expect Petrobras to adjust it in the next months; otherwise, the company will need to use its own funds to cover the losses on the distribution prices. Services grew only 0.1% in the month and accumulated a 5.1% growth on an annual basis, which is quite far from the 3.0% target.

In terms of monetary policy, the March inflation is good news for the BCB strategy. Core CPI only grew 0.1%, and YoY Core CPI stands now at 3.9%. These results could point to a continued deceleration of the Brazilian economy and the thesis that wage inflation would have a limited impact. Although inflation expectations are not well aligned with the targets, it is possible that they will fall to some extent in the next months if the benevolent behavior continues. The BCB, which is giving signs that they will slow down the pace of cuts, could actually continue to cut at 50bps in case inflation falls quicker than expected. For the moment, we are seeing CPI closing the year at 3.6% (Y/Y), and the policy rate finishing the year at 9.25% with a reduction of the cut pace to 25bps in June and keeping it until they reach 8.5% in 2025. A change in this strategy would mean keeping the 50bps pace and finishing the policy rate in 2024 at 8.5%.