UK CPI Inflation Preview (Apr 17): Inflation to Fall Broadly Further, But Momentum Still Evident

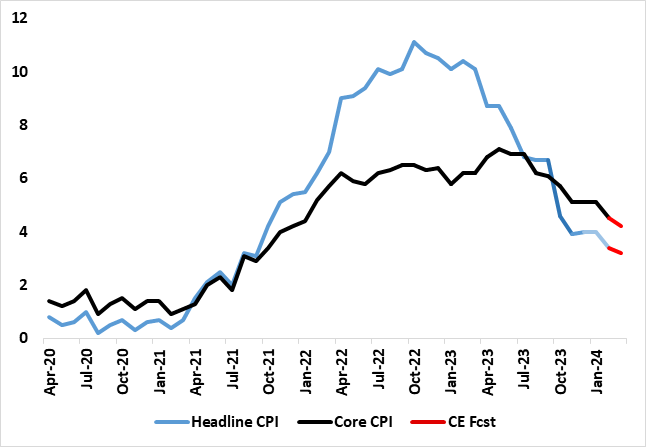

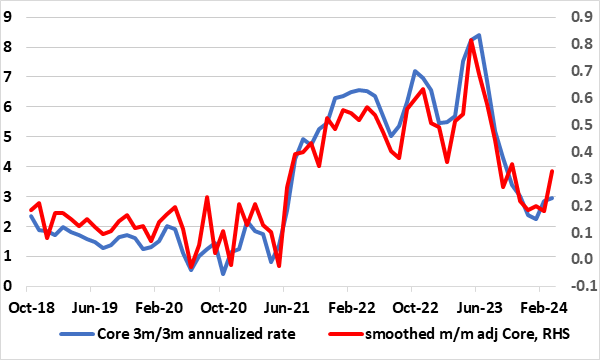

The economy may have been in only mild recession in H2 last year, but the ‘recovery’ now evident is hardly going to feel much better with GDP growth hardly positive. Admittedly, coming in as largely expUK headline and core inflation have been on a clear downward trajectory in the last few months the former having peaked above 10% in February and the latter at 7.1% In May. After a pause in the preceding three months, this downtrend seemingly resumed in the February CPI numbers and clearly so (Figure 1), despite higher petrol prices, with food acting as a major offset. Indeed, undershooting consensus and BoE thinking the headline rate fell to 3.4%, a 29-month low and the core down to 4.5% a 23-month low, including a belated slowing in y/y services prices to a cycle low of 6.1%. But there was some rise in apparent core momentum as measured by adjusted m/m numbers (Figure 2), including still-solid service strength and this may be apparent in the March numbers too. Even so, base effects should pull the headline down to 3.2% and the core to 4.2%, a 28-month low.

Figure 1: Headline and Core Inflation Drop to Continue

Source: ONS, Continuum Economics

The softer February CPI data came alongside mixed PPI data at least for manufacturing. Regardless, CPI headline inflation slowed to 3.4% y/y in February 2024, down from 4.0% in January. The largest downward contributions to the monthly change in CPI annual rates came from food, and restaurants and cafes, while the largest upward contributions came from housing and household services, and motor fuels. – NB; restaurant inflation is often seen as a good guide to persistent price pressures and thus its fall is reassuring. Core CPI (excluding energy, food, alcohol and tobacco) rose by 4.5% in the 12 months to February 2024, down from 5.1% in January; the CPI goods annual rate slowed from 1.8% to 1.1%, while the CPI services annual rate eased from 6.5% to 6.1%

The headline rate in February was some 0.1 ppt below formal BoE thinking but we think the March data may show a same-sized overshoot. This will reflect the impact of the early Easter, notably on travel (and which may limit any drop in services inflation to 0.2 ppt) but also higher petrol price coming through.

The March data should continue to picture of the clear disinflation trend in our estimate of the seasonally adjusted data continued seen in months prior to December, albeit perhaps less discernibly amid swings that we think at this juncture or noise rather than a change in tune. Indeed, on this basis, CPI core inflation was just above target and slightly more so as it was on a 3 mth/3 mth annualized basis, a measure that the B0E is starting to use more formally – indeed, there was some rise in core momentum as measured by the adjusted m/m numbers in the February data however, including still solid services pressures and this may be even clearer in the March numbers (Figure 2)!

Figure 2: Adjusted Core CPI Pressures No Longer Falling Broadly Clearly on BoE Measure?

Source: ONS, Continuum Economics, smoothed is 3 mth mov avg

Regardless, even our slightly less reassuring March CPI picture will not get in the way of the BoE cutting rates soon, with all meetings now seemingly ‘live’.