BoE Forecast Report: Uncertain How to Assess Uncertainty?

A long-awaited review of BoE forecasting techniques and goals is due on Apr 12 with a report commissioned by the BoE but authored by ex-Fed Chair Ben Bernanke. It is set to offer alternatives to the way the MPC currently produces and communicates its outlook and has been prompted by marked forecast errors during and since the pandemic. It has been openly suggested that the BoE will drop its long-standing so-called fan chart forecasts, still encompassing a central forecast but also probably involving alternative policy paths over and beyond the current emphasis on market rate profiles and/or stable policy. But while we regard such an overhaul as being overdue, not least given the manner in which the current fan charts are encompassing near-record assumptions about uncertainty which imply little practical faith in the actual forecast’s accuracies (Figure 1), other issues do not seem to be on the agenda. In particular, we are wary that the BoE is not more formally reconsidering a monetary agenda (Figure 2). Furthermore, the alternative policy perspectives being discussed (such as dot-plots and alternative scenarios) did not prevent the central banks using them (most notably the Fed and Riksbank) from making similar recent forecasting errors to the BoE.

Figure 1: Elevated or Excessive BoE Uncertainty?

Source: BoE, CE, Economic Policy Uncertainty

Policy Evolution

But adopting any such a new regime is unlikely to be brought in rapidly not least as the BoE tries to communicate a central forecast amid any scenario building. Indeed, Clare Lombardelli who takes over a s Deputy Governor from July will be responsible for leading the actions in response to the Bernanke’s review of the Bank’s forecasting process. Thus the report may have little relevance for more immediate policy decisions where the BoE has flagged rate cuts as being on the current policy agenda. Instead, it is part of what is an evolving process. Indeed, the BoE said last summer it had commissioned former Federal Reserve Chair Ben Bernanke to produce a report on its forecasting, and where BoE Governor Bailey made it clear that he sees the changes as a “once in a generation” opportunity for Britain’s central bank to upgrade its internal processes for forecasting what lies ahead for the economy and communicating this to the public and markets.

It is clear that the biggest and most needed change will be a move away from the bank’s so-called fan charts. Pioneered by the bank in 1996, they attempt to depict the array of probabilities of outcomes for growth and inflation under various assumptions, but have frequently been criticized as confusing, more recently having become far less authoritative as the BoE makes key assumptions about uncertainty.

Accounting and Assessing Uncertainty

Uncertainty as used by the BoE is a subjective assessment of how likely it is that the future events will differ from the central view. It is a forward-looking view of the risks to the forecast, not a mechanical extrapolation of past uncertainty. The MPC has to form a view as to whether or not uncertainty looking forward is greater or less than in the past. The degree of uncertainty (the degree of dispersion in the distribution) can be measured; the BoE uses a variance measure. When evaluating the risks, the MPC may decide to vary the degree of forecast uncertainty to reflect the prospective or recent variability of economic developments. This has become an ingrained habit. Initially, uncertainty was based on the experience of forecast errors from the previous ten years. But from around the GFC the MPC started to change the uncertainty parameter according to past forecast errors but, more recently, much more subjectively, sizeably and persistently. Indeed, this BoE assessment of uncertainty has steadily increased even against a backdrop where policy uncertainty has been more variable and usually much lower. Indeed, an index of uncertainty is based on newspaper articles regarding policy and is compiled independently and privately suggest a far less uncertain backdrop and outlook.

In perspective, for instance, this means that in the last set of forecasts, the MPC envisaged inflation at 1.9% at the end of its two-year formal forecast horizon, but with an uncertainty parameter also of 1.9%. In effect this, means that the MPC anticipates that (and with two-thirds probability attached) inflation will actually be in a range from zero to 3.8%. This is a very wide target which implicitly is seen being missed one third of the time

Scenario Building

Some bank officials argue that alternative scenarios would be a better way of analyzing and discussing the uncertain outlook. However, introducing scenarios would not be straightforward as too many alternatives may confuse/mask what is a central forecast for the future. And bank officials’ stress that careful deliberations would be needed to determine what alternative scenarios would/could be put forward, in particular whether this would involve the BoE putting forward differing forecasts for the likely path of interest rates; the BoE currently bases its forecasts on market interest rate expectations, as well as unchanged rates.

Dot-Plots

The BoE is also contemplating whether to adopt the system used at the US Fed, where individual FOMC officials mark their central expectations for appropriate interest rate policy in the coming years on a so-called dot plot. The system was first pioneered by the Fed when Bernanke was its chair, which makes it possible it will be floated in his review. But the BoE has said he was in two minds about using the Fed’s method because of the risk that individual policymakers would be pressured by politicians to reveal their rate outlooks.

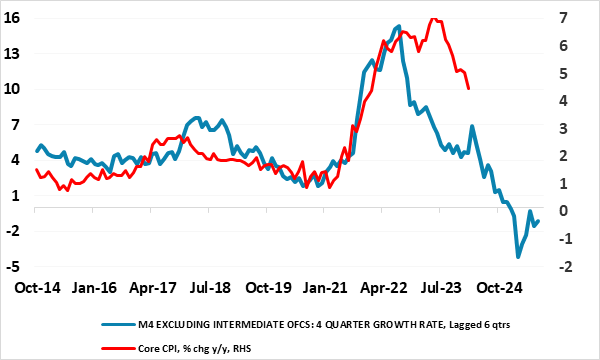

Figure 2: A Role for Monetary Data?

Source: BoE, CE, ONS

Lacking a Monetary Consideration

What we are as puzzled by is that recent Monetary Policy Reports have seen even less discussion on the monetary side of the economy, all the more surprising given the clear correlation (admittedly perhaps not causation) between monetary developments and inflation (Figure 2). This is also in spite of recent criticism that the Bank must do more to foster a diversity of views and strengthen a culture that encourages challenge. Indeed, a lack of emphasis on the monetary side has been a criticism we have made of the BoE for some time, all the more notable given the weakness and possible cause of such marked weakness in bank deposit and lending, the latter being a key factor behind our persistent below consensus real activity thinking.