UK GDP Preview (Apr 12): Fragile Recovery?

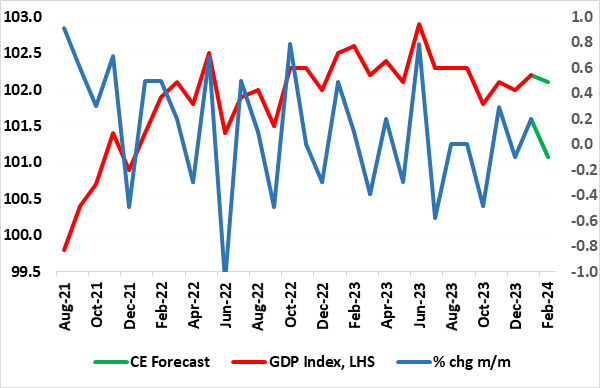

The economy may have been in only mild recession in H2 last year, but the ‘recovery’ now evident is hardly going to feel much better with GDP growth hardly positive. Admittedly, coming in as largely expected, and despite industrial action, GDP rose by 0.2% m/m in January more than reversing the 0.1% drop in December data, a result that nevertheless is nothing more than a continuation of the monthly swings seen of late, which may result in fresh drop of 0,1% in the upcoming February data (Figure 1). Notably, the apparent recovery, and in contrast to the message of business surveys, is still very much dependent upon non-cyclical parts of the economy, in particular public services, which are likely to come under pressure from spending restraint in the medium term. We thus remain cautious on the scale and pace of recovery although it now looks more likely that the economy this quarter will grow by 0.1% q/q, a result in line with current BoE thinking, but where policy by the latter is being shaped by price and costs developments not real activity.

Figure 1: Tentative Recovery – – Output Moving Sideways?

Source: ONS, CE

As for details, already released sales data suggest no fresh momentum in February, these probably having been hampered through the month by the very mild and wet weather; the warmest February on recent record in England). Thus may weigh on utility and construction activity in the month, while manufacturing may be hit by a fall in car production as signalled by industry data. Overall, the 0.1% m/m drop we envisage will continue the sideways, if not slightly downtrend seen in the level of GDP over recent months (Figure 1).

This sits with our still-relatively gloomy scenario, which still sees nothing better than 0.1% growth in 2024, but which may seem to be in conflict with survey data that have seemingly shown some degree of resilience, if not recovery, in the last few months. Indeed, PMI data have perked up late but these numbers have been very poor indicators of actual GDP swings in recent years (Figure 2), especially the composite measure which excludes the public sector. The data also excludes construction and retailing, perhaps the key sectors most affected by policy both monetary and fiscal. Indeed, despite being a gauge of private sector activity the PMI numbers have very much overstated official data in this regard.

Figure 2: PMI A Poor Guide to Private Sector GDP Swings?

Source: Markit, ONS

Even so, there are supportive factors: not least the marked drop in wholesale energy prices which will filter through in another bout next quarter and where the fiscal situation is going to be little more supportive than previously envisaged. But businesses are losing much of the energy support cushion through 2024. However, the main concern is clearly the impact of the sizeable tightening in monetary policy that is already causing tighter financial conditions that will increasingly bite the economy through the credit channel, this very much highlighted by unprecedented declines occurring in both the level of bank credit and bank deposits. This fragile outlook is very much led by the consumer, the most exposed to likely outright damage from the housing market. Admittedly, there are brighter signs regarding housing, but the level of transactions is still low and has been falling, this being the main factor that will affect and weigh on consumer spending.