India Real GDP Preview: Moderating government spending to weigh on growth in Q3-FY24

India's economic landscape in FY24 continues to impress with robust growth across various sectors. However, it appears that the economic activity is losing steam. Moderating government spending and high inflation are likely to have been a drag on economic growth. Given recent high frequency data, our expectation is now of a 6.4% y/y growth in real GDP, during the third quarter of FY24.

India is anticipated to have experienced a growth rate of 6.4% y/y in the third quarter of FY24 (April-March), marking a deceleration from the preceding three months when it stood at 7.6%, in our view. While the government remains optimistic about the economic activity levels sustaining, the market consensus is aligned with our view of a deceleration. The Reserve Bank of India too, estimates a 6.5% growth in the same period.

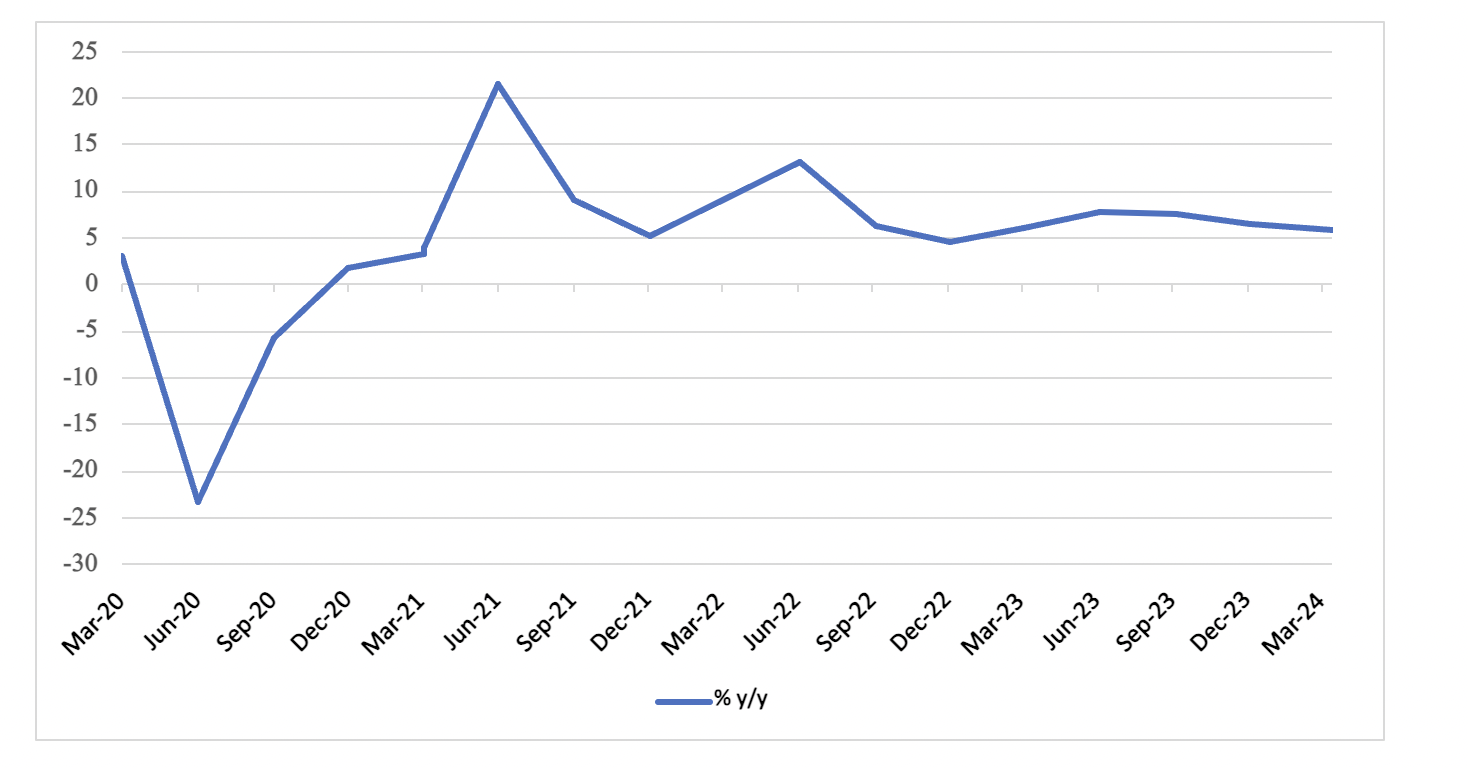

Figure 1: India Real GDP Growth (%change y/y)

Source: Continuum Economics

The expected slowdown in Q3 is attributed to a potential decrease in state-led capital expenditure, a significant driver of investment growth. Although the government has propped up growth in the last several quarters with a high capex, it appears that it may have eased up on the investment. Further, the government's aim was to drive private investment, which has been slow to pick up. Private investment cycle has not gained momentum as yet, and will likely only pick up in H2-2024 (or H1-FY25), with the market expecting the RBI to cut rates post elections in May. While several high frequency indicators such as air passenger traffic and passenger vehicle sales suggest that private consumption has remained strong, it is noteworthy that rural demand remains below potential. High levels of inflation are expected to have curbed household demand during the quarter. Furthermore, the agricultural sector is expected to have contributed to the deceleration as erratic rains disrupted economic activity in rural areas. Factors such as reduced rainfall and lower reservoir levels are believed to have caused a notable slowdown in the agricultural sector. Industry and services sectors are expected to have experienced sustained growth.

Further, in our view, economic slowing is expected in Q4 FY24 as well, as the impact of tight monetary policy begins to weigh on overall economic activity. The real interest rate is about 2% and this could weigh on credit off-take.

Looking ahead, we foresee a continuation of growth momentum in the upcoming fiscal year, although our optimism is more tempered compared to the RBI. We expect India's growth to average 6.4% y/y in FY24 (5.4% y/y in Q4FY24) and ease further to 6.3% y/y in FY25.