View Change: FOMC to ease by 75bps in 2024, starting in Q3

We now expect the Fed to ease by 75bps in 2024, rather than by the 125bps we forecasted in the December outlook. The revision to our Fed forecast is largely due to an upgrade to our GDP view with Q4 2023 having come in significantly stronger than we expected and leaving significant momentum entering 2024. We have made only marginal revisions to our inflation forecasts, with core PCE revised marginally lower in the near term despite the upside January CPI surprise given the progress made in reducing inflation in late 2023. Still, the strength of January’s CPI will add to Fed caution, and we now expect easing to start in Q3 rather than Q2.

GDP growth proving resilient

After Q3 2023 saw GDP rise by a seven-quarter high of 4.9% we expected a significant slowing in Q4 at the start of the quarter, and while we upgraded our forecast as data came in through the quarter, the 3.3% annualized increase significantly exceeded even our upgraded projection. Data, particularly for consumer spending, gained momentum late in the quarter, meaning momentum entering Q1. Early Q1 data has been mixed, with retail sales and industrial production slipping in January, though that was in part due to cold weather. January’s non-farm payroll showed a dip in the workweek consistent with a decline in activity, but strong employment growth suggests that the labor market remains tight, as did a stronger monthly gain in average hourly earnings.

We do not expect January’s 353k increase in non-farm payrolls, probably exaggerated by supportive seasonal adjustments, and its 0.6% increase in average hourly earnings, possibly in part due to the lower workweek, to be repeated, but growth in employment and wages remains supportive for real disposable incomes, provided January’s inflation bounce is also not repeated. Housing demand is another component of GDP that gained momentum entering Q1, in response to lower mortgage rates in late 2023. The Fed’s most recent Senior Loan Officer Survey showed less a less negative picture on demand for commercial and industrial loans, suggesting a fading of the downside risks to business investment that followed banking sector concerns earlier in 2023. Government maintains some momentum and net exports saw a modest improvement led by exports in Q4. A recent inventory buildup still looks in need of a correction, but resilience in demand argues for a smaller correction that we had previously expected.

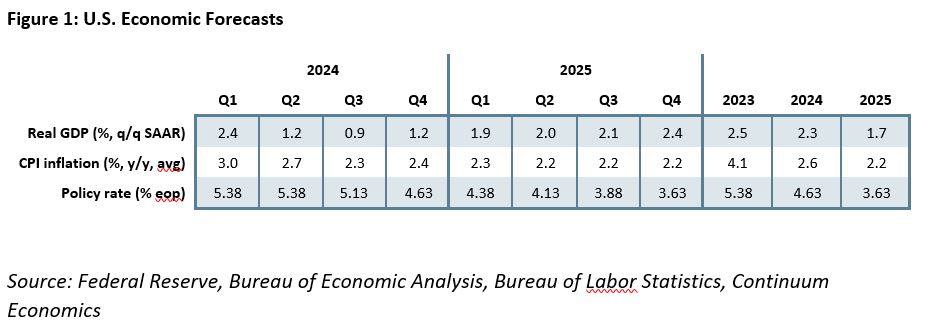

With Fed policy restrictive, we still expect the economy to lose some momentum with annualized gains of 2.4% in Q1 2024, 1.2% in Q2 and 0.9% in Q3, which we expect to prove a low before a 1.2% increase in Q4 with momentum set to build further through 2025. However, in December we had expected GDP to come in below 1.0% annualized in each quarter of 2024. The recent boost to momentum was stimulated by market hopes for Fed easing, notably through mortgage rates and equities, and looks set to fade until easing gets close. The Fed probably needs to keep rates on hold through H1 2024 to push momentum below long-run potential. Our upgraded GDP forecast for 2024 is 1.4% Q4/Q4 which is in line with what the FOMC projected in December. For 2025 we expect a rise of 2.1% Q4/Q4, above the FOMC’s 1.8% December estimate. That for the year as a whole our 2024 forecast of 2.3% is stronger than our 2025 view of 1.7%, reflects 2024 starting with more momentum than 2025.

Inflation and Fed Policy

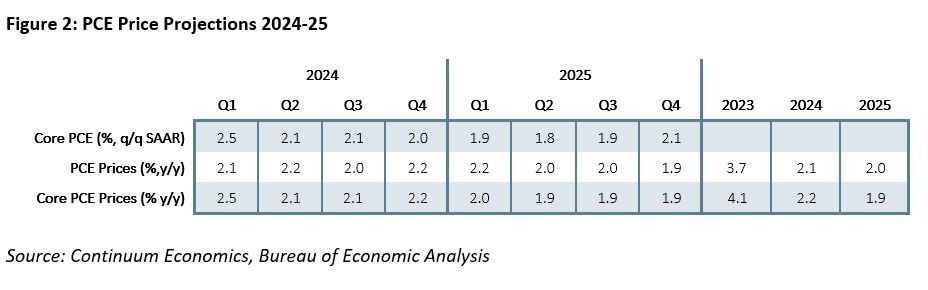

Our forecasts for inflation have not changed much since December. We still expect CPI to average 2.6% in 2024 though we have revised our core PCE Price forecast down to 2.2% from 2.5%, with the CPI outperformance of core PCE prices having increased in recent months. January’s strong CPI increase is likely to prove an above trend month, reflecting pricing decisions taken at the start of the year. Most recent months have produced subdued inflationary figures, particularly core PCE which saw only one month above 0.2% before rounding in the second half of 2023. Still, January’s CPI, where strength was concentrated in services, suggests that demand and wage pressures on inflation persist, despite significant price restraint coming from supply improvements in the goods sector. Getting inflation sustainably back to target is likely to require some cooling in demand as well as continued improvement in supply.

For 2025, we expect CPI to average 2.2%, versus our December forecast of 2.4%, and core PCE prices to average 1.9%, versus a December forecast of 2.0%. This will mean core PCE prices moving slightly below target in 2025 as a whole, but by the end of the year we expect underlying momentum to be starting to increase again, nudging marginally above 2.0% on an annualized basis in Q4 of 2025.An economy moving only modestly below potential, with some persistence in inflationary pressures, does not call for aggressive rate cuts, though GDP growth moving slightly below potential and inflation near target will justify gradual easing. With our forecasts for the economy now similar to the FOMC’s the December median dots, which saw 75bps of easing in 2024, look reasonable. Fed Chairman Jerome Powell stated in January that he does not expect that the Fed’s view has changed significantly since December. We expect one 25bps move in Q3, marginally more likely in July than September, and two 25bps moves in Q4 in response to Q3 GDP moving more clearly below potential. With 2025 likely to see growth moving back towards potential but inflation hitting target, we expect a cautious pace of easing, with one 25bps move in each quarter, also in line with December’s FOMC median dots.

The election and 2025

2025 forecasts clearly face considerable uncertainty with the election a very close call. In December we projected that President Joe Biden would be re-elected. While his prospects may be slightly stronger than polls currently suggest, as voters move towards making a choice between him and former President Donald Trump rather than simply making a judgement on Biden, the race now looks too close to call. Still, our central view is that 2025 will see no major policy-induced economic damage. Should Trump initiate an aggressive trade war then our GDP forecasts may have to be revised down, but with a Trump victory close to an even bet and there being little certainty over what he would do in office, a major economic disruption should not be a central scenario. In fact, should Trump be elected and avoid aggressive actions on trade, improved prospects of the Trump tax cuts being extended would be supportive for growth.