FOMC Minutes Cautious Rather Than Hawkish

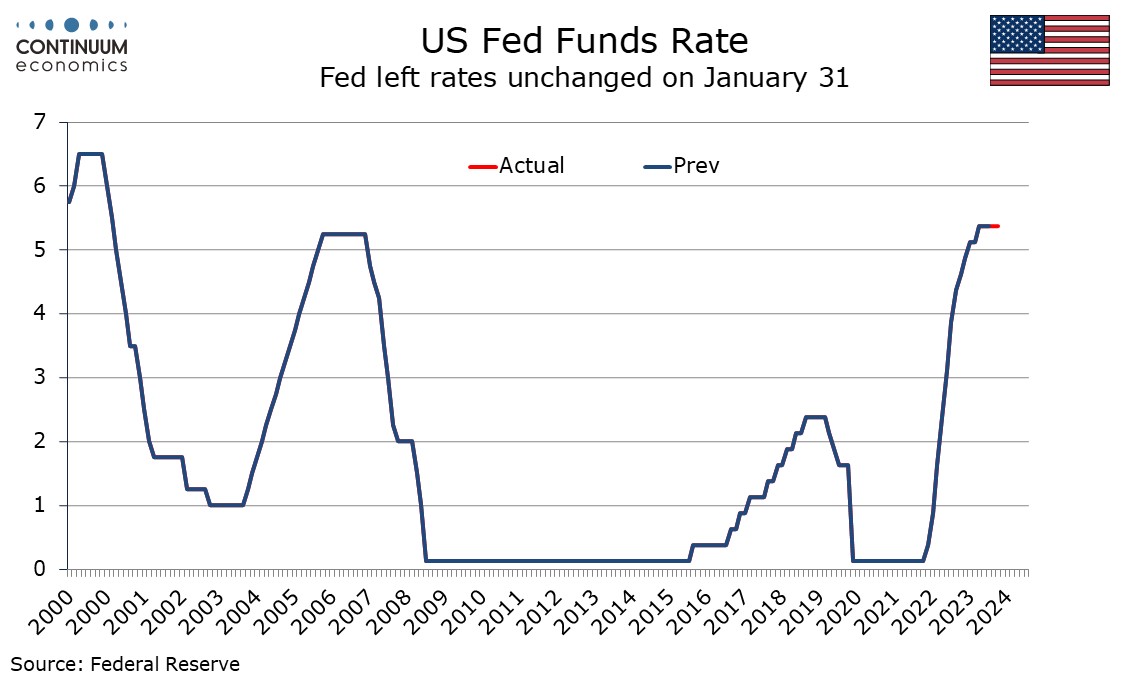

We see the FOMC minutes from January 31 as cautious rather than hawkish, with most noting the risks of easing to quickly, but the strength of Q4’s GDP data seemed to be causing only limited concerns. The discussion took place before strong January non-farm payroll and CPI data were visible. The latter in particular justifies continued Fed caution.

Participants saw the current policy rate as likely to be the peak and there was no sign that any were seriously considering the possibility of further tightening. Lower inflation and growing signs of supply and demand moving into a better balance were noted. However greater confidence that inflation was moving sustainably towards 2% was seen as necessary before easing. Most noted the risks of moving too quickly while only a couple pointed to downside risks of maintaining an overly restrictive stance for too long. The former camp appears to be a comfortable majority.

Stronger than expected Q4 GDP data was however downplayed, seen as boosted by inventories and net exports which are volatile and carry little signal for future growth. That consumer spending had been stronger than expected was noted but a number expected slowing in 2024 as labor income slowed and savings built up during the pandemic diminished. Some signs of stress for lower income consumers were noted. In looking at risks to inflation the potential for both stronger and weaker than expected demand were noted, as well as both less restrictive and persistently restrictive financial conditions, leaving a balanced tone. Upside risks to inflation were seen as having diminished but some noted that progress could stall.

Many participants suggested it would be appropriate to begin in-depth discussions of balance sheet issues at the next meeting, some feeling that given uncertainty over the ample level of reserves slowing the pace of runoff would smooth the transition or allow runoff to continue for longer. A few noted balance sheet runoff could continue after easing begins. However slowing the pace of runoff looks likely this year.