EUR, JPY flows: Quiet market favours higher yielders for now

USD a touch softer, JPY weakness still the only real trend, but becoming increasingly dangerous

A quiet start to what is likely to be a quiet day in the FX market, at least ahead of the FOMC minutes after European close. There is no data of note on the calendar, with this morning’s slightly smaller than expected UK budget surplus for January of little significance.

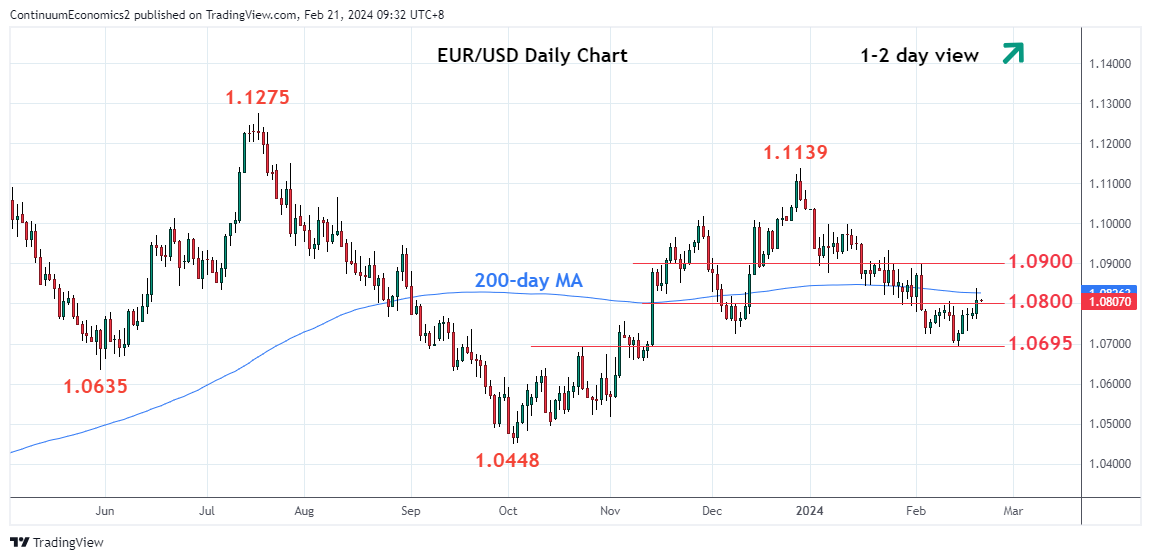

From an FX perspective, the USD is a little softer in the last few sessions, with EUR/USD breaking above the 1.07-1.08 range that has held since the US employment report. But this is so far a modest break, and we wouldn’t see scope for it to extend beyond 1.09 unless we see a very much more dovish than expected set of FOMC minutes tonight. There may be scope to the 1.0850-1.09 region, but that is a significant congestion zone that will be hard to penetrate.

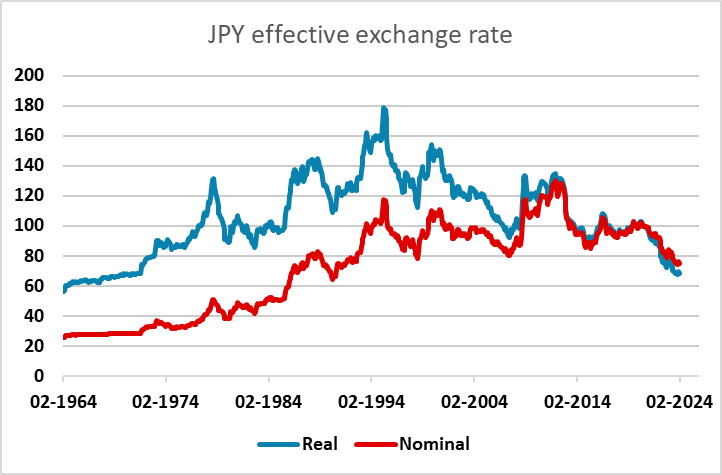

Trendwise, the only major trend in the developed FX market is the decline of the JPY. This has persisted for the last two months and is threatening the JPY lows seen in November, which were the lowest since 1990. Of course, in real terms the JPY is much weaker than that, hitting its lowest levels seen in the floating era. This trend is the key to the current market and is likely to reverse this year, but will require either BoJ tightening or equity market weakness to do so. When it does, expect a big increase in FX volatility, but in the meantime, in low vol conditions, the higher yielders may continue to outperform. However, we feel that looking for these gains is akin to picking up pennies ahead of the proverbial steamroller.