GBP flows: GBP downside risks on BoE testimony

BoE testimony may well be more dovish in view of recent developments, suggesting GBP downside risks

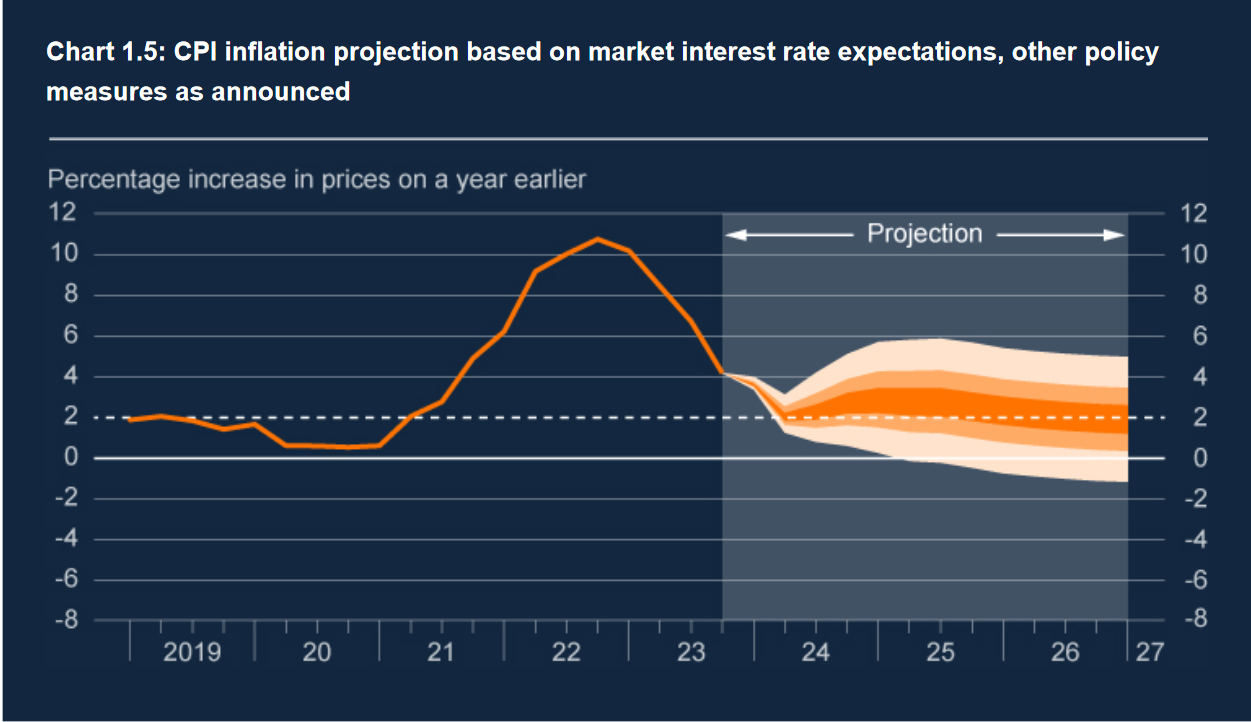

BoE CPI projections in the February Monetary Policy Report

Not much on the data front on Tuesday, with Canadian CPI the only significant number. This morning does however see the testimony of three BoE MPC members to the Treasury Select Committee, which could be of significance for GBP in the wake of the latest lower than expected CPI data and the 0.3% decline in GDP reported in Q4.

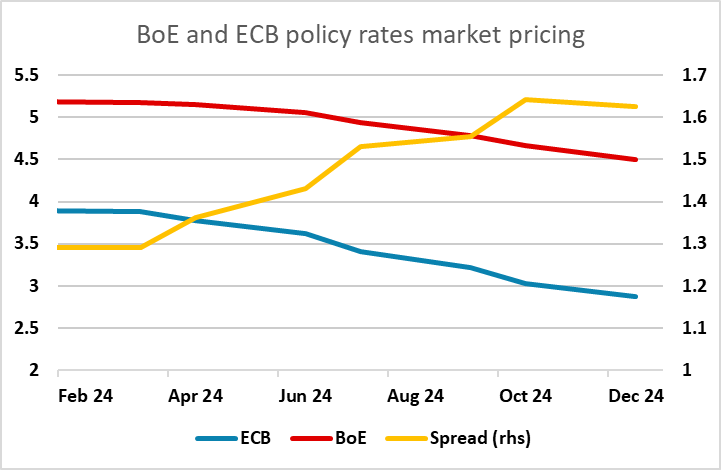

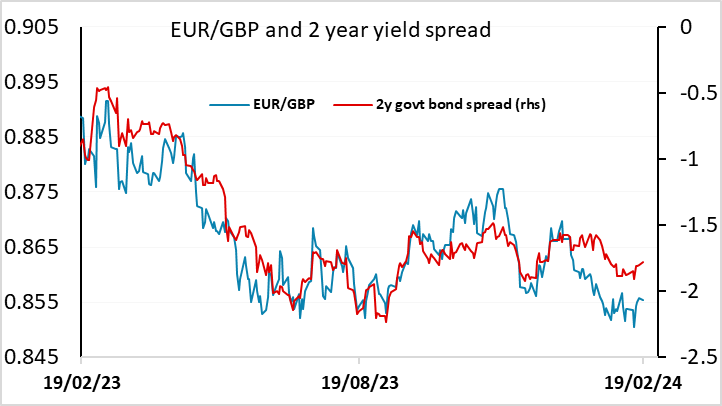

Despite the weakness of the latest UK data, UK front end yields haven’t fallen in the last week, and remain significantly higher over the year so far, with 2 year yields up 0.64% to 2.61% since the beginning of the year. Expectations for BoE easing this year have been steadily reduced with the first 25bp rate cut now not fully priced until August and less than three rate cuts priced for the year. Much of this is due to the correlation with US yields, which have risen on the back of strong US data, but there has been precious little support from UK data. While UK PMIs have been stronger, the GDP data suggests that the PMIs are not a terribly accurate indicator of UK growth.

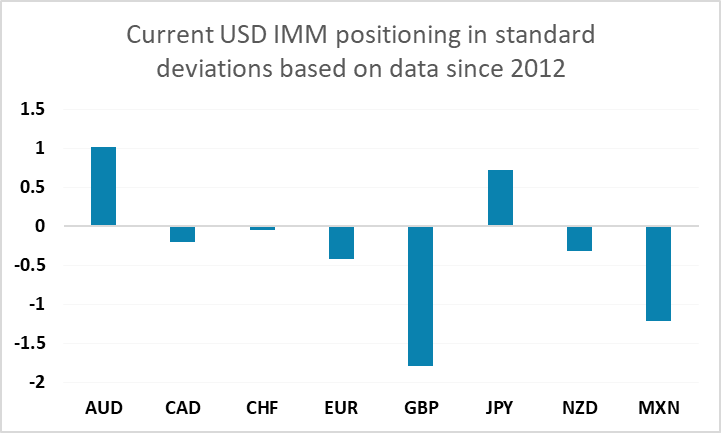

The BoE testimony will therefore be of interest this morning in the wake of the recent UK data and the rise in UK yields since the February Monetary Policy Report. In the February report, CPI inflation was expected to remain above target for the next two years before dropping below 2% in 2026. However, in view of the lower than expected inflation and growth numbers last week, and the significant rise in UK yields relative to the February MPR baseline, the Bank is now likely to see a more rapid decline in inflation. The softer GBP tone seen since the CPI data last week should therefore persist, with risks up to 0.86 in EUR/GBP, especially since GBP long positioning looked extended as of last Tuesday’s CFTC data.