Bank of Canada Drops Tightening Bias

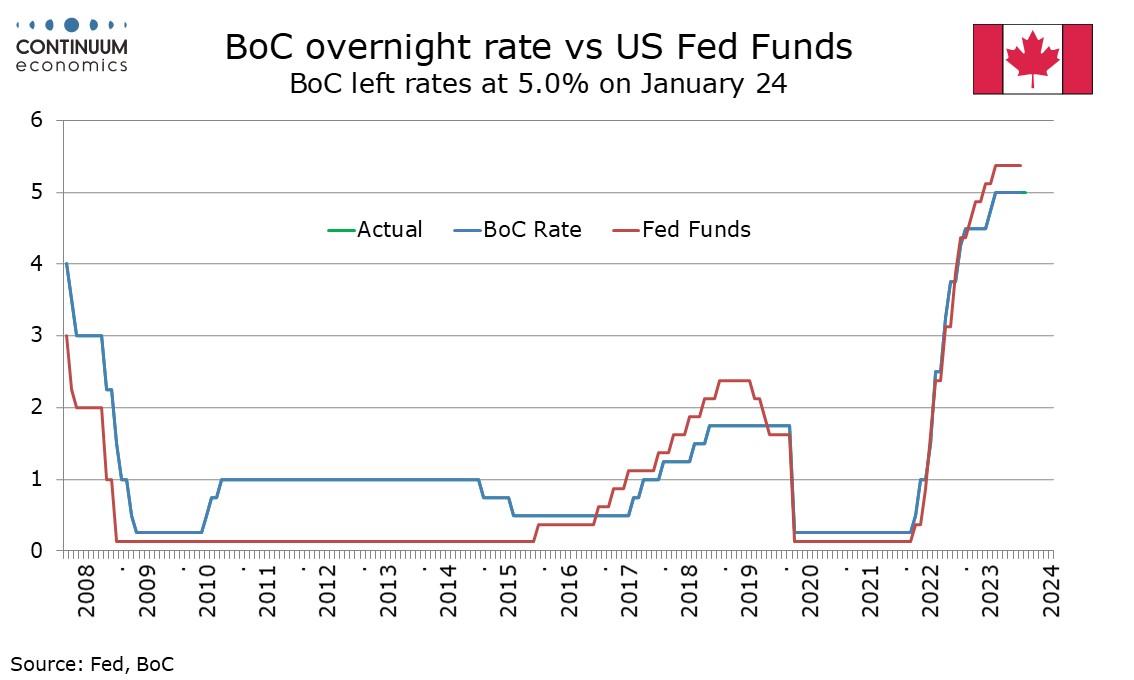

The Bank of Canada left rates at 5.0% as expected though the statement took a clearly more dovish tone, dropping a tightening bias though still expressing concern over persistently high inflation. Easing does not appear imminent but we now expect it to start in Q2 rather than Q3.

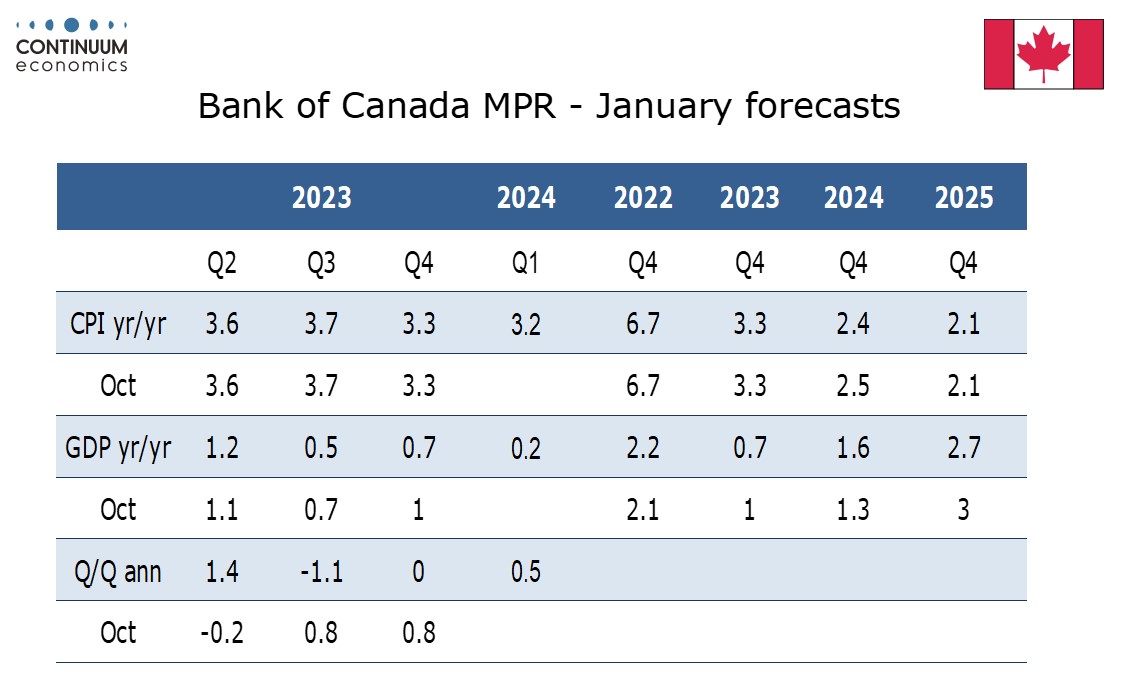

The statement made several dovish adjustments, most significantly dropping a reference to being prepared to tighten further if needed. The statement was negative on global growth, noting unexpected strength in the United States but expecting it to slow, and weakness in Europe and China. Canada’s economy is seen as having stalled with Q4 2023 seen flat (weaker than we expect) though 2024 has been revised up to 1.6% Q4/Q4 from 1.3% with growth seen strengthening gradually from the middle of 2024. In December the BoC stated the economy was no longer seeing excess demand. Now it sees the economy operating in modest excess supply.

Despite the statement noting oil prices being $10/barrel lower than assumed in October the BoC made no significant adjustment to its inflation forecasts. Despite seeing an easing of labor market conditions it notes that wages are still rising by 4-5%. The BoC does see slowing demand reducing pressures in a broader number of inflation components with shelter being the biggest contributor to above target inflation, but states it wants to see further and sustained easing in core inflation. Inflation is seen remaining near 3% in the first half of this year before gradually easing to the 2% target in 2025, though its forecast for that year remains at 2.1% Q4/Q4.

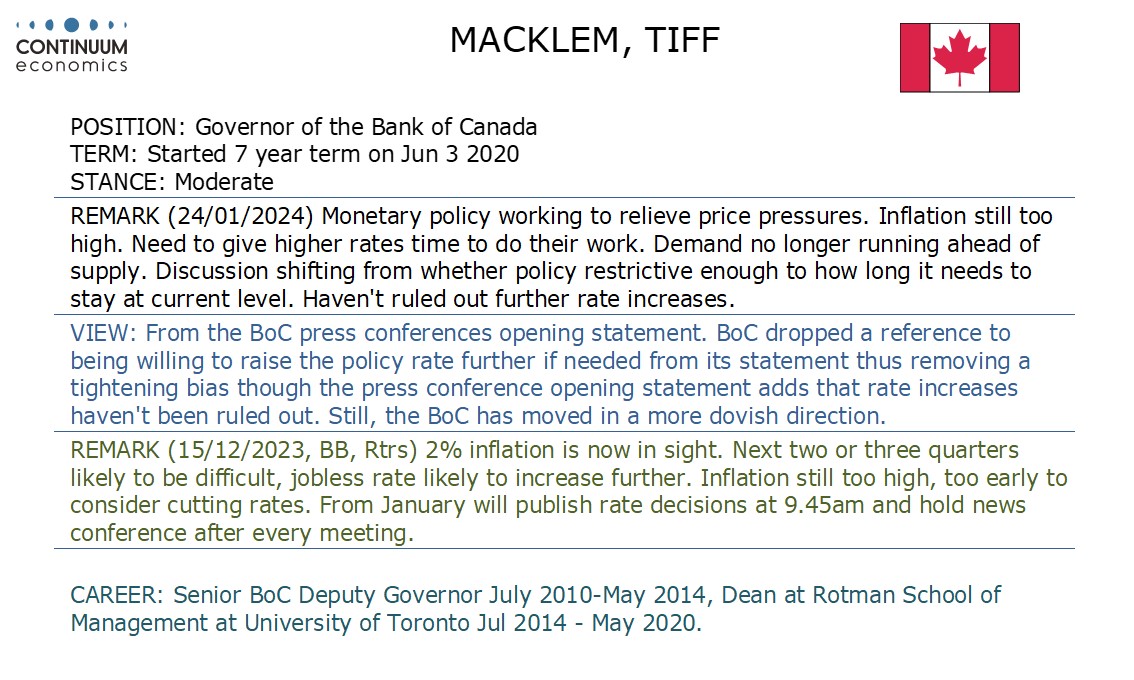

In his opening statement Governor Tiff Macklem gave a twofold message. Monetary policy is working to reduce inflationary pressures and the BoC needs to give higher rates time to work. However discussion is shifting from whether rates are restrictive enough to how long policy needs to remain at this level.

Macklem went in to say it was premature to discuss easing and refused to rule out another rate hike, though it is clear that there is no longer a tightening bias at the BoC. With the latest message a little more dovish than we expected we now expect easing to start in June rather than Q3, though easing is likely to start cautiously and we still expect the total amount of easing in 2024 to be 100bps.

That the BoC dropped a reference to potential future tightening may have some asking whether the FOMC will do the same on January 31. We would not see the BoC as giving a signal for the FOMC given that the message from Canadian data is very different from that in the US, where growth is significantly outpacing that in Canada but progress on reducing inflation has been faster.