Bank of Canada Unlikely to Hint at Easing on January 24

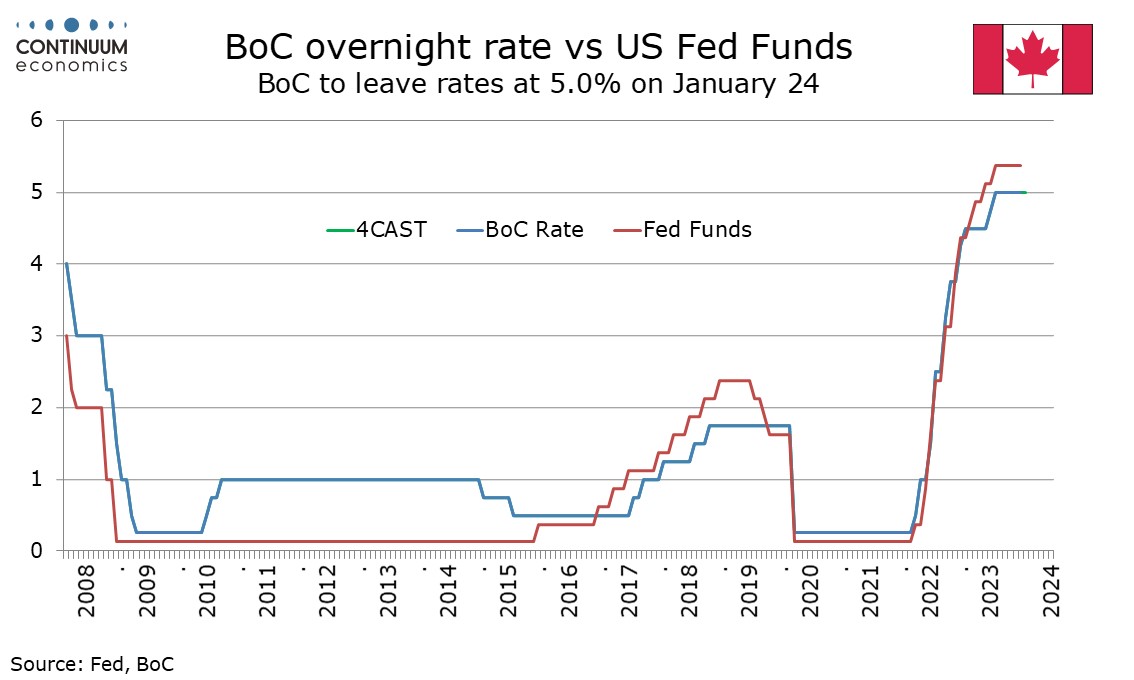

The Bank of Canada meets on January 24 and rates look highly likely to remain unchanged at 5.0%. The statement is likely to see a similar tone to that on December 6 which no longer saw the economy as in excess demand but remained willing to raise the policy rate further if needed.

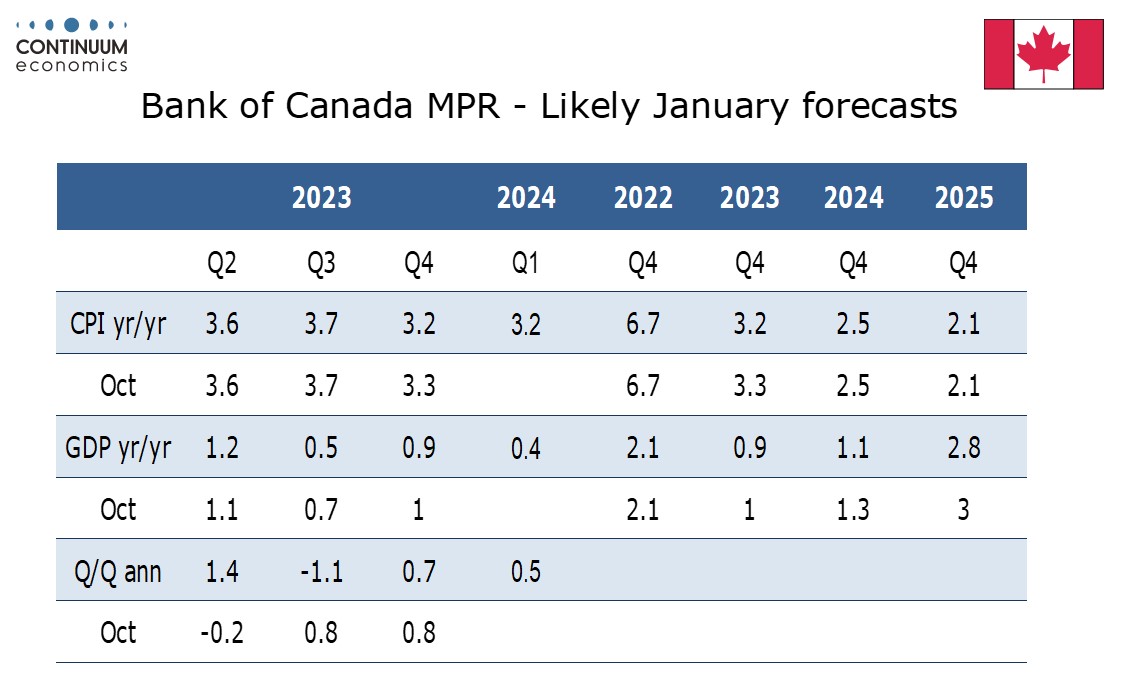

This meeting will see a quarterly Monetary Policy Report released, and that means an update to the BoC’s economic forecasts is due. However these look unlikely to change much from those released in October. Q4 CPI came in marginally below what was seen in October but December saw some acceleration and the BoC’s core rates remain stubbornly high averaging closer to 4.0% than 3.0%. The BoC is unlikely to expect much further progress in Q1 and while declines in inflation will continue to be expected in 2024 and 2025, even the latter will be seen finishing with inflation marginally above the 2.0% target.

Since October’s meeting Q3 GDP came in unexpectedly negative but with Q2 revised higher, and a quarter of weak growth looks likely in Q4, probably marginally below the 0.8% annualized projection made by the BoC in October. Another subdued quarter is likely to be seen in Q1 and risk is that the BoC will fine tune its 2024 and 2025 forecasts lower, from the 1.3% and 3.0% respectively seen in October, on a Q4/Q4 basis. Canadian employment growth has lost momentum, stagnating in December but wage pressures, noted as resilient in December’s statement, accelerated further.

A mix of weak growth and stubborn inflationary pressures suggest there is no strong case to move rates in either direction, but the BoC will need to stress that inflation remains a concern, and this means the statement is unlikely to see any further dovish fine tuning. The BoC is likely to continue to express a willingness to raise rates further if needed, even if that now seems unlikely. We expect the BoC to ease by 100bps in 2024, but we do not expect easing to start until the second half of the year, and that will require inflation showing more convincing signs of heading back to the 2% target than is now the case.