JPY flows: JPY gains as yields slip in the US and Europe

Lower yields in the US and Europe are extending JPY strength today. We are sceptical that these yield declines are justified by recent Fed and ECB comments, but JPY strength looks well justified nevertheless.

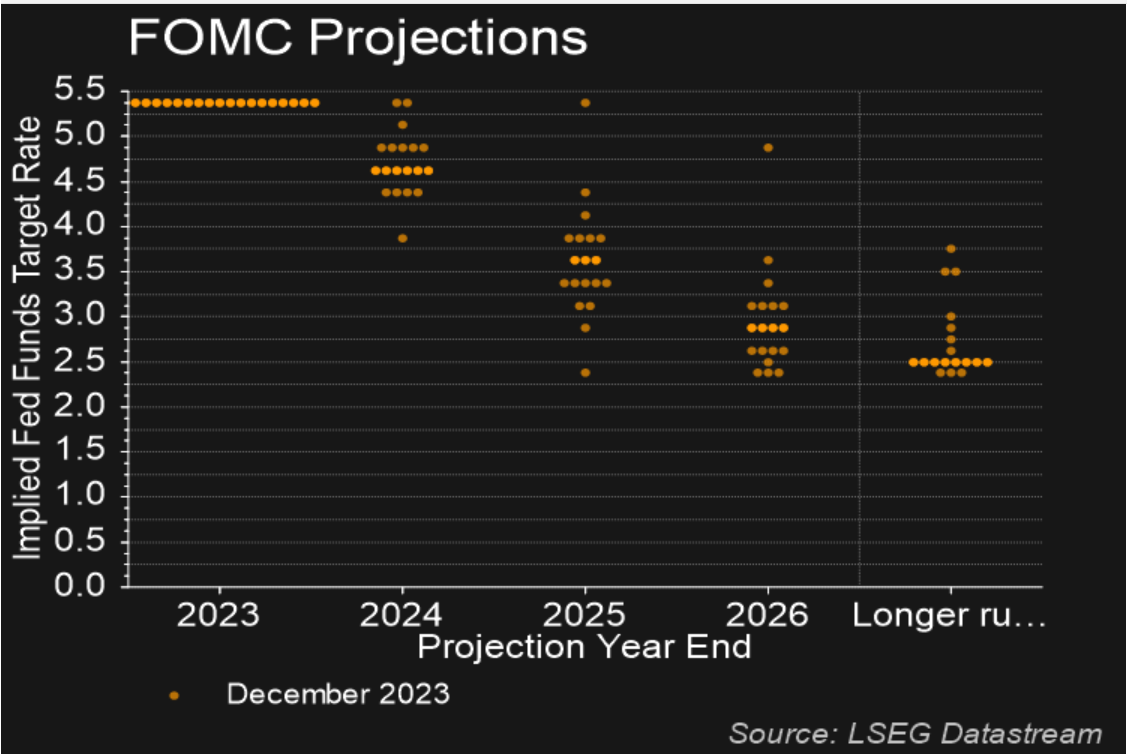

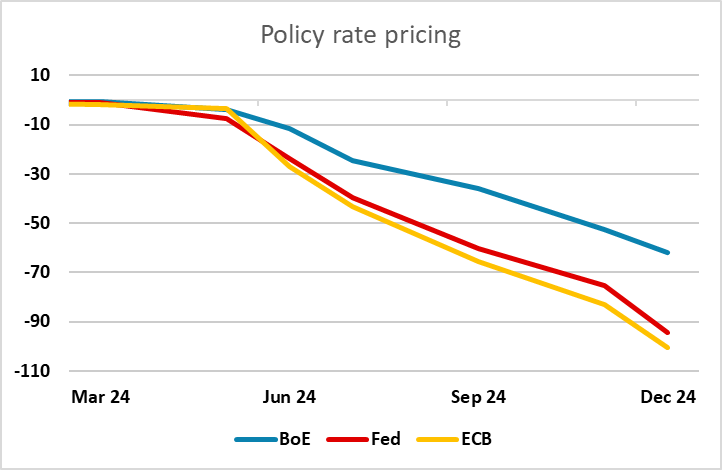

JPY strength is the main feature this morning as we see yields dropping across the board in the US and Europe. We now have four 25bp rate cuts fully priced in for the ECB this year (100 bps), with 94 bps of cuts priced in for the Fed. The decline in rate expectations looks a little strange to us after the Powell testimony and the ECB statement, neither of which seemed to us to be particularly dovish. The Fed dots from December indicated 3 cuts were the median expectation, and the data has certainly been on the strong side since then, so the market pricing in nearer to 4 than 3 cuts looks optimistic. Having said this, it is likely to take a solid employment report to reverse the current dovish market slant.

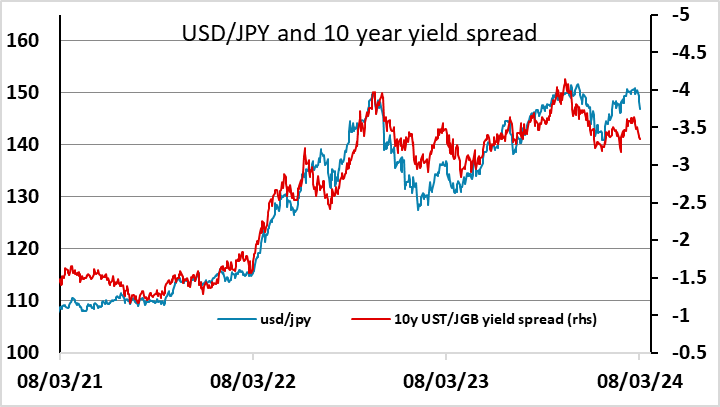

In spite of our reservations about the market’s interpretation of the Fed and ECB, JPY strength looks fully justified even if yields were to rise somewhat from here. From a yield spread perspective, USD/JPY looks to have potential to near 140 based on the correlation that has held for the last few years. We would add that a longer term view suggests even more USD/JPY downside potential based on the simple nominal yield spread correlation, while the relatively low Japanese inflation in recent years has mean the JPY’s real decline has been around 15% more than it appears in nominal terms. On top of all this, the risk of tighter BoJ policy is now being priced as near a 50% chance as early as the March 19 meeting, and higher JGB yields look very likely as the year goes on, with confirmation of higher wage settlements in the spring likely to be a trigger for higher rate expectations and higher yields. So we may be seeing the beginning of a very large JPY recovery.

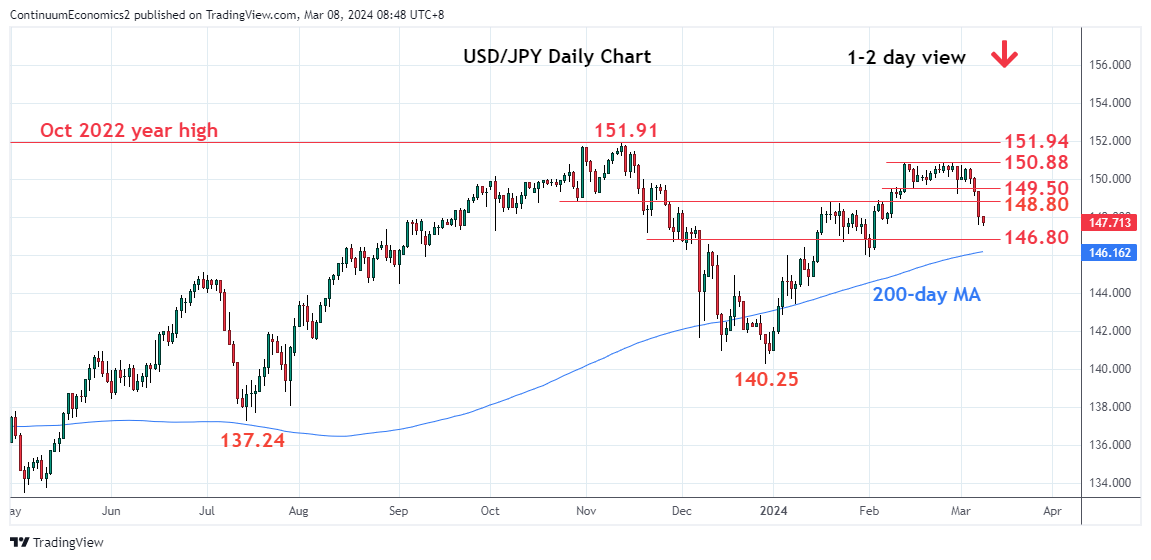

However, it remains difficult to be confident of such a move until or unless there is some weakening in the strength of US equity sentiment, with the US equity risk premium continuing to correlate strongly with JPY cross moves in particular. That the correlation holds as much if not more for JPY crosses as for USD/JPY makes us distrust it – there is no obvious fundamental reason for European currencies to benefit against the JPY due to the strength of the US equity market. So we expect the JPY will catch up with the yield spread moves in its favour. Short term, there are big technical levels on the 146 handle – 38.2% retracement of the December/February rally and the 200 day moving average. A break below here could trigger a bigger trend.