FX Daily Strategy: Asia, July 17th

GBP short term risks on UK CPI on the upside…

…but scope for sustained gains now looks quite limited.

Positioning and valuation measures suggest a lot of good news is priced in

USD to maintain better tone on US data

GBP short term risks on UK CPI on the upside…

…but scope for sustained gains now looks quite limited.

Positioning and valuation measures suggest a lot of good news is priced in

USD to maintain better tone on US data

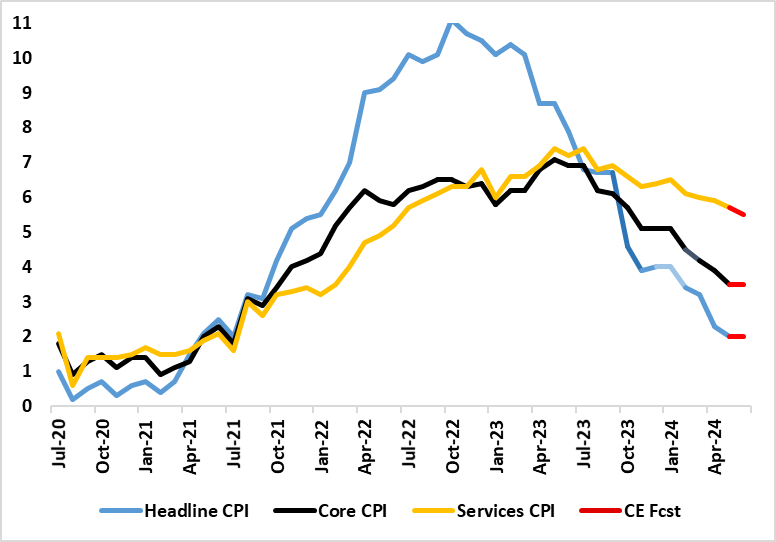

UK Headline and Core Inflation Steady But Services Less Resilient?

Source: ONS, Continuum Economics

UK June CPI is the main item on the calendar on Wednesday. We see the headline staying at 2.0% in the June numbers and with a stable core rate of 3.5%, but with services easing only to 5.5% and thus some 0.4 ppt above BoE thinking. Our forecast is on the high side of market expectations, and consequently the risks should be to the GBP upside, at least in terms of the knee-jerk reaction.

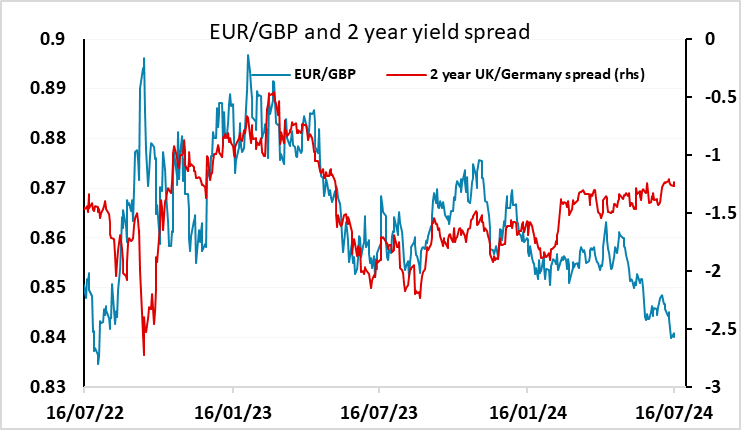

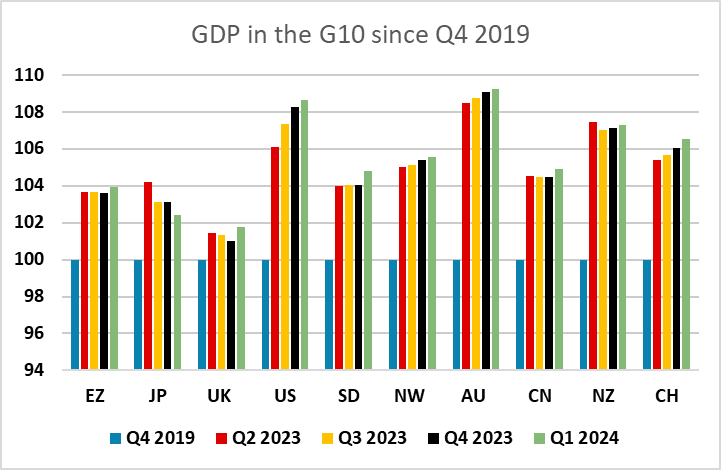

But there are a few factors that argue against any sustained GBP strength. GBP gains in the last few weeks have come without any support from yield spreads. Indeed, yield spreads have moved slightly in favour of the EUR in the last couple of months, while EUR/GBP has fallen from 0.86 to 0.84. This relative GBP strength may to some extent reflect optimism about the new UK Labour government, particularly in comparison to the situation in France after the election. But such optimism is a little speculative. Even though UK data has been somewhat improved in the last few months, UK GDP remains the weakest in the G10 relative to the last pre-pandemic quarter of Q4 2019, so there is a fair bit of catch-up needed before any growth optimism can be justified.

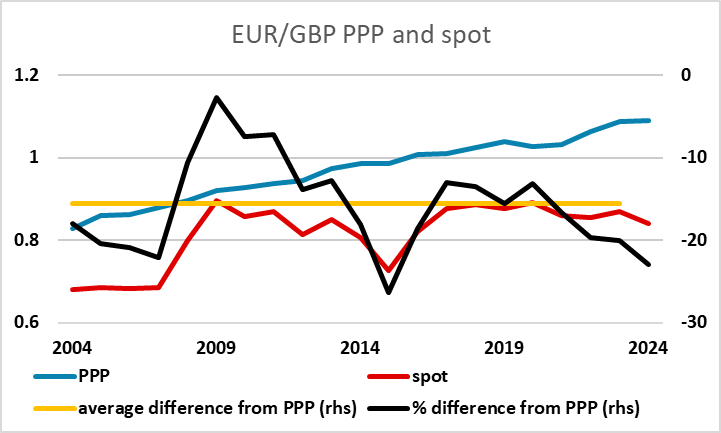

GBP strength is also looking rather stretched here from a valuation perspective. UK inflation has been higher than most peers in the last few years, and EUR/GBP Purchasing Power Parity for consumption was estimated by the OECD to be up to 1.09 in 2023. While GBP has always traded above PPP against the EUR (for reasons that aren’t entirely clear) current levels are the furthest above PPP since 2015.

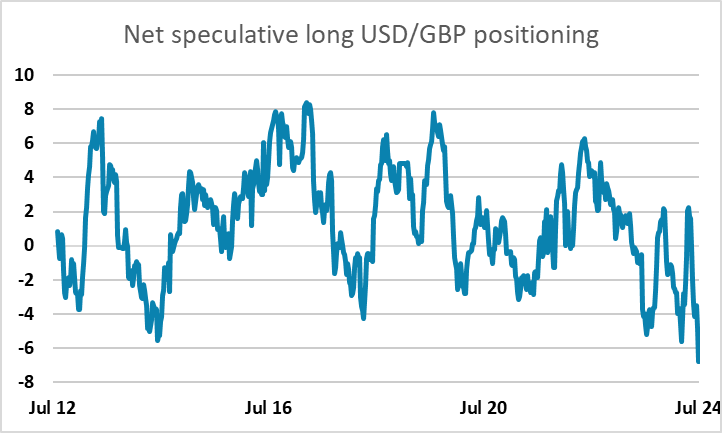

On top of this, speculative positioning in GBP is now very extended according to the CFTC futures data. This has net long speculative GBP positions at all time highs. So while the CPI data may provide some support for recent GBP gains, there does look to be a lot of good news priced in.

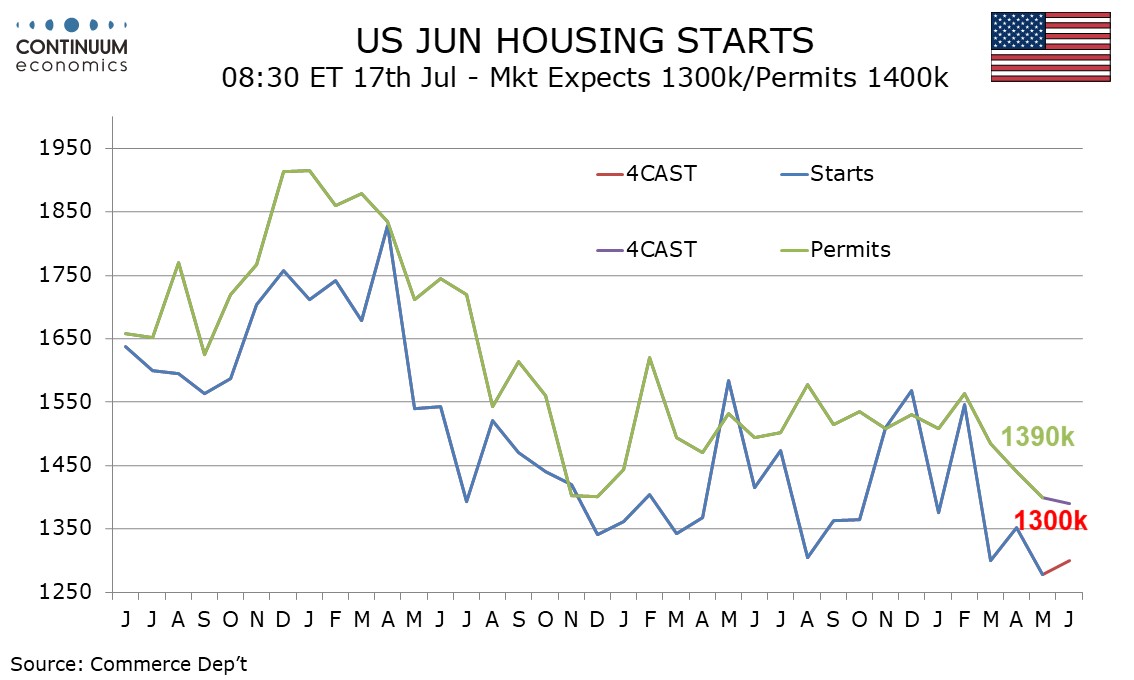

We also have US housing starts, building permits and industrial production data in the US. Tuesday’s stronger than expected US June retail sales data provided the USD with a modest boost, but didn’t trigger any significant rise in US yields, with the market much more focused on the price data than anything in the real sector. The US data is therefore probably not going to have a great deal of impact. Even so, we favour housing starts and industrial production to be reasonably strong in June, and this should help maintain a slightly more positive USD tone.