GBP flows: GBP slightly lower after softer CPI

UK January CPI slightly softer than expected, but y/y unchanged from December and data unlikely to change BoE stance

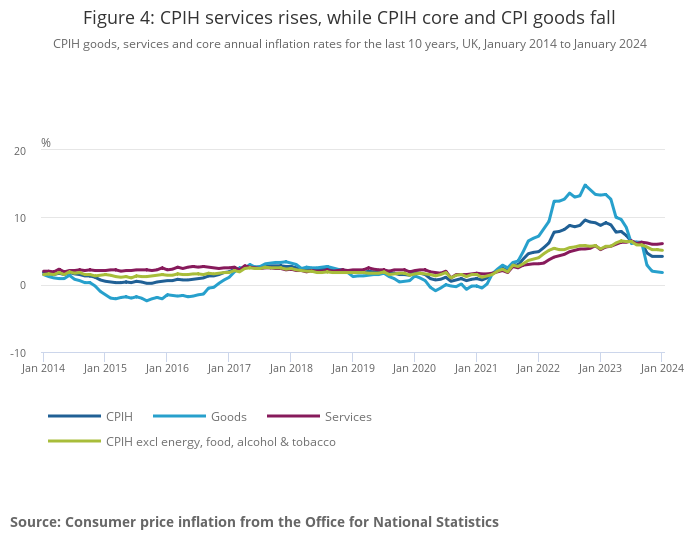

UK CPI has come in weaker than expected, albeit only modestly, with both headline and core CPI unchanged on a y/y basis in January from December at 4.0% and 5.1% respectively. EUR/GBP has gained around 20 pips on the news, bouncing up to 0.8525. But in practice, this isn’t going to have a major impact on BoE thinking, especially since services inflation was actually slightly higher, and the hawks on the MPC see services inflation as key, as it is more likely to reflect the strong rise in wages. The CPIH all services index rose by 6.1% in the 12 months to January 2024, up from 6.0% in December 2023. However, the largest upward contribution to the change came from housing services, which is less obviously wage related.

UK CPI has come in weaker than expected, albeit only modestly, with both headline and core CPI unchanged on a y/y basis in January from December at 4.0% and 5.1% respectively. EUR/GBP has gained around 20 pips on the news, bouncing up to 0.8525. But in practice, this isn’t going to have a major impact on BoE thinking, especially since services inflation was actually slightly higher, and the hawks on the MPC see services inflation as key, as it is more likely to reflect the strong rise in wages. The CPIH all services index rose by 6.1% in the 12 months to January 2024, up from 6.0% in December 2023. However, the largest upward contribution to the change came from housing services, which is less obviously wage related.

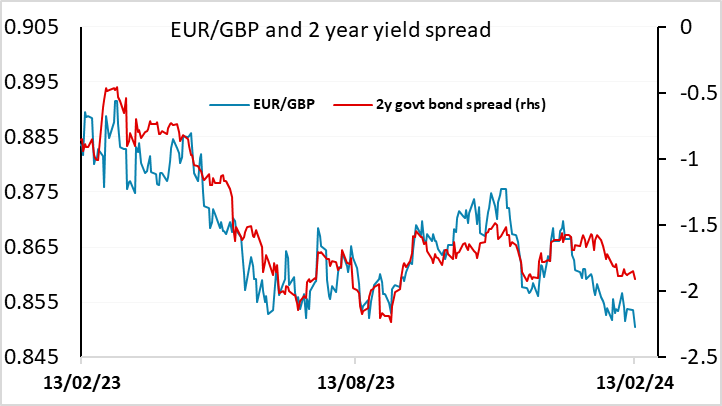

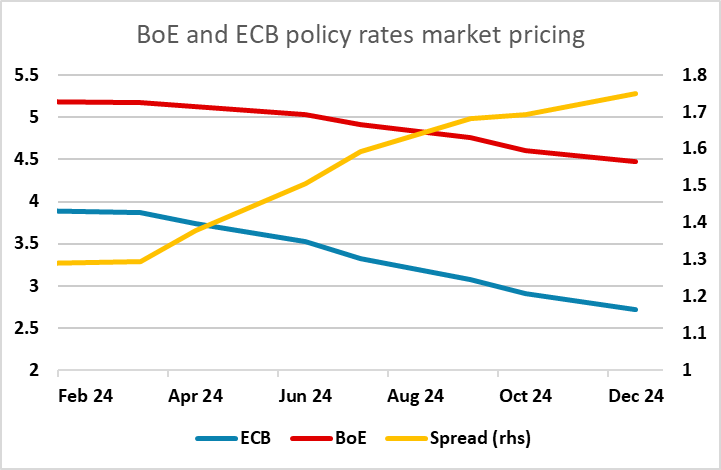

All in all, the numbers don’t provide any real rationale for a change in market expectations of the UK rate path. GBP remains a little strong against the EUR relative to the recent yield spread correlation, so today’s numbers should be enough to prevent a break below 0.85 and may see a correction back to 0.8550, but no major move seems likely.