USD, JPY, AUD flows: USD, JPY former, AUD looks oversold

USD and JPY benefit as equities soften but equity weakness is mild and AUD looks undervalued

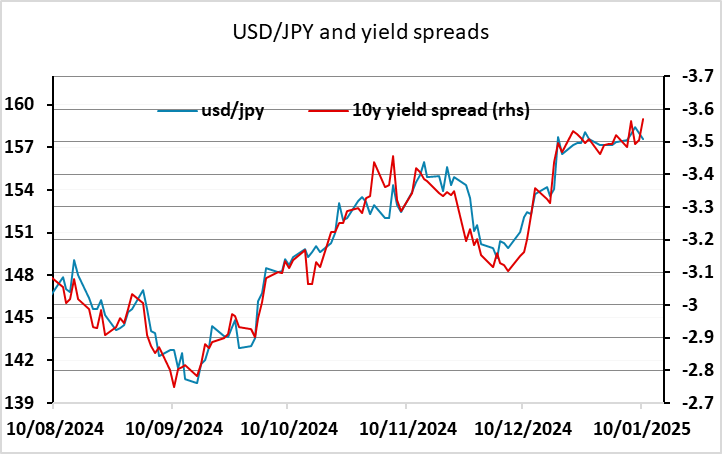

While the calendar is quiet, the FX markets showed more risk aversion overnight, reflecting the negative equity market response to the strong US employment report released on Friday. The USD and JPY were up across the board, with the JPY the best performer, gaining half a figure against the USD overnight as the USD made gains against all the riskier currencies.

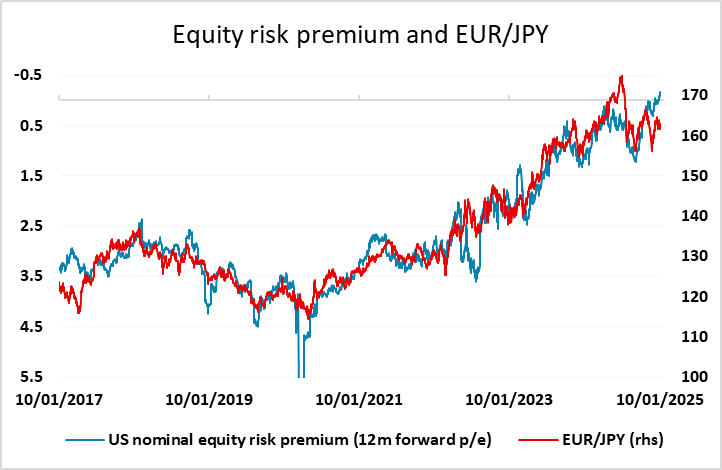

In reality, the equity market declines we have seen have been quite modest given the sharp rise in yields in the US and elsewhere in recent weeks. Indeed, the nominal equity risk premium on the S&P 500 has fallen to its lowest since 2002, as the rise in equity yields due to the decline in prices hasn’t quite kept up with the rise in bond yields. The correlations seen in recent years would suggest this would actually be supportive for the riskier currencies against the JPY, but the paradigms may be changing given the extreme low level of the JPY, the threat of BoJ tightening and or Japanese FX intervention. We continue to see some upside potential for the JPY longer term, but bigger JPY gains will likely require either lower US yields or a bigger equity market reversal.

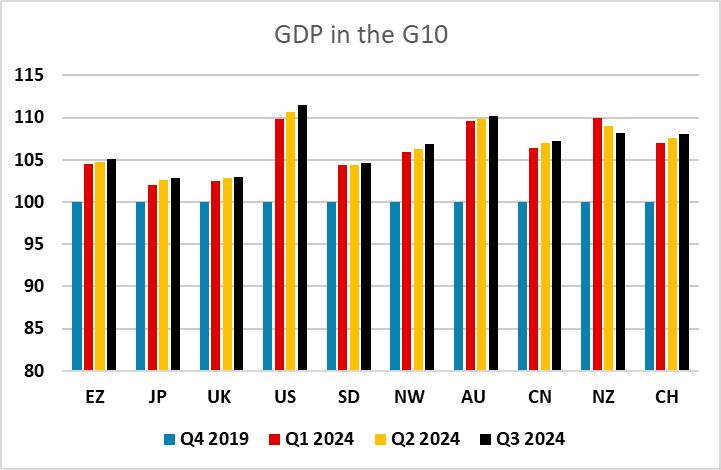

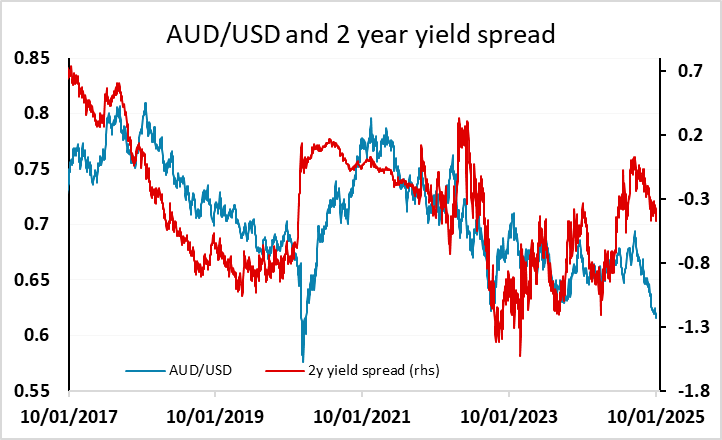

USD gains elsewhere owe something to rising US yields, but this is not the whole story. Yield spreads have actually moved in favour of the EUR this year, and the AUD has fallen much more than indicated by the movement in yields and historic correlations. Some of the USD strength reflects perceptions of a relatively strong US economy., and the US has been the fastest growing of the G10 economies since before the pandemic. However, Australia has been a close second, and the AUD looks to have underperformed on that basis. AUD/USD hit a new post-pandemic low overnight, but should find support near 0.61, and may have significant upside from there unless we see a major turn lower in equities and risk sentiment.