US December Employment Review - Key headlines exceed expectations but detail mixed

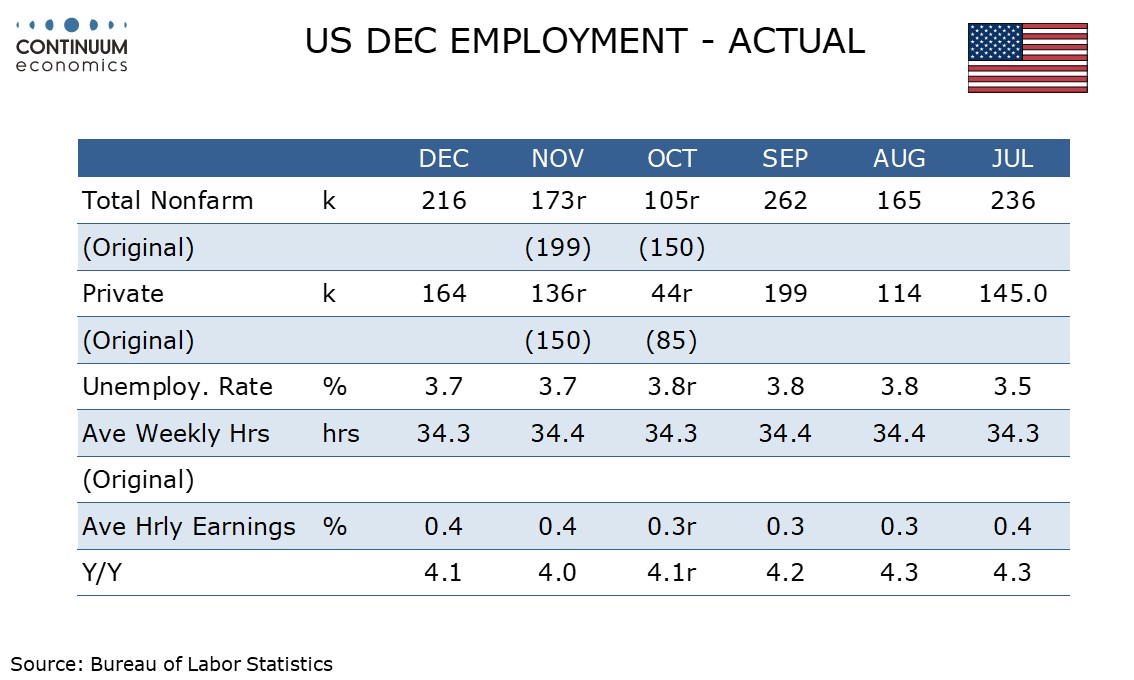

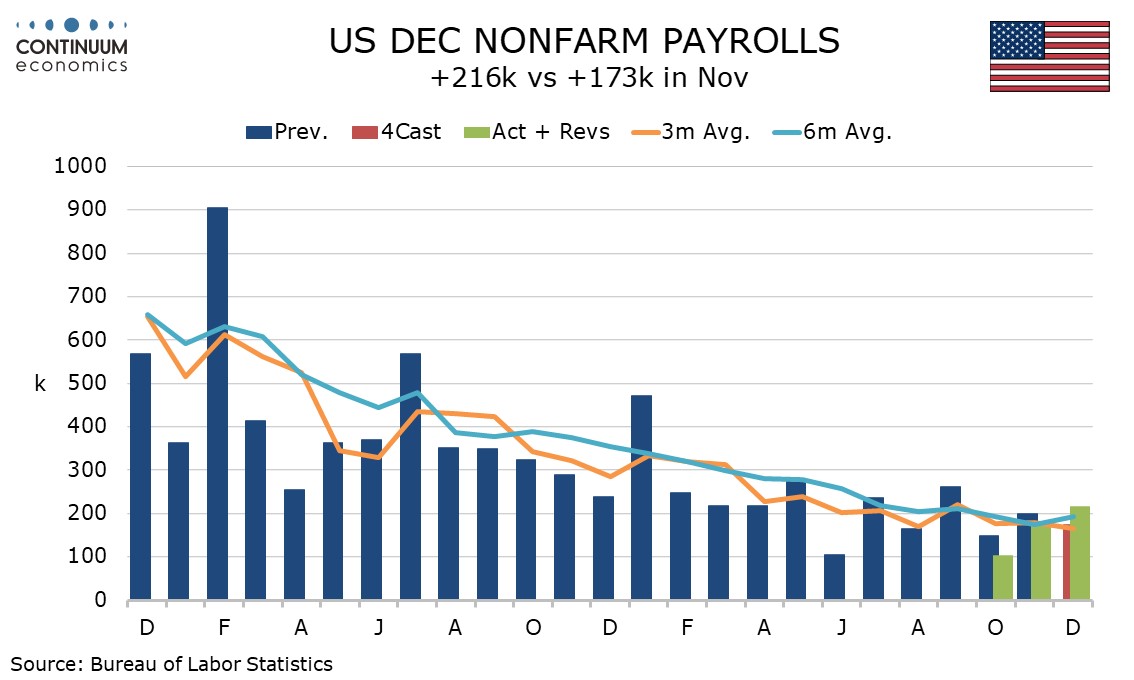

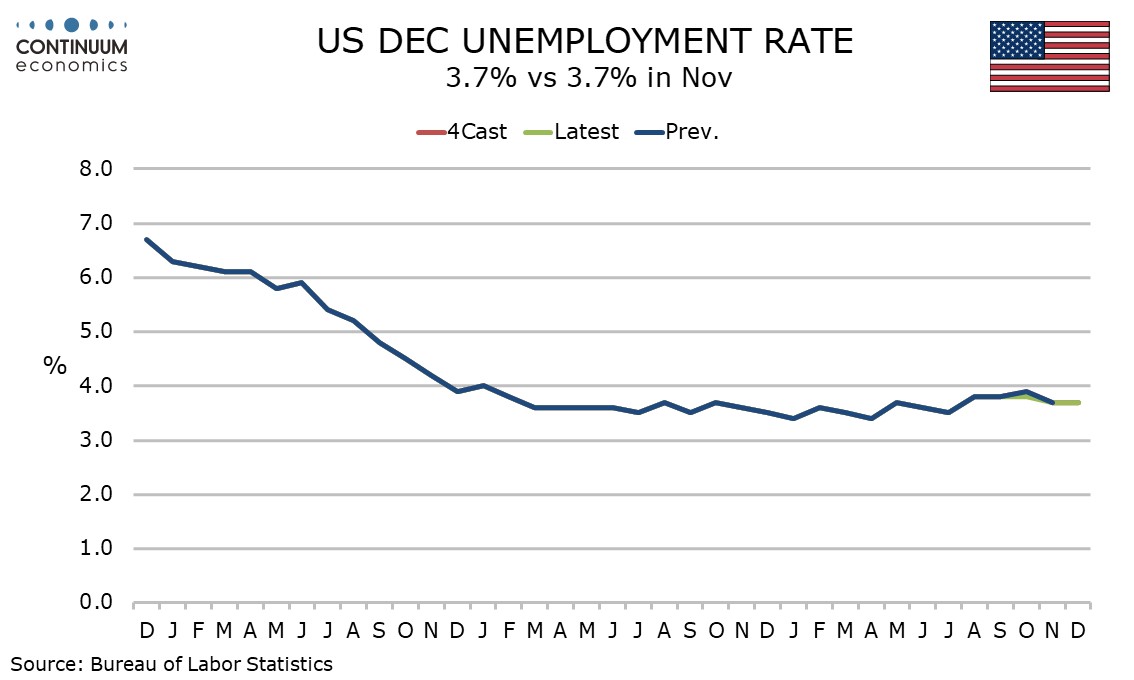

December’s non-farm payroll increase of 216k, 164k private, is on the firm side of consensus but the upside surprise is more than offset by 71k in net downward revisions, mostly in October. Unemployment, unchanged at 3.7% is lower than expected and average hourly earnings at +0.4% are stronger than expected, but a fall in the workweek hints at economic slowing.

The payroll gain, both overall and private, is a 3-month high and backed by lower initial claims and a stronger ADP report.

There are few standouts in the payroll breakdown, with construction at 17k and manufacturing at 6k modest positives, government still strong at 52k, and private services up by 142k. Private services remain led by health care though at 59k the sector is not as strong as in most recent months. Leisure and hospitality showed some acceleration at 40k. However temporary help at -33k was weak and this is sometimes seen as a leading indicator.

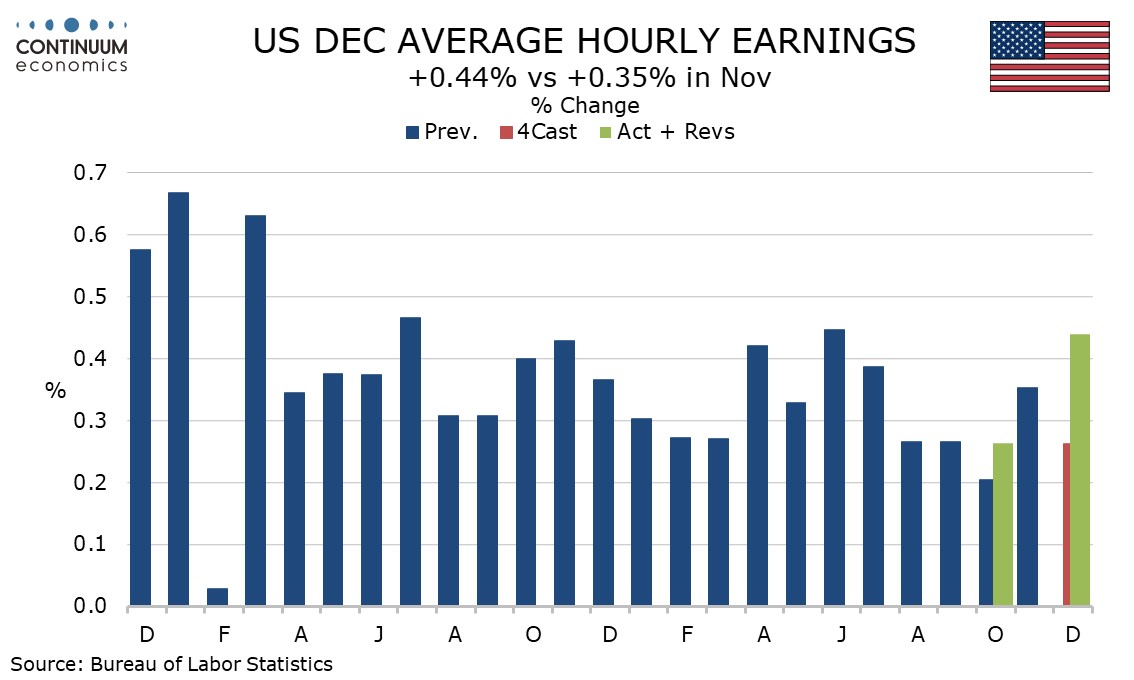

Average hourly earnings rose by 0.44% before rounding so are clearly on the firm side of expectations with yr/yr growth unexpectedly firmer at 4.1% versus 4.0%.

While the unemployment rate was lower than expected the details of the household survey, with employment falling by 683k and the labor force falling by 676k were very weak indeed, sharply underperforming the message of payrolls. The unemployment rate saw historical revisions but these were minimal.

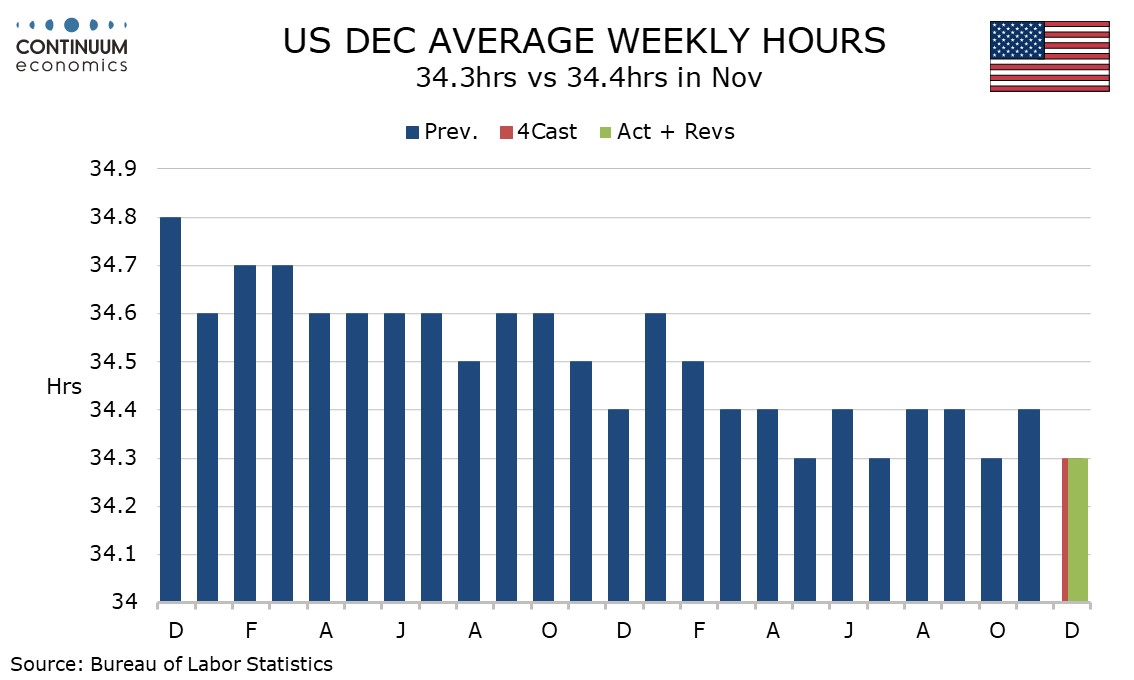

The workweek at 34.3 hours, means that Q4 saw two months at this level and only one at 34.4. Q2 and Q3 each saw two months at 34.4 and one at 34.3, so this data is consistent with a modest loss of economic momentum.