RBI Decision Review: RBI Balances Inflation and Growth with Neutral Policy

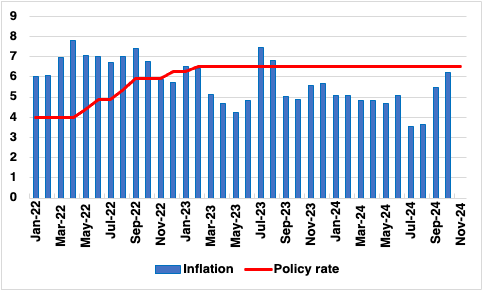

The RBI kept the repo rate unchanged at 6.5% but unexpectedly cut the CRR by 50 basis points to inject ₹1.16 lakh crore into the banking system. Growth forecasts for FY2025 were revised down to 6.6%, while inflation expectations rose to 4.8%. This cautious approach reflects the central bank’s focus on stimulating growth while managing inflationary pressures.

India's Monetary Policy Committee (MPC) of the Reserve Bank of India (RBI) voted to maintain its benchmark interest rate at 6.5% for the 11th consecutive meeting on December 6, aligning with our expectationa. However, the central bank introduced a liquidity measure by cutting the Cash Reserve Ratio (CRR) by 50 basis points to 4%, a move designed to inject INR 1.16tn into the banking system. The decision to hold rates was made by a majority vote of 4:2, with dissenting members Dr. Nagesh Kumar and Professor Ram Singh advocating for a 25-basis-point cut in the policy repo rate. Meanwhile, the CRR cut, the first since March 2020, will be implemented in two phases starting December 14 and December 28, underscoring the central bank's neutral stance.

RBI Governor Shaktikanta Das highlighted the dual challenges facing the Indian economy: moderating growth and persistently high inflation. The central bank revised its GDP growth forecast for FY2025 downward to 6.6% from 7.2%, citing weak manufacturing and prolonged monsoon effects. Conversely, the inflation outlook was adjusted upward to 4.8% from 4.5%, driven by global uncertainties and domestic price pressures. The policy stance remains "neutral," reflecting the RBI’s cautious approach to calibrating liquidity and maintaining economic stability. Governor Das noted, "Prudence and timing are critical as we navigate evolving economic conditions."

The CRR reduction, while providing a liquidity boost, signals a strategic pivot to support credit flow and stimulate economic activity. We expect this infusion to ease financial conditions for sectors grappling with rising borrowing costs. However, the decision raises questions about potential inflationary risks and its impact on the Indian rupee, which remains under pressure against the U.S. dollar. Moreover, the RBI has taken additional measures to enhance financial accessibility. It increased the collateral-free agricultural loan limit from INR 160,000 to INR 200,000 per borrower, a move aimed at supporting rural credit demand. Simultaneously, banks can now offer higher interest rates on Foreign Currency Non-Resident (FCNR) deposits, potentially attracting greater foreign inflows.

With the next MPC meeting scheduled for February 2025, the RBI faces a delicate balancing act. The latest CRR cut and steady policy rates reflect its intent to preserve growth momentum without exacerbating inflationary pressures. However, the subdued GDP data and sluggish recovery in manufacturing underscore the need for policy moves to reignite India's economic engine. In the interim, the financial markets responded positively, with benchmark indices recovering and banking stocks turning green. Yet, the broader economic outlook remains clouded by global headwinds and domestic vulnerabilities, leaving the central bank with limited room for maneuver. In our view, the RBI will wait for atleast two downward trending headling inflation prints before cutting rates. The earliest rate cut is likely in February 2025, of 25bps.

Figure 1: India CPI and Main Policy Rate (%)