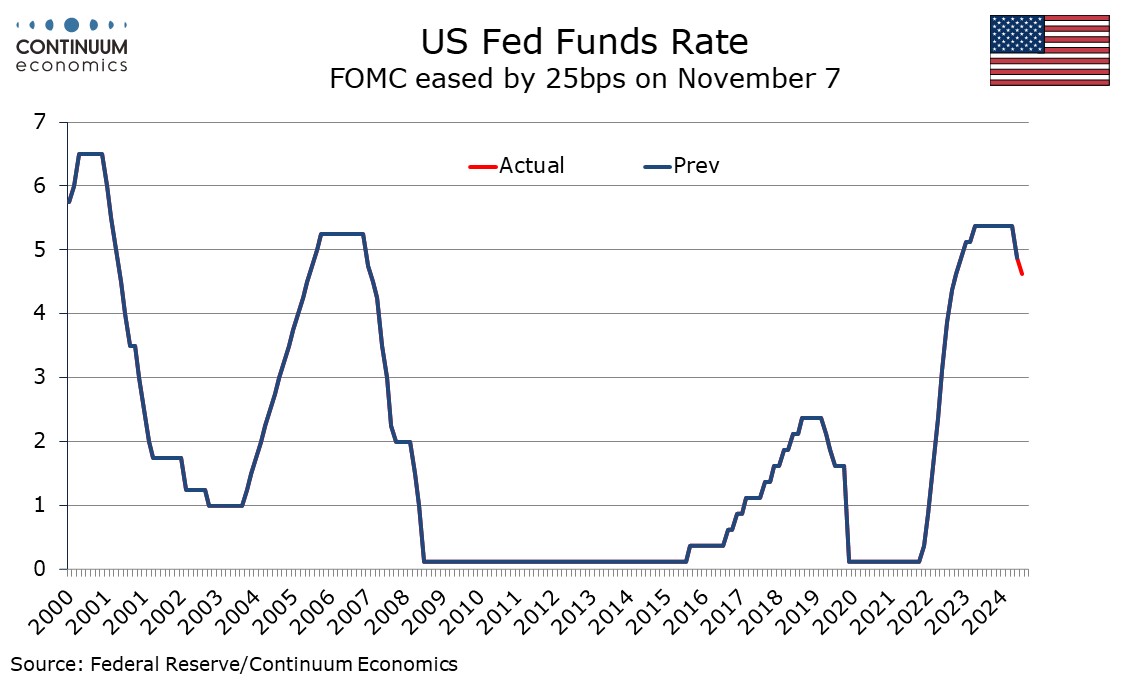

FOMC Minutes from November 7 - Few hawkish signals despite stronger than expected data

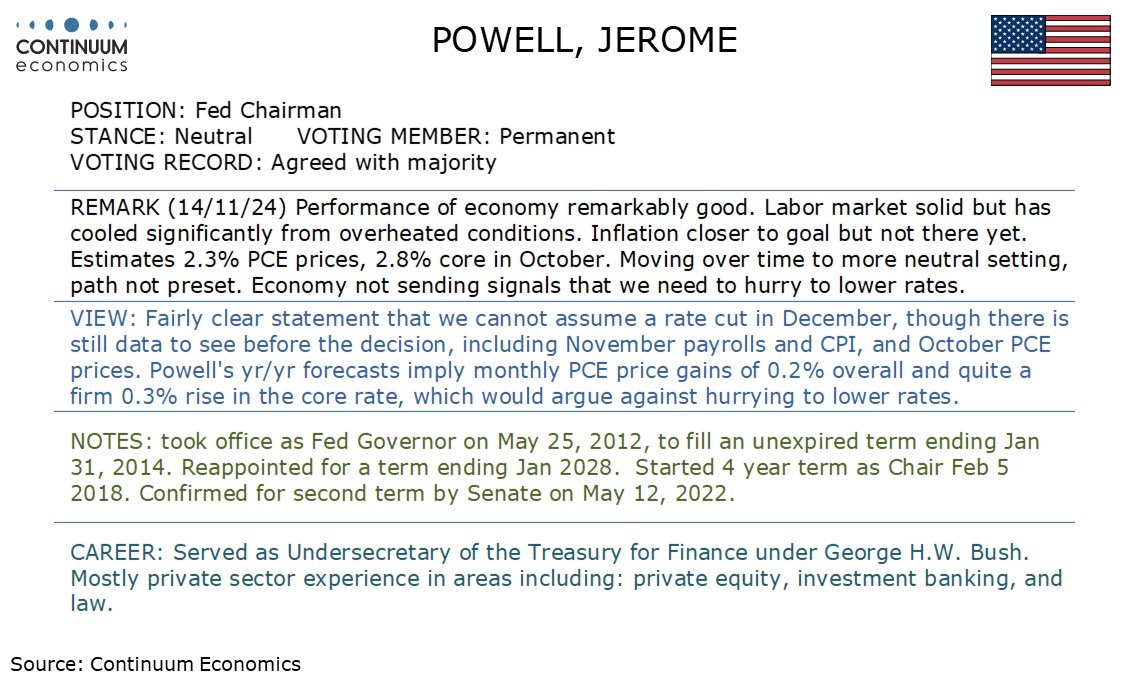

FOMC minutes from November 7 show agreement that almost all participants judged risks to their dual mandate objectives of maximum employment and price stability to be roughly in balance and almost all backed the decision to ease by 25bps at the meeting, a more moderate move than the 50bps move that had commenced the easing cycle in September. There is not much sign of hawkishness in the minutes, easing concerns generated by comments by Chairman Powell on November 14.

Upside risks to the inflation outlook were seen as little changed while downside risks to employment and growth were seen as having decreased somewhat. The views on inflation look quite optimistic, with almost all judging incoming data as consistent with a return to the 2% target, though a couple said the process could take longer than previously expected. Labor market readings were seen as consistent with conditions remaining solid, with strikes and hurricanes seen behind weak October data. Some still saw elevated risks that conditions could deteriorate, though many saw the risks of an excessive cooling as having diminished.

It is notable that while recent data was seen as having been largely stronger than expected, risks to the inflation outlook were seen as little changed. Participants anticipated that if data came in about as expected, with a sustainable move in inflation down to 2% and the economy remaining near maximum employment, it would likely be appropriate to move gradually to a more neutral rate. Participants noted that policy would need to balance the risks of easing too quickly or too slowly. This suggests easing was expected, though some commented the Fed could pause if inflation remained elevated while some remarked that easing could be accelerated if the labor market turned down or activity faltered. There was not much discussion over the economic implications of the election result.

We would judge the tone of the minutes to be a little less hawkish than Powell’s November 14 speech in which he stated the economy was not sending signals that the Fed needed to hurry to lower rates. A December pause is still possible, but data will have to be quite strong to prevent another easing. The minutes suggest that the Fed does not appear to see recent healthy data as an inflationary risk, though clearly any unexpected strength in inflation would cause concern.