USD flows: USD weaker on trade deals

The USD has weakened on talk of trade deals, but underlying picture is unclear

USD weakness has extended overnight, with talk of a US/EU trade deal similar to the US/Japan deal helping to support the EUR. European diplomats said on Wednesday that the European Union and the U.S. were moving towards a trade agreement that could include a 15% U.S. baseline tariff on EU goods and possible exemptions for sectors like aircraft and lumber as well as some medicines and agricultural products.

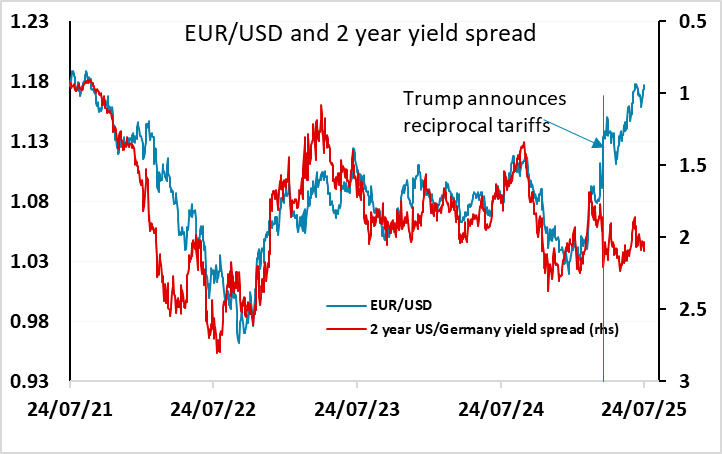

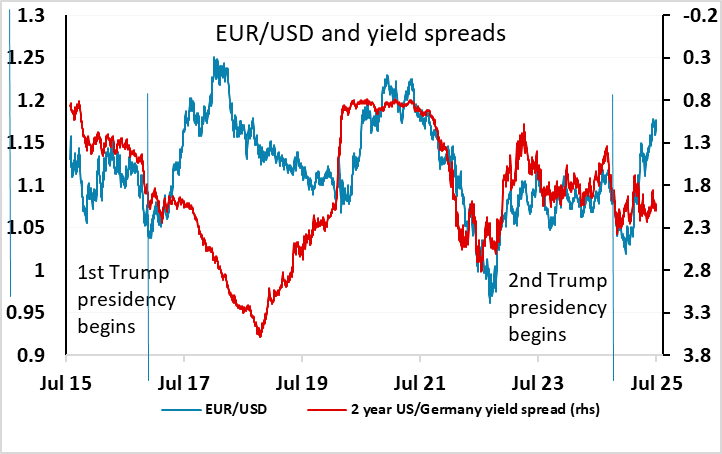

However, the rationale for FX moves is far from clear. The USD fell back after the reciprocal tariffs were announced in early April, so logic would suggest that deals removing or reducing reciprocal tariffs might be USD positive. However, this has not proved to be the case, with the JPY and the EUR both being boosted by reports of trade deals this week. Some of the USD decline since April is seen as a consequence of international institutional investors structurally reducing their USD exposure and (mainly) shifting to the EUR because of uncertainty about US policy and concerns about being too overweight the US. If this is the case, these decisions might not be reversed, and the USD might hold onto the majority of the post-April decline, but it would still argue against USD losses on positive trade news.

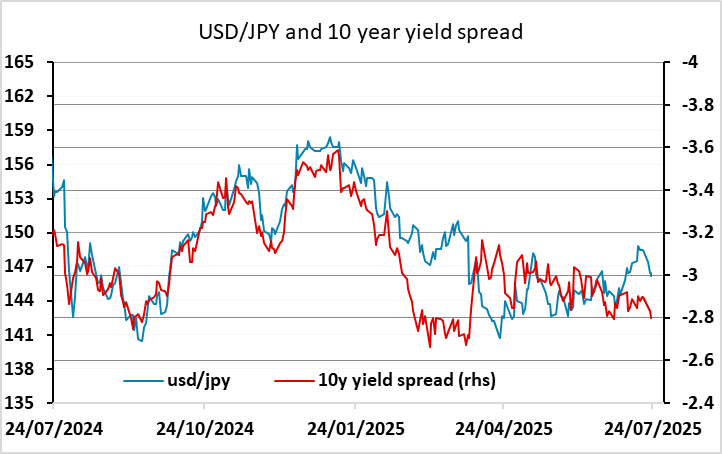

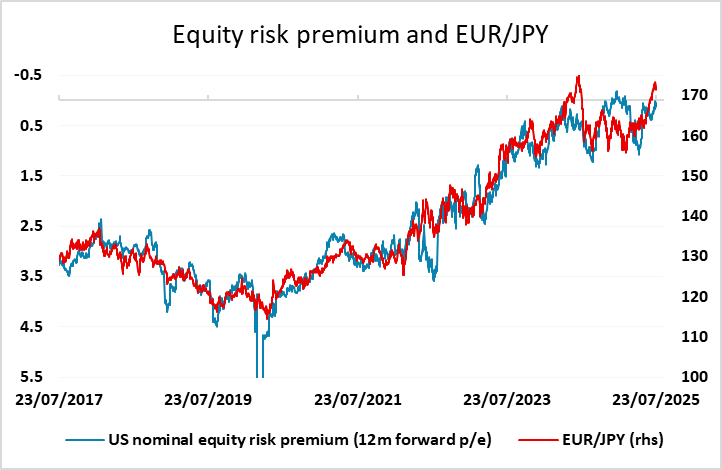

The picture is somewhat different for the EUR and the JPY. The JPY remains weak relative to historic yield spread correlations, while the EUR has outperformed these correlations since April. At the same time, the JPY tends to suffer, particularly on the crosses, in risk positive environments. Positive trade news could thus be seen as negative for the JPY on the crosses, with US equity indices continuing to make new highs. This still looks overly optimistic as some US slowdown is already underway, and there may be more to come as tariffs hit, but as long as equities are strong, the JPY is unlikely to make much of a recovery on the crosses.

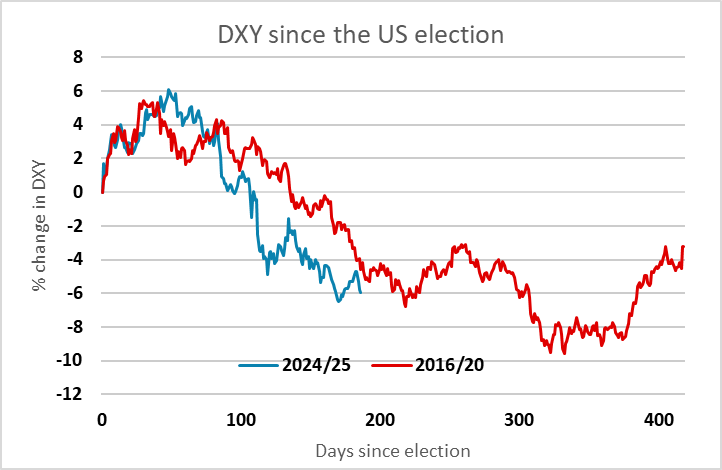

For the USD in general, (or at least DXY which is primarily driven by EUR/USD) we continue to broadly follow the path seen in the first Trump presidency, with the USD falling 6% since the election and moving against the trend in yield spreads. If first time around is any guide, we may stabilise near here for a period, but a 10% decline was seen at the USD’s lowest point in November 2018.