USD flows: USD slips on weaker CPI

Weaker than expected US October/November CPI triggers USD sell off

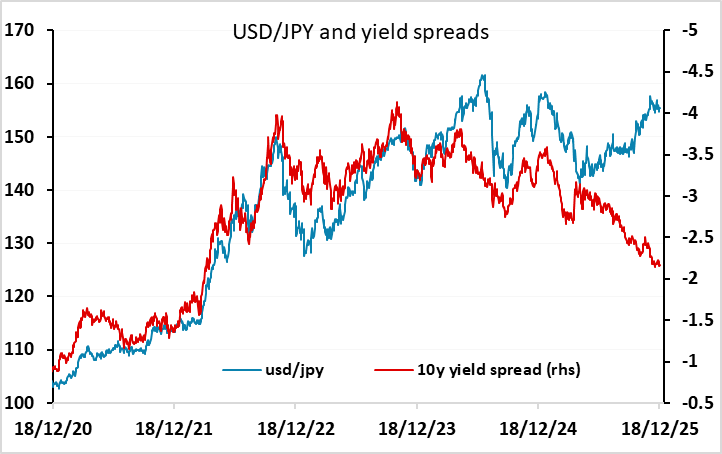

US CPI for November has come in much weaker than expected at 2.7% y/y, 2.6% core, against a consensus expectation of 3.1% and 3.0% respectively. There is no split announced between October and November, but lower than expected outcome has increased market expectations of further Fed easing, undermining the USD and helping to boost equity markets. The USD decline has been quite modest, with yield spreads playing a fairly minor role in FX trading of late. Typically, the JPY would normally benefit most from lower US yields, but positive equity responses limit the scope for JPY gains, and JPY crosses are little changed with the market focus on tomorrow’s BoJ decision.

The ECB meeting had limited impact, with the upgrading of GDP growth expectations already well flagged.