USD, JPY, CHF flows: USD lower versus safe havens on risk negative trade

US banking concerns trigger USD declines, especially against safe havens. JPY has scope for further gains.

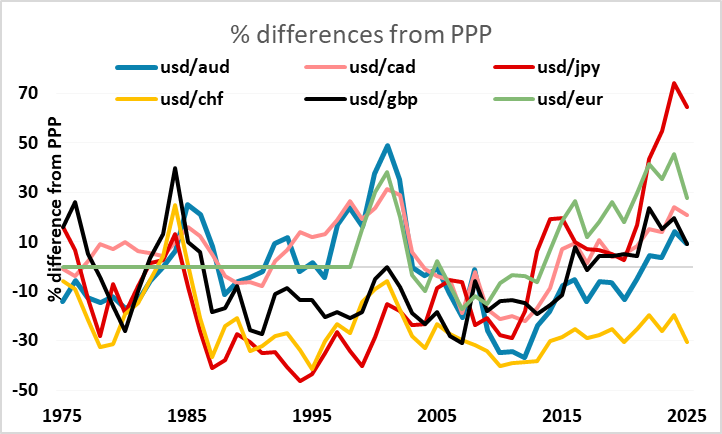

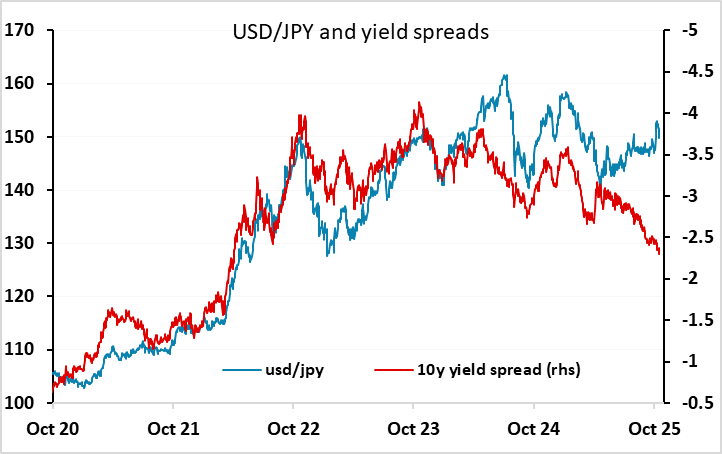

Concerns about credit stress at a couple of US regional banks triggered a general risk negative move overnight, benefiting the JPY and CHF in particular and weighing on the USD in general. The AUD lost a little ground but otherwise the USD was lower across the board. We suspect the concerns are overdone, and are unlikely to lead to significantly greater easing from the Fed than was previously expected, but coming into the weekend there is scope for a further unwinding of long risk positions for fear of more negative news. The JPY remains the most obvious candidate for further gains, starting as it does from such low levels, and still some way below the level seen before Takaichi was elected as the new LDP leader. It remains probable that she will be the new PM, but still uncertain. A vote is due next week, and the JPY could get a renewed setback if she is successful, even though it is far from certain that her policies will be JPY negative. So there is plenty of scope for JPY volatility in the coming week. While we prefer the JPY upside medium term, there may be some more near term setbacks.

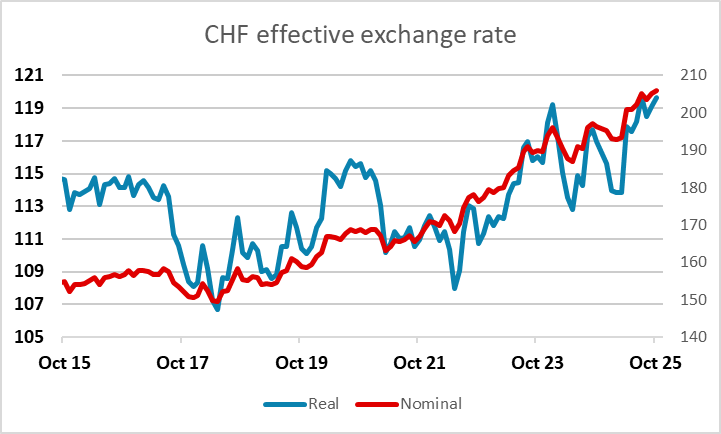

CHF strength is also significant, with EUR/CHF hitting its lowest level since April overnight. The all time low excluding the January 2015 spike was at 0.9204 in November last year. Neither Swiss government nor the SNB can be happy with the extent of CHF strength, as the government reiterated yesterday that US tariffs are weighing on Swiss industry, and a strong exchange rate will increase the pressure. While the SNB are very reluctant to go to negative rates again, and similarly reluctant to intervene in the FX market, the US banking issue seems unlikely to be systemic, and we doubt it is sufficient to trigger a new EUR/CHF low.