USD, GBP flows: USD firmer, GBP risks on the downside

USD firmer on Venezuela. ISM the main data. GBP firm but risks on the downside.

The Venezuela situation has grabbed the headlines and led to a generally modestly stronger USD overnight, although there has been little net impact on equity indices. The JPY initially made some small gains on the crosses, but these have largely been reversed. We doubt there will be much persistent impact near term unless there is some significant development escalating the situation.

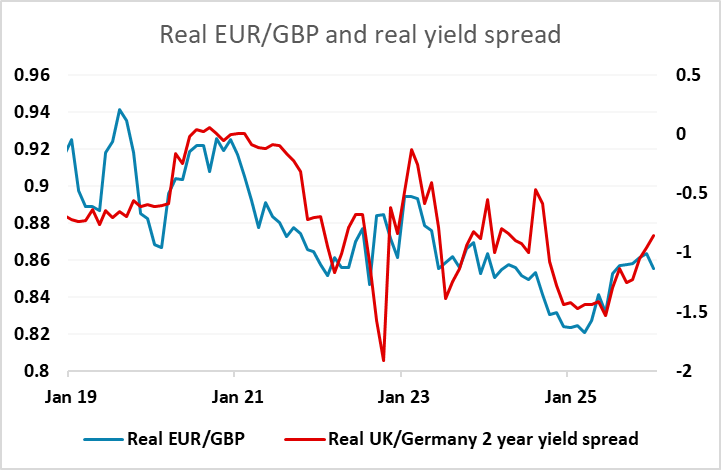

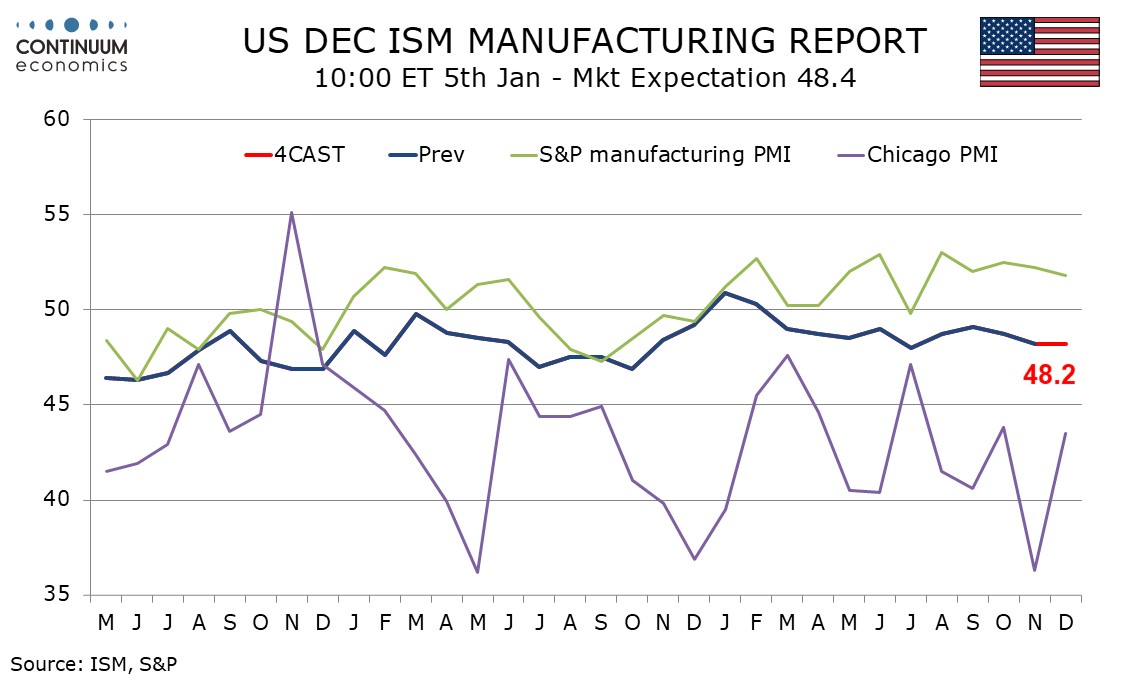

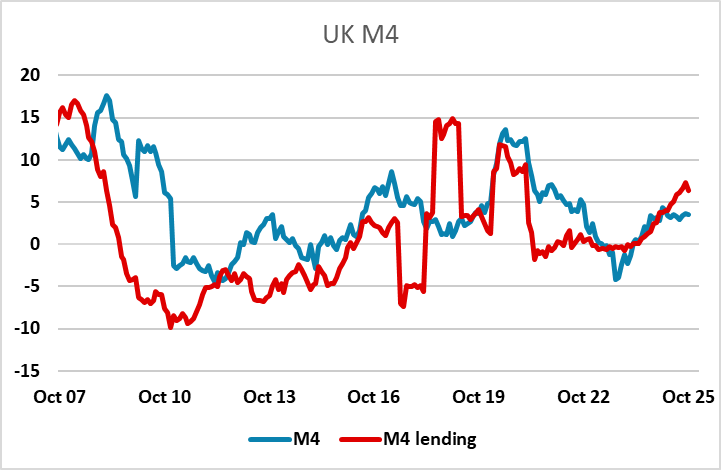

The US manufacturing ISM survey is the main data of the day, but there is some UK money and credit data due this morning. GBP has continued to trade generally firm in the last couple of weeks, despite generally soft data. Money data has been reasonably strong, despite softening GDP data, particularly M4 lending, so any weakness in this might be seen as a reason for GBP to fall back. We would still regard EUR/GBP medium term risks as mainly to the upside.